Finances

Choose the perfect credit card and apply in just a couple of minutes

We've selected the best options based on your credit score. Choose an option below and learn how to apply.

Advertisement

Find out if you’re approved in a few minutes and enjoy the card’s benefits!

Select a card based on your credit score

Most people want to choose the best credit card for their needs. But, with so many credit options out there, it might be tough to know where to start.

Some cards will fit travelers’ needs; others will offer discounts and rewards. Luckily, we can help you make that call! Start wondering what you expect from it: Miles, rewards for purchases, making international transactions fee-free?

When should you consider a secured credit card?

If you're suffering from a bad credit score, you should consider getting a secured credit card to improve it. Read this content to see if it's the right option for you.

Once you have the answer, check your score. Then you’ll be able to rank options and list their benefits. Don’t worry! There are many cards available, even for bad scores. Do you want to know more about it?

Please stay with us to learn how to choose the right credit card for you based on your credit score. You may get surprised!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

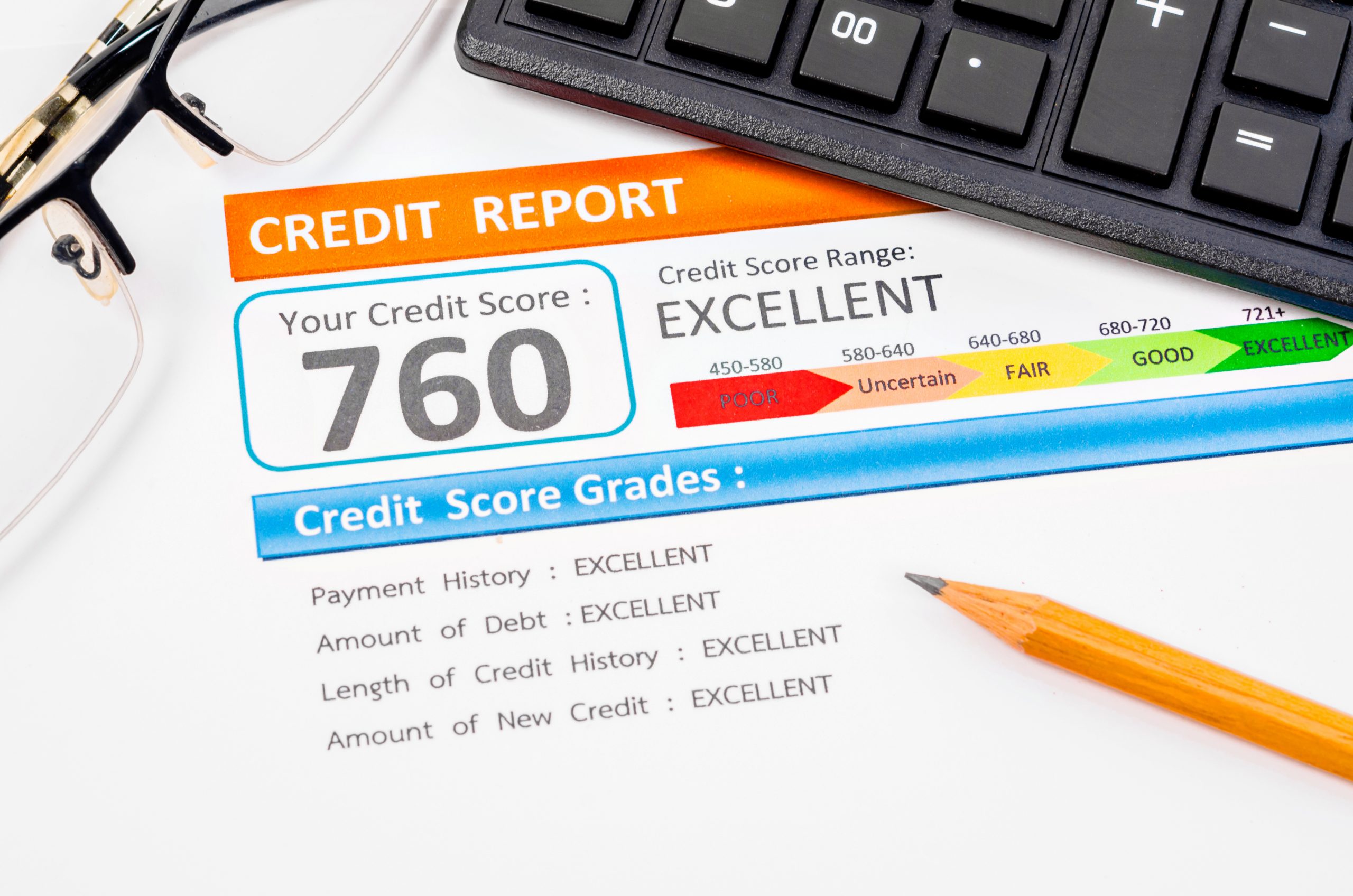

What is a credit score?

First, a credit score is a number that shows how trusted you can be to repay your debts.

It’s based on your credit history, which lenders can access through credit bureaus like Experian, Equifax, and TransUnion.

Your score can range from 300 (very high risk) to 850 (low risk). A good credit score can help you get approved for a loan, lower your interest rates, and even get a job.

Conversely, a low credit score can lead to denied loans and higher interest rates. So it’s important to know what affects your credit rating and take steps to improve it if needed.

Credit score ranges

Lenders of all kinds tend to see potential good borrowers by analyzing their scores. That’s what makes it one of the main features to consider before you choose your credit card.

How can you do that? Start checking your credit score. The range will vary from 300 to 850. See the table:

| SCORE | CREDIT STATUS |

| 300-629 | Bad |

| 630-689 | Fair |

| 690-719 | Good |

| 720-859 | Excellent |

8 smart ways to dig yourself out of debt

Being in debt can be overwhelming. But don't worry. You can and will find your way out of this debt whole. These tips will help you to get back on track!

After considering your score, you can narrow down the options to choose your credit card. If you have a scratched rate, apply for a secured card.

The limit is based on a deposit. It helps clean your history since it reports your payments to the three main credit bureaus.

By bringing it up, the range of possibilities grows. That opens space for you to choose other cards with different attributes and advantages.

What concerns excellent scores, the borrowers qualify for most credit cards.

Advertisement

What to consider when choosing a credit card?

Have you ever wished for a credit card with perfect rewards and benefits but were denied? Let’s understand why this happens.

Firstly, credit cards are designed for specific audiences. Financial education helps you think critically about your background to see why you couldn’t meet the requirements.

Secondly, you can find the best card by analyzing and narrowing down options for your score. Once you do that, ask yourself what you look for:

- What’s your score?

- What are the essential features of a credit card to you?

- Do you have a bad score? If yes, which secured cards can meet your needs?

- Is your credit score good enough to consider that one card you want?

- Are fees and APRs attractive?

With the credit score status and your needs in hand, it’s time to look at some options to fit your profile.

Why is it important to choose a card based on your credit score?

If you are unaware of your credit score, chances are you will choose your credit card based on its benefits instead of considering your profile.

But can anyone apply for any card? The answer is no. If your score is poor or low, trying a credit card that requires good or excellent scores will be useless.

Focus on your score. It’s the perfect spot to encounter alternatives. If you’re low-scored, seek secured cards that won’t need a history check.

They usually charge a $200 deposit to lend credit. Also, remember to pay off your debts to level up and widen the options.

If you have an average or good score, you will get slightly more attractive opportunities, such as an unsecured card.

These cards are free of deposit or collateral. They offer credit based on your score and trust you with it without needing a guarantee.

And in case your profile is excellent, scores tend to open doors for more exciting credit cards, loans, and mortgages.

Advertisement

How to find the best card for you?

Now that you comprehend that your credit score rate is the first thing to consider, start by learning how to choose a credit card based on your current financial status and needs.

Once you have that information, picking a credit card is quicker and easier. What’s your goal? Here are some things you may be looking for:

- Miles to travel:

If you like to travel and want to accumulate miles, review the options according to your score.

- Increase credit score:

If you struggle with bad credit, see for credit cards to rebuild your score. Many banks and credit card companies offer it as a way out.

In case you are a student, apply for a student card. It usually has lower fees than usual cards and doesn’t need history approval.

- Earn Rewards

Who doesn’t want to earn rewards for purchases? These types of cards can be handy if you are looking for them.

The benefits can be many: collecting points to pay for purchases, having discounts in some stores, and insurance plans. Some credit cards also offer cash back.

- 0% initial APR

If you have some long-term expenses, try to find a credit card with 0% APR (annual percentage rate) for purchases.

The credit card companies describe the fee in their applications. Be careful because some cards increase the APR annually.

Considering the features takes us to our following recommendation. If you want a credit card that suits you, don’t forget to mind card types. There are many choices you can go for.

1. Credit card to bring up credit:

Pay attention to what you should check if you want to improve your score.

- No-cost credit card payment reports

- Zero annual fee

- History reported to the three credit bureaus

2. Credit card for rewards:

Getting rewards is excellent, but depending on the maintenance cost and conditions, some cards may not be what you thought. To clear things out, mind these aspects:

- Annual fee

- Sign-up bonuses

- How much reward you can receive

- Miles

- Discounts

3. Credit cards with 0% starting APR

It might seem significant, but probably your card will charge an APR fee after a year. Be attentive!

4. Credit card debts

Consider the TAEG (Annual Percentage Rate). It corresponds to the final amount that the borrower will pay for a loan.

If the credit card has a 0% fee, it will help you transfer the balance from other cards and pay less interest.

Our suggestions must have prepared you to choose a credit card. All things considered, what’s the verdict? What credit card should you choose? It really depends on your score and what benefits are important to you.

If you have a high score, go for a card with great rewards programs and no annual fees.

If your credit isn’t as good, look for a card with a lower interest rate and maybe some added perks like cash back or travel rewards.

No matter which card you choose, make sure to read the terms and conditions carefully, so you know what you’re getting into.

And most importantly, remember to always pay your bill on time! Whenever you are ready, click on the link below to understand more about your score and how to calculate it!

Learn how to calculate your credit scores!

Understanding how your credit score will be calculated is the first step to increasing it. So, find out essential information about it and start improving your finances!

Trending Topics

The Plum Card® from American Express review

Are you ready for this The Plum Card® from American Express review? Then read on! Pay early and enjoy 1.5% cash back!

Keep Reading

Citi® / AAdvantage® Platinum Select® World Elite Mastercard® application: how does it work?

Are you planning to apply for the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®? Check out this guide for the application!

Keep Reading

Twitter shareholders filed a lawsuit against Elon Musk

Twitter shareholders are claiming the billionaire deflated the company’s stock prices on purpose to walk out or renegotiate his bid.

Keep ReadingYou may also like

You can save money even when interest rates are low: learn how

Find ways to save money with low interest rates, no matter the economy. Here are five tips you should use today! Read on!

Keep Reading

Bad credit accepted: apply for BankAmericard® Secured Credit Card

Discover how to apply for the BankAmericard® Secured Credit Card - start with a security deposit of $200 and build credit fast! Read on!

Keep Reading

Apply for Navy Federal cashRewards Credit Card: $0 annual fee

How to apply for the Navy Federal cashRewards Credit Card - everything you need! Earn cash back on purchases! Read on!

Keep Reading