Comparison

The Centurion® Card or The Platinum Card® from American Express: choose the best!

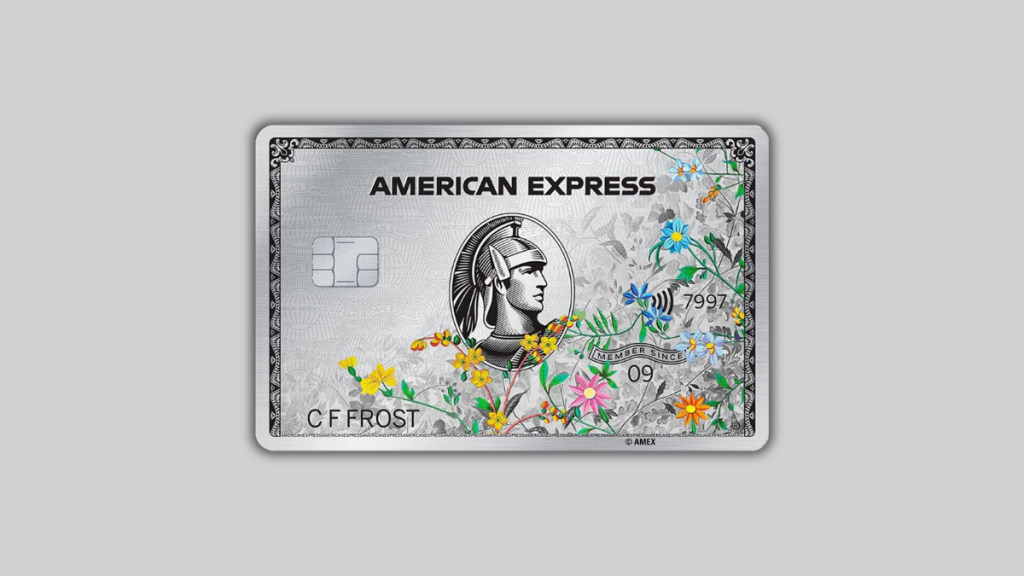

American Express has two great options for travel cards. The Centurion® Card from American Express is the top ultra-exclusive black card. On the other hand, one of the most reliable credit cards is The Platinum Card® from American Express. This article is a full review comparing both travel credit cards by Amex!

Advertisement

All information about The Centurion® Card from American Express has been collected independently by The Mad Capitalist.

The Centurion® Card or The Platinum Card® from American Express: learn the best option for you

At American Express you can choose between The Centurion® Card or The Platinum Card®. Whichever you choose, you’ll have an amazing travel credit card in your hands.

One of the best credit card brands in the market, American Express has a lot to offer. In the matter of travel credit cards, it has two excellent options for exigent customers.

The major difference between them is the costs. To be a Centurion member you’ll pay thousands of dollars in the initiation and annual fee. Also, you need an invitation to have one.

The American Express Platinum can be more accessible in comparison with the Centurion card. You will also have travel facilities and excellent benefits.

To choose between The Centurion® Card or The Platinum Card® from American Express, The Mad Capitalist brought you the major factors of both for comparison. Stay for reading it entirely, it’s good info.

How to apply for The Centurion Card

Do you have what it takes to ask for The Centurion® Card from American Express? Here is the step-by-step to make your requisition. Keep reading!

How to apply for The Platinum Card

It is simple to apply for The Platinum Card® from American Express. If you love getting benefits and traveling the world, apply now for it.

| The Centurion® Card from American Express | The Platinum Card® from American Express | |

| Sign-up bonus | Membership Rewards® Points – variable to each client *Terms Apply. | 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. *Terms Apply. |

| Annual Fee | $5,000 + Initiation fee $10,000 | $695. Rates & Fees. |

| Rewards | 1X Membership Rewards® Points for each dollar spent on eligible purchases | 5x points on flights you book directly through airlines or American Express Travel (up to $500,000 on these purchases per calendar year); 5x points on prepaid hotels (valid for those you book through AmexTravel.com); 1x point on any other eligible purchase. |

| Other perks | – Platinum and Diamond Elite Status at the best hotels – Delta Skymiles Platinum Medallion status – CLEAR and Equinox memberships – and much more. | – $200 in credit for airline incidental fees – $300 credits at Equinox – Gold Elite Status at the Marriot Bonvoy and Hilton – Room upgrades and late check-out in thousand of places – and much more. |

| APR | Prime Rate + 21.99% (variable) | See Pay Over Time APR. |

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

American Express Centurion

This card screams “luxury” in all of its features. The grandfather of the “black cards” is a symbol of high status.

Only the ultrarich have access to the Centurion membership. It is not possible to apply for it without an invitation. However, you can ask to be considered for an invite at the American Express Centurion website.

American Express doesn’t expose exactly what are the requirements. We can set some parameters from users’ reports, but this leads to uncertain numbers.

Before asking for the invitation, check if you fit the requirements:

- Excellent credit score

- A responsible credit history with American Express. The Centurion can’t be your first credit card.

- At least $250,000 to $450,000 spent with your Amex credit cards for at least one year.

After fitting these requirements, you have to afford it. The annual fee is $5,000.

If the annual fee seems too much, you should see the initiation fee: $10,000. This is not a card for everyone, only a few can pay for it.

On the other hand, this card will give you a lot of exclusive benefits. These are some of them:

Benefits

- 24/7 Concierge program to assist you with everything you need during your trips.

- Personal shoppers at Saks Fifth Avenue and other high-class stores and brands.

- First-class upgrades in flights and boarding preferences.

- Membership Reward Points program, easy to redeem and never expire.

- Platinum and Diamond Elite Status in the best hotels worldwide.

Disadvantages

- Expensive annual fee

- No cashback program

- Heavy initiation fee

American Express Platinum

It has two options, the Personal and the Business card. Here we will cover the personal card features.

The benefits are similar to the ones offered by the Centurion. However, they won’t have the same status.

The Platinum can be your first Amex credit card if you fill the requirements. You can apply through the American Express website in just a few minutes.

With excellent reliability, it is unlike that it won’t be accepted in any part of the world. To apply for it you’ll need a credit score above 720 and to prove a steady source of income of at least $50,000 a year.

The benefits are directed to travel experiences and luxury purchases. See if you can take the best of these benefits:

Benefits

- Membership Reward Points that go from 1x to 5x the amount spent.

- Access to airport lounges through the American Express Global Lounge Collection.

- Gold Elite Status in the best hotels

- 24/7 Concierge Program.

- American Express Preferred Seating: get the best seats at entertainment events.

- Thousand of dollars worth in other perks and discount offers.

- No preset spending limit and no foreign transaction fees.

Disadvantages

- The annual fee is high – $695 per year.

- It will be harder for a less experienced credit card holder to convert the benefits without expending more than they would usually do.

The Centurion® Card or The Platinum Card® from American Express: choose the best.

The Centurion® Card and The Platinum Card® from American Express have similar features. However, the Centurion credit card is way beyond the ruler of credit cards.

The Platinum credit card is a viable option for more people. It has a great number of benefits and a more accessible annual fee. All of this with the Elite Status of a bon vivant.

The Centurion, however, is so exclusive that is hard to deny the invitation when you receive one. It is up to the invited Amex cardholder to weigh the cost and the benefits.

If none of these credit cards pleases you, we can recommend a third option. Check the review of the Discover it® Secured card!

Application for the Discover it® Secured card

Discover it® Secured card offers more than just benefits. It will help you rebuild your financial life with a healthy credit score. We'll tell you how to apply for it!

Trending Topics

Citi Rewards+® Card review: No annual fee and extra rewards on purchases

The Citi Rewards+® Card review will give you all the details you need about this card's features, rewards, and pros and cons. Keep reading!

Keep Reading

Capital One Spark Cash Plus application: how does it work?

Capital One Spark Cash Plus is what you need to run your business more easily. Read on to learn how to apply!

Keep Reading

Visa vs. Mastercard: are they really different?

Find out if there's a big difference between the two major credit card companies: Visa vs. Mastercard, and which one is best for you to get.

Keep ReadingYou may also like

How to travel for free using miles: a guide for beginners

Discover how to travel for free, why you should be earning and saving miles instead of paying with cash, and the best ways. Read on!

Keep Reading

How to apply and get verified on the Electro Finance Lease easily

Learn how to apply for an Electro Finance Lease today in just a few steps and receive your electronic products in as little as one day!

Keep Reading

Bank of America Business Advantage Travel Rewards Card review

Get a full Bank of America Business Advantage Travel Rewards Credit Card review. Enjoy 0% intro APR for 9 months and much more!

Keep Reading