Reviews

Apply for The Platinum Card® from American Express

The Platinum Card® from American Express is worth the price if you enjoy its perks. You can count on benefits at airlines, hotels, entertainment, and rental services. Here you'll learn how to apply for it.

Advertisement

The most desired travel card around the world

One of a kind, The Platinum Card® from American Express has made its name in the market. With excellent reliability, the Platinum members will count with wide acceptance worldwide.

It has more than 40 years of history and has improved within the course of time.

The Amex Platinum has the best benefits for travelers and its own Membership Rewards® Points program, such as up to $300 in statement credits every year on membership at Equinox (digital or club).

If you’d like to have your own Platinum Card® from American Express, you’ll learn everything about how to apply. Keep reading.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

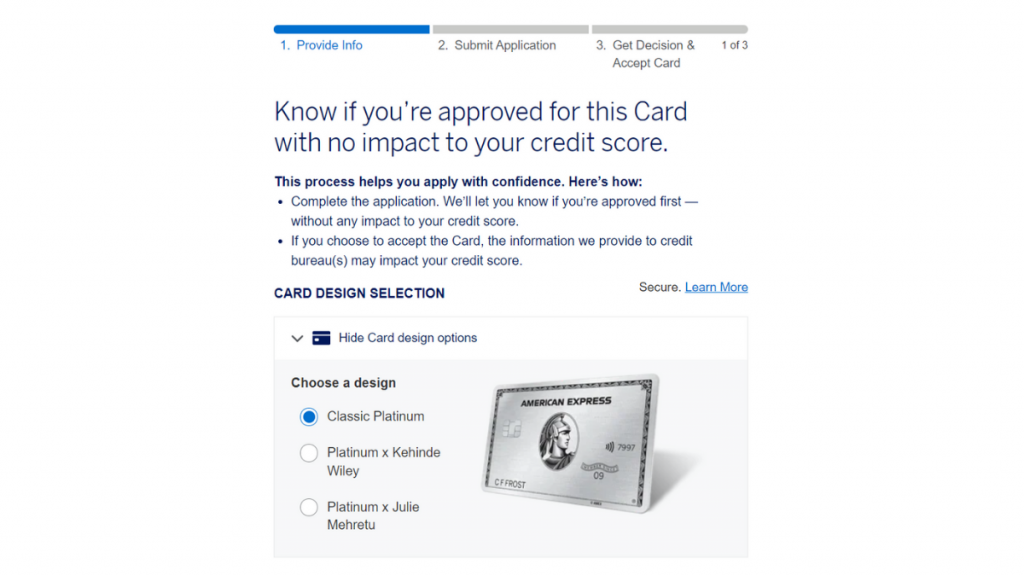

Apply online

The whole application process is online through the American Express website.

There, you’ll find all the information about the credit card. You can check its benefits and its costs.

After reading it, if you decide to apply, you just have to hit the button “apply now”. If you’re lucky, you can earn a special offer for your welcome bonus.

You’ll have to fill up a form with some basic info. Contact and personal information, the usual.

The last three questions are the important ones. You’ll have to explain where your income comes from and how much it is. This info, along with your credit history, will determine whether you’ll be approved or not.

Even if the application is easy to be done, pay attention to the requirements. If you don’t fit, then use your energy and time to apply for a more suitable option for you.

Apply using the app

The application for The Platinum Card® from American Express is through the website only. There is no option to apply using the American Express app.

Advertisement

The Platinum Card® from American Express vs. The Centurion® Card from American Express

If you’re looking for a travel card, American Express has another option. But it will cost you more. Way more.

The Centurion® Card from American Express is an ultra-exclusive travel card. To be a part of the Centurion membership, you’ll need an invitation.

To get the invite, you’ll need to fill in some requirements. It is exclusive to the best American Express users. If you fit the standard, you can ask to be considered for an invite.

The Platinum credit card has a lot of benefits you’ll have with the Centurion. They may be less “VIP”, but for the majority of people is more than enough.

In the table below, you have some technical information for comparison.

| The Platinum Card® from American Express | The Centurion® Card from American Express | |

| Credit Score | Recommended 720 or higher. | Excellent. |

| Annual Fee | $695. | $5,000 (+$10,000 of Initiation Fee). |

| Foreign Transaction Fee: | None. | Not disclosed. |

| Regular APR | See Pay Over Time APR. | Cash Advance APR: Prime Rate + 21.99% (variable). |

| Welcome Bonus | Earn 80,000 Membership Rewards® points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership. | Variable to each client. Usually, you get an offer of Membership Rewards® Points. |

| Rewards | 5x points on flights you book directly through airlines or American Express Travel (up to $500,00 on these purchases per calendar year); 5x points on prepaid hotels (valid for those you book through AmexTravel.com); 1x point on any other eligible purchase. | 1X Membership Rewards® Points for each dollar spent on eligible purchases. |

See Rates & Fees

The Centurion® Card from American Express

Do you have what it takes to ask for The Centurion® Card from American Express? Here is the step-by-step to make your requisition. Keep reading!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

75k bonus Avios: British Airways Visa Signature® Card review

Unveil the benefits and expenses of the British Airways Visa Signature® Card in our thorough review. Is it worth it? Learn more.

Keep Reading

Learn to apply easily for the Flagstar Bank Mortgage

Learn how to apply for a Flagstar Bank Mortgage. Enjoy several loan options and affordable pricing! Keep reading to learn more!

Keep Reading

Integra Credit Personal Loan review: how does it work and is it good?

Read our Integra Credit Personal Loan review to weigh its pros and cons! Pay $0 origination or prepayment fees! Stick with us and learn!

Keep ReadingYou may also like

Best secured credit cards with no credit check: easiest to get!

Pick one of the best secured credit cards with no credit check to fix your credit score. This will help you in the future for sure!

Keep Reading

Learn to apply easily for the PenFed Mortgage

How to apply for PenFed mortgages? Follow these 5 steps! Choose from a variety of loan products! Enjoy closing-cost credits!

Keep Reading

Cheap flights on Priceline: save up to 50%

Looking for ways to save money when booking flights? Discover Priceline cheap flights with these tips to help you get great deals. Read on!

Keep Reading