Reviews

Citi Rewards+® Card review: No annual fee and extra rewards on purchases

Turn your purchase payments into rewards points to redeem in statement credit and gift cards. Learn how you can do that in the in-depth Citi Rewards+® Card review we've prepared just for you. Read on!

Advertisement

Citi Rewards+® Card: get rewards for everyday purchases!

The Citi Rewards+® Card review will show you how to earn points on everyday purchases.

How to apply for Citi Rewards+®Card

Here's all you need to know about the Citi Rewards+® Card application online and straightforward. Keep reading to learn more!

This card has some great features, including points on all dining and grocery purchases, no annual fee, and a generous sign-up bonus. Read on to learn more!

- Credit Score: Good;

- Annual Fee: $0;

- Regular APR: 0% Intro APR on balance transfers for 15 months from the date of the first transfer and on purchases from the date of account opening. After that, the variable APR will be 18.49% – 28.49%, based on your creditworthiness, and a 29.99% variable APR for cash advances;

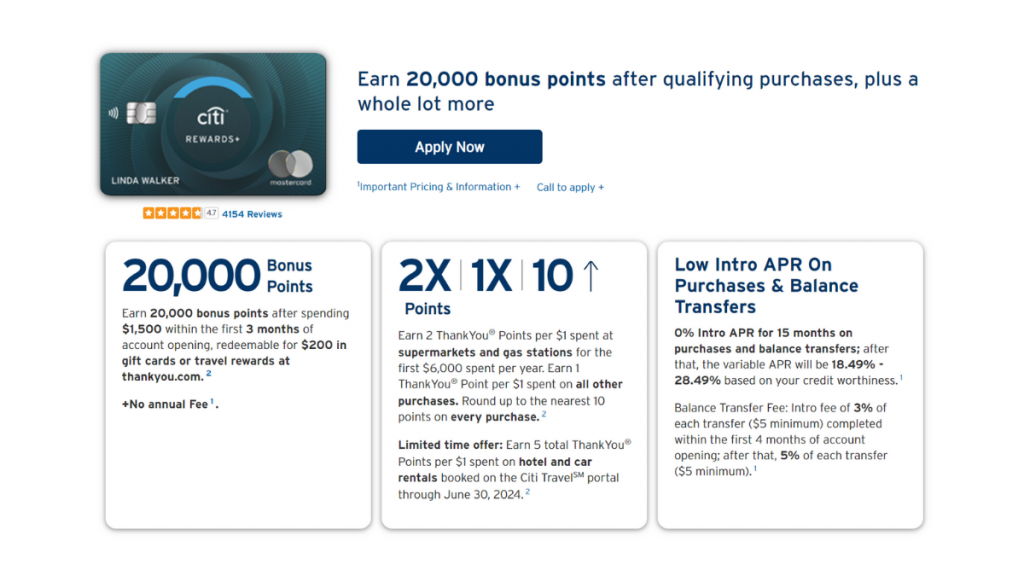

- Welcome bonus: Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com.

- Rewards: 2X ThankYou® Points at Supermarkets and Gas Stations for the first $6,000 per year and then 1X Points. Plus, earn 1X ThankYou® Points on All Other Purchases;

- Other rewards: The only credit card that automatically rounds up to the nearest 10 points on every purchase (no cap).

- Terms apply.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Citi Rewards+® Card: how does it work?

The Citi Rewards+® Card offers points for every purchase, which you can redeem for gift cards.

You’ll earn 2 points per dollar at supermarkets and gas stations (for the first $6,000 spent per year) and 1 point on all other purchases.

Also, you’ll get a 10% bonus on all the ones you’ve earned during the year (up to 100,000 points).

When it’s time for redemption, you can choose from various options, including cash back (as a statement credit) and gift cards.

There are no annual fees for this card.

Citi Rewards+® Card: should you get one?

The Citi Rewards+® Card has an attractive intro annual fee that will help you earn as many reward points as possible.

Let’s examine its pros and cons to decide if this is the right card for your needs.

Advertisement

Pros

- Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com.

- Plus, for a limited time, earn 5 ThankYou® Points per $1 spent on hotel, car rentals and attractions booked on the Citi Travel(SM) portal through June 30, 2024.

- 0% Intro APR on balance transfers for 15 months from date of first transfer and on purchases from date of account opening. After that, the variable APR will be 18.49% – 28.49%, based on your creditworthiness. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Earn 2X ThankYou® Points at Supermarkets and Gas Stations for the first $6,000 per year and then 1X Points thereafter. Plus, earn 1X ThankYou® Points on All Other Purchases.

- The Citi Rewards+® Card – the only credit card that automatically rounds up to the nearest 10 points on every purchase – with no cap.

- No Annual Fee.

Cons

- Good credit is required.

Advertisement

Credit score required

The minimum credit score to apply for this card is good. So, if you want to have one, check your score first.

Citi Rewards+® Card application: how to do it?

We hope you’ve enjoyed the Citi Rewards+® Card review. Keep reading to discover how you can apply online for this card below.

How to apply for Citi Rewards+®Card

The application for the Citi Rewards+® Card is easy and takes only a few minutes. Read on to learn how to do it.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

What can the big 4 of retail business tell us about the average consumer?

The four biggest names in retail have very different outlooks on how and where the average American consumer is spending their money.

Keep Reading

What is a CD: how it works, interest and more!

Before investing, learn what a CD is and what advantages it has to offer. You can choose a low-risk investment and still grow your money.

Keep Reading

Earn up to 5% cash back: Apply for Instacart Mastercard® today

Apply for the Instacart Mastercard® quickly with our guide. Elevate your grocery shopping experience and enjoy exclusive rewards. Read on!

Keep ReadingYou may also like

Ink Business Cash® Credit Card Review: up to 5% Cash Back

Here is the right card for small businesses - no annual fee, extra employee cards. Check out our review of the Ink Business Cash® Credit Card.

Keep Reading

Cheap flights on Priceline: save up to 50%

Looking for ways to save money when booking flights? Discover Priceline cheap flights with these tips to help you get great deals. Read on!

Keep Reading

Application for the Upgrade Bitcoin Rewards Visa®: how does it work?

To get into the cryptocurrency market, apply for an Upgrade Bitcoin Rewards Visa® and start receiving your cashback as Bitcoin.

Keep Reading