Earn points and maximize your buying power with this credit card

Marshland Visa® Card, Smart Spending Made Easy – pay $0 annual fee!

Advertisement

Save on fees, earn points, and travel in style with the Marshland Visa® Credit Card. Competitive rates, rewards program, and travel benefits make it a reliable choice for savvy spenders. Get yours now!

Get the freedom to spend confidently and manage your finances easily with the Marshland Visa® Credit Card. Discover its top 4 benefits now:

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Navigating the intricate world of credit cards can sometimes feel like wandering through a dense marsh, but the Marshland Visa® Card is here to illuminate the path.

Tailored for those who value simplicity and effectiveness in their financial tools, this card promises more than just swiping benefits.

Let's take a closer look and discover if the Marshland Visa® Card is the beacon you've been searching for.

Strengths and Special Offerings

- Broad Acceptance: Being under the Visa® umbrella, the Marshland Card ensures you're welcomed at millions of merchants worldwide. An international passport to spending, if you will.

- Security Features: With advanced fraud protection, this card offers peace of mind. Marshland's dedication to security means you're protected against unauthorized transactions.

- Flexible Credit Limits: Marshland acknowledges varied financial needs, offering a range of credit limits to suit diverse spending habits.

- Customer Service Excellence: Get round-the-clock access to customer service, ensuring that no query goes unanswered. A dedicated team is always on standby to assist.

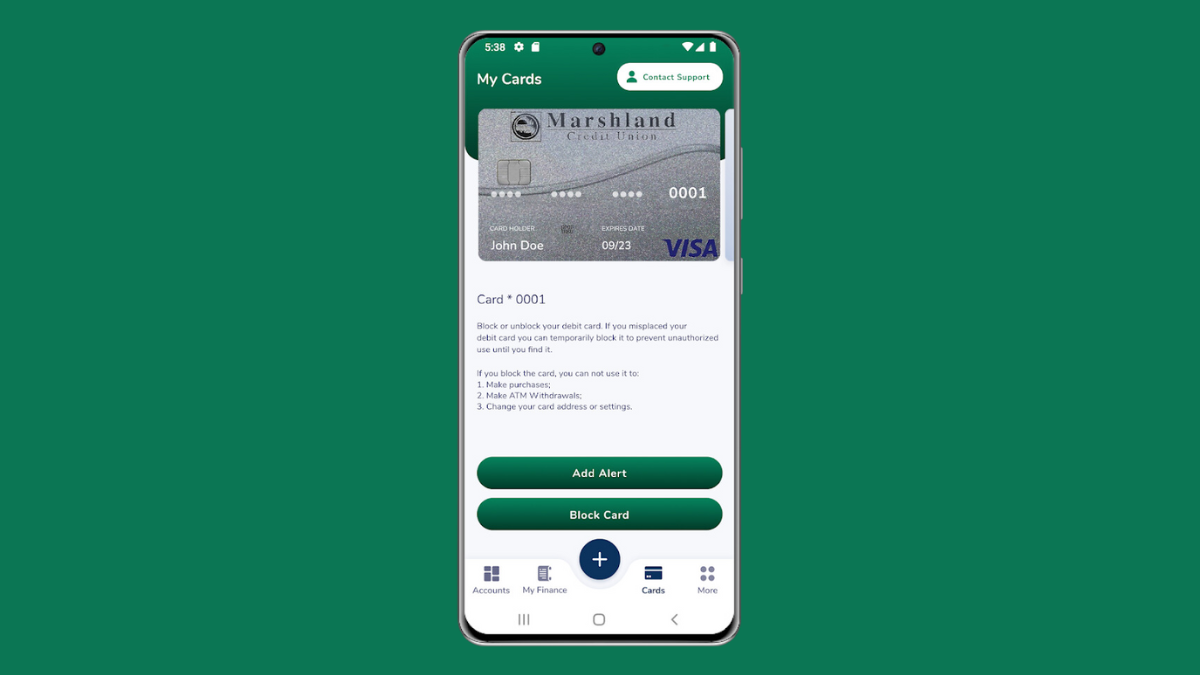

- Online Management Tools: Track expenses, manage payments, and analyze your spending patterns—all through Marshland’s user-friendly online portal. Financial management is just a click away!

Limitations to Consider

- Foreign Transaction Fees: Globe-trotters might feel the pinch, as international transactions may come with an added fee.

- No Extensive Reward System: If you have a penchant for collecting points or miles, the Marshland Visa® Card might not satiate that craving.

The Marshland Visa® Card is a trustworthy companion for those who seek both reliability and flexibility in their financial adventures.

It’s less about the frills and more about steadfast service and security. It might not shower you with rewards, but it promises a stable and supportive credit experience.

Whether you're taking the first step or the hundredth in your credit journey, Marshland offers a solid foundation to build upon.

The Marshland Credit Union offers the Marshland Visa® Credit Card, which has numerous benefits, including low-interest rates. The Marshland Visa® Credit Card can be used for online purchases like any other credit card.

Yes, you can use your Marshland Visa Credit Card abroad. However, there may be foreign transaction fees associated with using your card in another country.

If your Marshland Visa® Credit Card is lost or stolen, you should contact Marshland Credit Union immediately to report it. They can help you cancel the card and issue a replacement.

Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Looking to boost your purchasing power and earn cash back at the same time? The Discover it® Cash Back Credit Card is an excellent choice.

With its low-interest rates and generous rewards program, it is a strong and reliable credit card option to help you get the most out of your spending. Interested in applying? Check out our next post!

Discover it® Cash Back Credit Card application

Learn how to apply for the Discover it® Cash Back Credit Card. Earn up to 5% cash back on purchases and double it after the 1st year!

Trending Topics

Apply for the Blue Cash Preferred® Card from American Express

Learn how to apply for the Blue Cash Preferred® Card from American Express and earn cash back. Keep reading!

Keep Reading

Net First Platinum credit card review: is it legit and worth it?

To purchase at the Horizon Outlet, you need a merchandise credit card like the Net First Platinum. Learn more about this card here.

Keep Reading

A 101 guide on how to invest your money: tips for beginners

Do you want to know how to invest your money? This article is for you! Here you will learn more and find easy tips to start investing.

Keep ReadingYou may also like

Discover it® Balance Transfer Credit Card review: 0% intro APR

This Discover it® Balance Transfer Credit Card review will cover this product's perks! Pay no annual fee and earn up to 5% cashback.

Keep Reading

How to start planning your retirement

Wondering how to plan for retirement? Check out our top tips on how to save enough money and create a plan that's just right for you.

Keep Reading

BOOST Platinum Card Review: Is it worth it?

Shop with the BOOST Platinum Card and enjoy $750 merchandise credit. No credit checks, perfect for low scores. Financial flexibility awaits!

Keep Reading