Reviews

Discover it® Balance Transfer Credit Card review: 0% intro APR

Learn all about the Discover it® Balance Transfer Credit Card! Pay no annual fee and enjoy several perks! Stick with us and find out more!

Advertisement

Discover it® Balance Transfer Credit Card: Earn up to 5% cash back

Read our Discover it® Balance Transfer Credit Card review. This card is an excellent option for those who want to pay down their debt in a manageable way.

Apply for the Discover it® Balance Transfer Card

Get the lowdown on how to apply for Discover it® Balance Transfer Credit Card! Enjoy 0% intro APR and more! Keep reading!

You’ll learn the advantages and disadvantages and take an overview of this card in our full article. Here’s how it works!

- Credit Score: Good to excellent;

- Annual Fee: No annual fee;

- Regular APR: 0% APR for 15 months on purchases and balance transfers. Then 16.24% to 27.24%, and up to 5% fee for future balance;

- Welcome bonus: Cashback Match will double the cash back you’ll earn at the end of the first year of the account;

- Rewards: 5% cash back on quarterly categories up to $1500,00 (needs activation) and 1% on all other purchases.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Discover it® Balance Transfer Credit Card: how does it work?

Discover it® Balance Transfer Credit Card allows you to transfer all or part of your existing balance from one or more high-interest credit cards onto this card.

This card has no annual fee and offers 0% intro APR on purchases and balance transfers made within the first 15 months.

You can also take advantage of the Cashback Match™ feature, which doubles all the cash back you earn in your first year as an account holder.

Rewards and benefits

Discover it® Balance Transfer Credit Card also offers cash back for each purchase you make with your card.

It can be redeemed for gift cards, travel rewards, and more. Plus, there are no blackout dates when redeeming points for travel rewards like airfare or hotel stays.

Additionally, this card has various benefits, such as fraud protection and extended warranty coverage on select items purchased with the card.

Also, purchase protection if your card is damaged or stolen within 90 days of purchase.

Advertisement

Cashback bonus categories

Discover it® Balance Transfer credit card also comes with rotating cashback bonus categories.

It gives you 5% cash back in purchases each quarter when you activate the bonus category online (1% afterward).

Categories can include restaurants, gas stations, and Amazon purchases—so there’s something for everyone.

Discover it® Balance Transfer Credit Card: should you get one?

The Discover it® Balance Transfer Credit Card can be highly advantageous for those who want to make the most of their money!

But is it the right choice for you? Check out the pros and cons of this card to help you decide.

Advertisement

Pros

- No annual fee;

- 0% intro APR on purchases and balance transfers for 15 months from account opening;

- Up to 5% cash back purchases;

- Enjoy bonus categories.

Cons

- The rotating cashback category requires activation.

Credit score required

This credit card provides amazing benefits to its cardholders. As a result, it requires good credit from applicants.

To qualify for the Discover it® Balance Transfer Credit Card, you just have a credit score of 690 or higher.

Discover it® Balance Transfer Credit Card application: how to do it?

Find out how to apply for the Discover it® Balance Transfer Credit Card in our post below. Start enjoying its benefits right away! Keep reading!

Apply for the Discover it® Balance Transfer Card

Get the lowdown on how to apply for Discover it® Balance Transfer Credit Card! Enjoy 0% intro APR and more! Keep reading!

Trending Topics

How to buy cheap flights on SkyScanner

Are you looking for ways to save money when you travel? Use these tips to buy cheap flights on Skyscanner. Keep reading!

Keep Reading

Chase Freedom Unlimited® review: is it worth it?

With all its benefits, the Chase Freedom Unlimited® is hard to beat. Read this review to learn about its cash back program and more!

Keep Reading

Instacart Mastercard® Review: Shop, Earn, Save!

How can Instacart help you earn cash back on all your purchases? Find out for yourself in our Instacart Mastercard® review. Read on!

Keep ReadingYou may also like

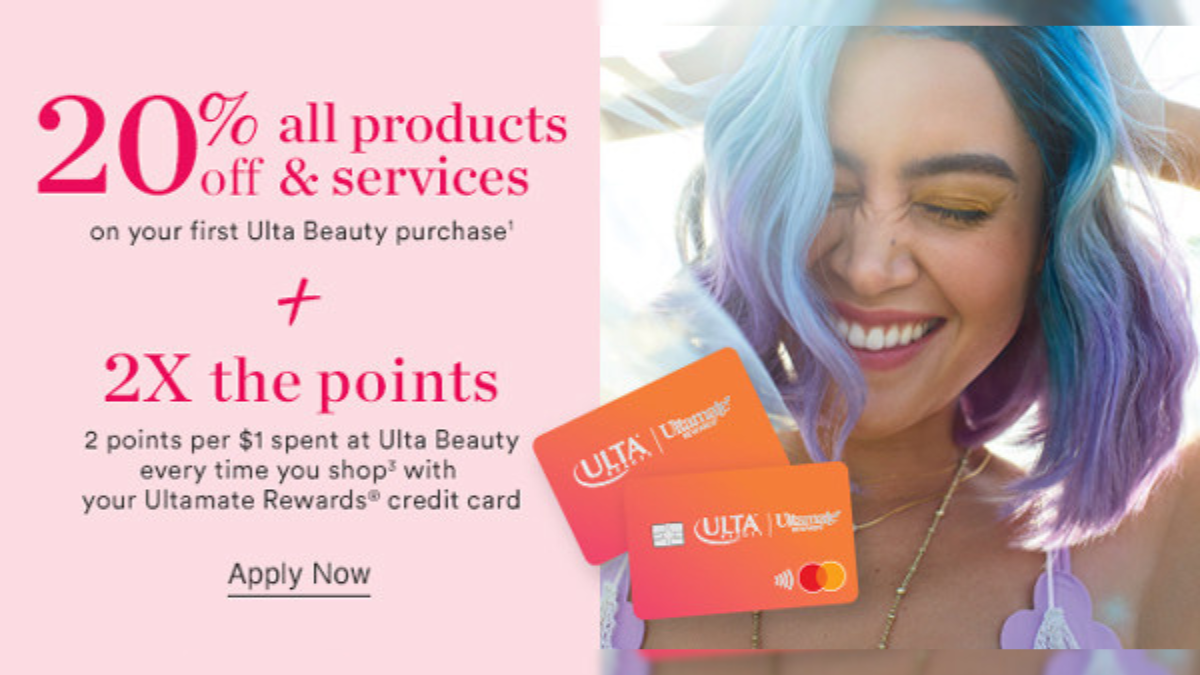

Beauty on a Budget? An Ulta Credit Card Honest Review

Earn 20% off your first beauty purchase at Ulta with the credit card in our review: Ulta Credit Card. Find out other benefits here!

Keep Reading

Checklist for moving out of state: your definitive guide

Are you packing up and relocating to another state? Check off all the to-dos with this moving out of state checklist.

Keep Reading

How to invest with Qtrade Direct Investing: Maximize Returns

Start investing easily with Qtrade Direct Investing: learn the basics, enjoy a user-friendly interface, and access top-notch investment tools.

Keep Reading