Reviews

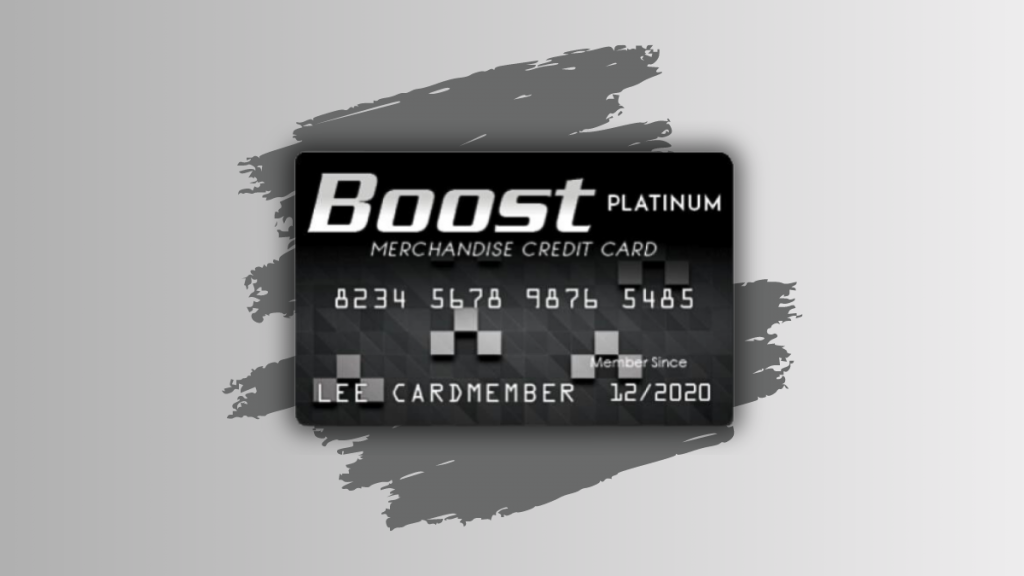

BOOST Platinum Card Review: Is it worth it?

Discover shopping freedom with the BOOST Platinum Card. Access $750 in merchandise credit instantly, no credit checks required. Ideal for low scores, offering a seamless way to shop.

Advertisement

BOOST Platinum Card: A credit limit of $750 to get you started

If you have a low or no credit score, it can be challenging to find a card to fit your profile. But the BOOST Platinum Credit Card is designed specifically for people in this situation, so join us as we review its features.

How do you get the BOOST Platinum Card?

See how to apply for a BOOST Platinum Card and have access to a generous merchandise credit line!

With a credit limit of $750, this product performs no employment or credit checks. You can only purchase items available at Horizon Outlet stores.

So if you’re ready to take the first step towards financial freedom, let the BOOST Platinum be your guide. Read on for more information about its main features!

| Credit Score | Not needed |

| Annual Fee | $177.24 ($14.77 monthly fee) |

| Regular APR | 0% |

| Welcome bonus | N/A |

| Rewards | N/A |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

BOOST Platinum Card overview

The BOOST Platinum is offered by Horizon Financial Services and works as a basic store card. That means you can’t make any purchases outside the establishment responsible for its emission. In this case, it’s the Horizon Outlet stores.

The best feature about this credit card is that it makes no credit or employment check, and you don’t have to worry about having a bad credit history. Its application process is quick, and acceptance is almost immediate.

The only thing Horizon does require is a checking account or a credit/debit card to your name.

There are no interest rates on purchases, and the credit limit is $750. You even get a free 7-day trial, and if you don’t like the card, you can return it and only pay for the items you bought.

This card has a monthly fee of $14.77 that provides privacy protection, roadside protection, credit monitoring, and more.

BOOST Platinum Card: should you get one?

If you’re a frequent shopper at Horizon Outlet and want a store card without a credit check, this card is the best choice for you. Check its pros and cons below:

Advertisement

Pros

- Accepts all kinds of credit scores;

- $750 credit limit;

- Fast and Easy Application;

- No Employment or Credit Check.

Cons

- Charges a $14.77 monthly fee;

- Only for purchases at Horizon Outlet.

Advertisement

Credit score required

The card welcomes applicants regardless of their credit score. Ideal for those looking to enjoy credit facilities without the hassle of credit checks.

With no minimum credit score requirement, the BOOST Card offers a unique opportunity. It’s designed for individuals seeking financial flexibility and merchandise access.

BOOST Platinum Card application: how to do?

In conclusion, the BOOST Platinum Card stands out as a flexible financial tool for those with lower credit scores, offering $750 in merchandise credit without stringent checks.

To discover how you can apply for this card and start enjoying its benefits, follow the comprehensive guide in the article below.

How do you get the BOOST Platinum Card?

See how to apply for a BOOST Platinum Card and have access to a generous merchandise credit line!

Trending Topics

Ally Bank increased its APY rates to 0,90%

Ally Bank has been increasing its APY rates for customers. Check out the latest increase and see just how much you can earn.

Keep Reading

Learn to apply easily for the OneMain Financial Personal Loan

Understand how to apply for a OneMain Financial Personal Loan here! Enjoy direct payments for debt consolidation! Keep reading for more!

Keep Reading

100 Lenders personal loan review: how does it work and is it good?

Do you need a personal loan for an emergency or to pay off debt? If so, read our 100 Lenders personal loan review and learn more about it!

Keep ReadingYou may also like

The hidden cost of banking: 6 common bank fees you may not know about

Millions of people are fed up with the fees banks charge. Take a closer look at 6 common bank fees and how to avoid them. Keep reading!

Keep Reading

Appy for the Neo Credit Card: No annual fee!

Learn how to apply for the Neo Credit Card and unlock high cashback rewards with a seamless digital banking. Start now!

Keep Reading

OpenSky® Plus Secured Visa® Credit Card Review

Build credit without annual fee: Our review of the OpenSky® Plus Secured Visa® Credit Card reveals all. Learn more!

Keep Reading