Credit Cards

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Ready to level up your buying power? Apply for Marshland Visa® Credit Card and get rewarded for every purchase you make with cash back. Keep reading!

Advertisement

Unlock Your Purchasing Power and Earn Rewards by Applying for Marshland Visa® Credit Card Today

Apply for the Marshland Visa® Credit Card in four easy steps and boost your purchasing power with 1 point per dollar spent on all your purchases!

Our guide makes the whole application a breeze so anyone can do it. Then keep reading to learn how to apply now.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Here are the steps to apply for a Marshland Visa® Credit Card.

1. Application Process

First, visit the Marshland Federal Credit Union website and locate the Marshland Visa® Credit Card.

After that, hit the “Apply Now” button to begin the application process.

Advertisement

2. Application Form

Then you’ll be directed to a PDF application form. Print the form and fill it out with your personal and financial information.

Make sure you double-check all the details to ensure accuracy.

3. Submitting the Application

After filling out the form, fold the paper and secure it in an envelope.

Send the envelope containing your application to the following address: Marshland Federal Credit Union, Brunswick, GA 31520 F.

PS: You can find this address in the PDF form.

Advertisement

4. Application Review

Once Marshland receives your application, they will review it to determine if you qualify for the Marshland Visa® Credit Card.

If approved, you will receive your Marshland Visa® Credit Card in the mail within a few weeks.

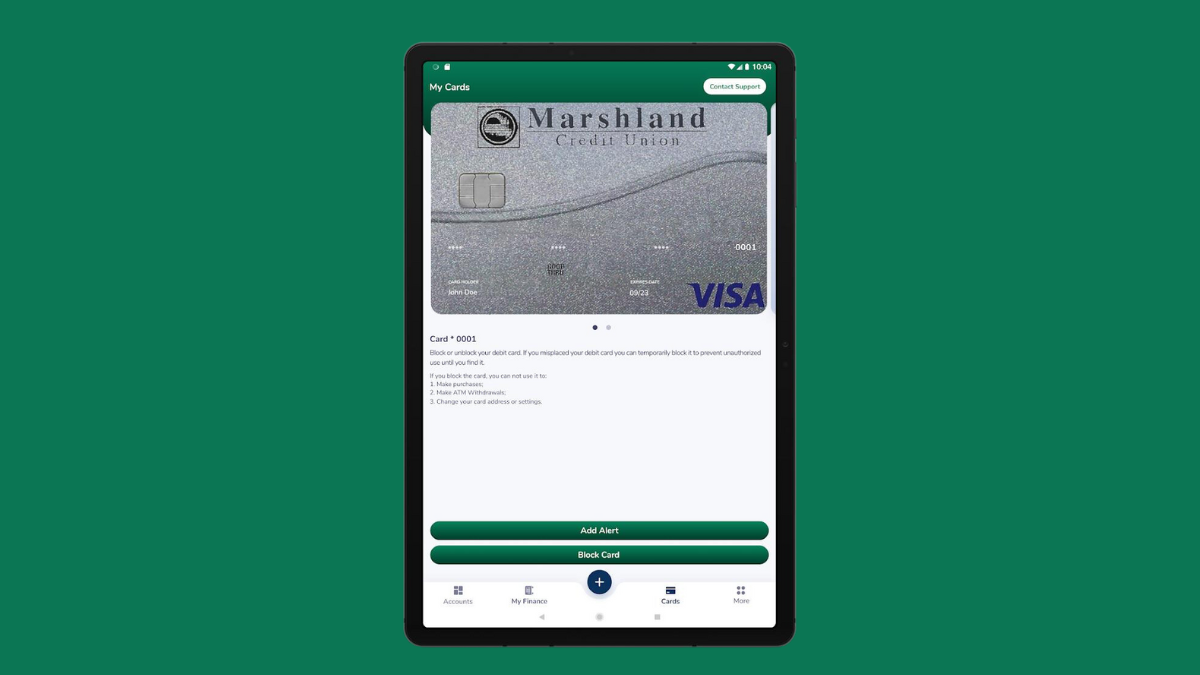

Apply using the app

The app does not have an option for applying. So you must complete your application through their official website!

Marshland Visa® Credit Card vs. Discover it® Cash Back Credit Card

The Marshland Visa® Credit Card and Discover it® Cash Back Credit Card differ in terms of purchase power.

The first card offers 1 point per dollar spent on all purchases.

Conversely, the second one comes with up to 5% cashback on selected categories, plus 1% cash back on everything else.

Review the features below to determine which card aligns with your financial objectives.

Marshland Visa® Credit Card

- Credit Score: Not disclosed;

- Annual Fee: $0;

- Purchase APR: 25-day grace period, after that 9,90%;

- Cash Advance APR: 9,90%;

- Welcome Bonus: N/A;

- Rewards: Earn 1 point on every dollar spent with your card.

Discover it® Cash Back Credit Card

- Credit Score: Good – Excellent;

- Annual Fee: $0;

- Regular APR: 0% Intro APR for 15 months on purchases and balance transfers, then 16.99% to 27.99%;

- Welcome bonus: Get an automatic unlimited cashback match on all your earnings at the end of your first year;

- Rewards: 5% cash back on rotating categories each quarter, 1% cash back on all other purchases, and unlimited cashback match with the Marshland Visa® Credit Card.

Apply for the Discover it® Cash Back Credit Card now with our quick and easy tips.

Further, follow our breakdown of the application process and apply online in no time. Don’t miss out – read on!

Discover it® Cash Back Credit Card application

Learn how to apply for the Discover it® Cash Back Credit Card. Earn up to 5% cash back on purchases and double it after the 1st year!

Trending Topics

Learn to apply easily for 100 Lenders personal loan

If you need a loan that accepts all scores and can help you in times of need, read on to learn how to apply for 100 Lenders personal loan!

Keep Reading

What is a private loan for students? Learn how to get one.

Learn what is a private loan for students by reading this article. Is it really worth it? Can you get one? This content have the aswers.

Keep Reading

Apply for the Blue Cash Preferred® Card from American Express

Learn how to apply for the Blue Cash Preferred® Card from American Express and earn cash back. Keep reading!

Keep ReadingYou may also like

Southwest Rapid Rewards: a complete guide

Get reward flight information, know how to earn maximum points, details of the new changes, and more. Learn about Southwest Rapid Rewards!

Keep Reading

Apply for the Hilton Honors American Express Card in a Flash

Here is the quickest way to apply for the Hilton Honors American Express Card - earn up to 7 points on purchases with $0 annual fee! Read on!

Keep Reading

Sam´s Club Credit Plus Member Mastercard credit card review: is it worth it?

Find out if the Sam’s Club Credit Plus Member Mastercard credit card, which offers cash back on gas and dining, is a good option for you.

Keep Reading