Comparison

Luxury Titanium or Luxury Black card: choose the best!

Are you trying to decide between Luxury Titanium or Luxury Black? This review will help you decide, showing the benefits and disadvantages of each one. Please read on to find out the best travel card for you!

Advertisement

Luxury Titanium or Luxury Black: learn the best option for you

Luxury Titanium and Luxury Black are two great options for travel lovers. Anyone looking for luxurious status and benefits will like these cards. They have a cutting-edge design to match your best clothes and pay for the best dinners. When traveling, don’t forget to take them with you, because they have no foreign transaction fees. However, they have some differences concerning premium travel benefits. If you’re willing to pay more in an annual fee, you can enjoy VIP treatments at airports around the world.

Check out the benefits and disadvantages of each of these cards. See which one is worth it for you and fits your needs. What do you want in a credit card? See which one has it.

How do you get the Luxury Titanium card?

The Luxury Titanium credit card has premium benefits and will give you reward points in every purchase. Learn how to get yours.

How do you get the Luxury Black card?

If you wish to enjoy the Luxury Black credit card benefits, you'll find all the information you need right here in this article.

| Luxury Titanium card | Luxury Black card | |

| Sign-up bonus | No welcome bonus | No welcome bonus. |

| Annual fee | $195 | $495 |

| Rewards | 1x point per dollar 2% value for airfare redemptions 1% value for cashback redemption. | 1x point per dollar 2% value for airfare redemptions 1,5% value for cashback redemption. |

| Other perks | Cellphone insurance 24/7 Concierge service | Hotel and airline credits. Access to airport lounges. |

| APR | 0% Intro APR for 15 months. After that, 14.99%, Variable | 0% Intro APR for 15 months. After that, 14.99%, Variable |

Luxury Titanium

Luxury Titanium is the little brother of the Luxury Card family. The Titanium is the most affordable version of these premium cards with an annual fee of $195, giving you access to many benefits. Several of these benefits are provided by Mastercard, such as cell phone protection against theft or damage and travel insurance for accidents and baggage delays.

Perfect to take on your best trips, this card is accepted at millions of establishments in over 200 countries, and you pay no foreign transaction fee to use it. And on all purchases you make, you receive 1 point per dollar spent, which you can exchange for cashback or discount on airline tickets.

If you are interested in fashion, design, technology, and much more, you will love Luxury Magazine. Exclusive to members, the covers contain artwork to collect. Also, Luxury Card members receive special gifts every now and then.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Benefits

- Even tho the annual fee is not low, it is lower than other travel credit cards in the same category.

- Rewards program where you earn 1 point for every dollar spent. These points are worth cashback at 1,5% for account deposit or 2% for airfare redemption.

- Exclusive subscription to the Luxury Magazine. The best content about art, fashion, design, wellness, technology, and more.

- 24/7 access to a Concierge Service to assist you.

- Get complimentary benefits at selected hotels with the Luxury Card Travel.

- You may get a surprise luxury gift at any time.

Disadvantages

- Fewer credit benefits than the Black and Gold versions of the card.

- Charges annual fee.

- No access to airport lounges.

- No welcome bonus, which is a big disadvantage if compared to others travel credit cards.

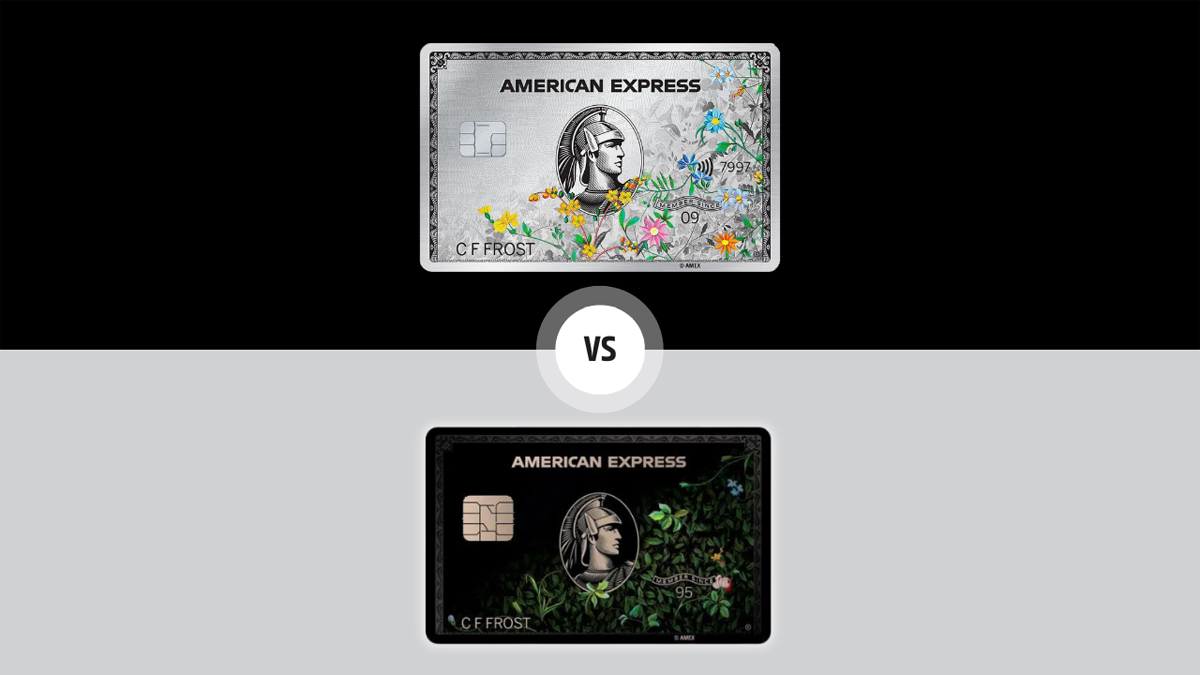

Luxury Black

Black cards are usually the most ultra-exclusive credit cards from their issuers. This is not the case for Luxury Card, which has another card above Luxury Black. However, the Black card remains an exclusive card with high-value benefits. Anyone who can afford the $495 annual fee will have access to travel, hotel, and global entry credits.

With the Black card, you have luxury benefits. Receive $100 in credits to use on airlines and $100 in credit to use in the Global Entry application. In addition, one of the most sought-after benefits by frequent travelers is access to airport lounges. After all, there’s nothing like having a comfortable space to rest between connections and wait for your flights with VIP treatment. Avoid lines with preferential boarding, and if you are going to travel to an airport you don’t know yet, you can schedule a trained agent to assist you in the boarding and disembarkation process.

Benefits

- Rewards program: You’ll get 1 point per dollar in every purchase. Them, you can redeem these points as cashback, for a 1% value or you can redeem as airfare for a 2% value.

- Beautiful metal card with 22g of Black-PVD-Coated Stainless Steel Card.

- $100 credit for purchasing air tickets, every year.

- $100 credit to use with a Global Entry application.

- Access to airport lounges and Priority Pass.

- Concierge assistance you can ask for help 24/7.

- The Luxury Card Travel will give you complimentary benefits at thousand of hotels and accommodations worldwide. You’ll get up to $500 for upgrades, food, services, and more.

- Surprise luxury gifts.

Disadvantages

- High annual fee.

- The absence of a welcome bonus makes it very difficult to collect enough points to take advantage of the rewards program.

- Some financial products experts believe that the benefits are not worth the annual fee, and there are competitors in the same category that are more advantageous.

Luxury Titanium or Luxury Black card: choose the best

As you can see in this review, both Luxury Black and Luxury Titanium are great options. If you are looking for a travel card with benefits and cashback, you can choose any of them. The main difference is in the annual fee. Luxury Black has some more advantages, being a more exclusive card, with a higher cost.

But if you want an even more exclusive card, Luxury Card also has a Gold version. With this card, you will have more credits and more luxurious benefits to travel and stay in renowned hotels. And it is not just golden: it is real gold.

Curious to know more about this golden card? Then check out the Luxury Gold credit card review. The article is in the following, just click and keep getting informed on the best finance portal.

Luxury Gold credit card review: is it worth it?

The Luxury Gold credit card has premium benefits and is an excellent card to take on every trip. Learn more about this golden card here.

Trending Topics

Upgrade Cash Rewards Visa® review

The Upgrade Cash Rewards Visa® is perfect for you who need a higher credit limit. Enjoy a card with no annual fee and cash back!

Keep Reading

The Centurion® Card or The Platinum Card® from American Express: choose the best!

The Centurion® Card or The Platinum Card® from American Express? We've made a comparison to help you decide which is best.

Keep Reading

How to make $5000 a month: 10 simple strategies anyone can use

Discover how to make $5000 a month with these simple strategies and secrets that anyone can use. Keep reading!

Keep ReadingYou may also like

Apply for the Verizon Visa® Card: enjoy no annual fee

You can apply for a Verizon Visa® Card easily! Earn up to 4% cash back with no annual fee! Read on and learn more!

Keep Reading

Apply through MaxCarLoan: Skip the Dealership

Unlock your dream car with MaxCarLoan - Learn to apply today for swift approvals and a hassle-free auto financing experience. Read on!

Keep Reading

Axos Bank Rewards Checking Account Review: Earn Amazing Rewards

Looking for a great rewards? Then take a closer look at this Axos Bank Rewards Checking Account review - earn up to $300 welcome bonus!

Keep Reading