Credit Cards

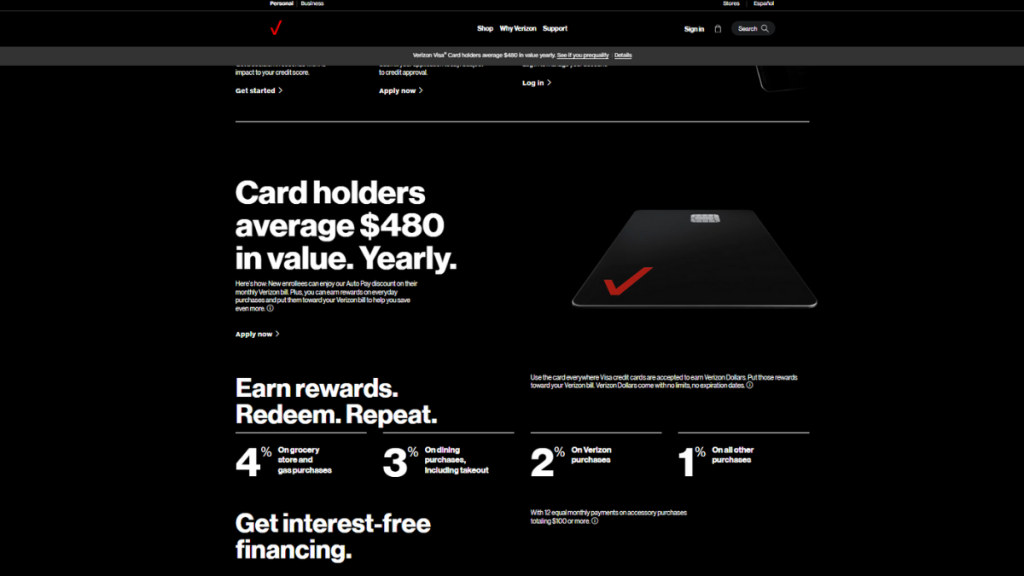

Apply for the Verizon Visa® Card: enjoy no annual fee

Find out how to apply for the Verizon Visa® Card and enjoy the convenience of $100 statement credit in the first year. Stay tuned!

Advertisement

All Digital: From Applying to Getting the Card

Verizon Wireless customers looking for a credit card that complements their lifestyle can now apply for the Verizon Visa® Card.

With no annual fee and a range of rewards, it’s designed to enhance your Verizon experience. Do you want to learn how to apply? Keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The easiest and only way to apply for the Verizon Visa® Card is through their website. To start, log in with your User ID or Verizon mobile number.

Then, follow the application process steps. You’ll need to give personal and financial details to fill out the form during this process.

After submitting it, you’ll then get an instant response of whether or not your application was successful.

All digital, all online, the process is straightforward and takes only a few minutes.

Requirements

To get the Verizon Visa® Card online, you must be the Account Owner or an Account Manager of a Verizon Wireless customer.

Your wireless account can have up to 12 phone lines (depending on your plan). However, Verizon Business and Prepaid accounts are not eligible for this card.

Advertisement

Apply using the app

Unfortunately, you cannot apply for the Verizon Visa® Card using the mobile app.

However, the app can be a handy tool to manage your card account, make payments, and redeem rewards once approved.

Verizon Visa® Card vs. Discover it® Cash Back Credit Card

Choosing between the Verizon Visa® Card and the Discover it® Cash Back Credit Card comes down to key factors.

The Verizon Visa® Card offers rewards through Verizon Dollars, which can be redeemed for Verizon purchases and bill credits.

On the other hand, the Discover it® Cash Back offers more flexibility with 5% back on rotating categories each quarter and 1% on all other purchases.

So, if you’re weighing your options and deciding between the Verizon Visa® Card and the Discover it® Cash Back Credit Card, here’s a quick comparison:

Advertisement

Verizon Visa® Card

- Credit Score: Good-Excellent;

- Annual Fee: None;

- Purchase APR: 26.99% or 30.99% (variable);

- Cash Advance APR: N/A;

- Welcome Bonus: $ 100 statement credit on your credit card bill after spending $1,000 during the first 90 days of account opening;

- Rewards: 4% back on grocery store and gas purchases, 3% on dining purchases (takeout included), 2% on Verizon purchases, and 1% on everything else.

Discover it® Cash Back Credit Card

- Credit Score: 690-850 (Good – Excellent);

- Annual Fee: No annual fee;

- Regular APR: 0% Intro APR for 15 months on purchases and balance transfers, then 17.24% to 28.24% after; also 3% intro balance transfer fee up to January 2024, then 5%;

- Welcome bonus: They match all your cash back earned in the first year;

- Rewards: 5% cash back on everyday purchases at a different place each quarter, such as four grocery stores, restaurants, Amazon.com, and gas stations. Activate each quarter to maximize your rewards from different merchants: 1% cash back on all other purchases; and with unlimited cashback match, you can get limitless cash back on your purchases.

For more details on applying for the Discover it® Cash Back Credit Card, please refer to our post below.

Discover it® Cash Back Credit Card application

Learn how to apply for the Discover it® Cash Back Credit Card. Earn up to 5% cash back on purchases and double it after the 1st year!

Trending Topics

Metaverse investors are losing money to phishing scams

Find out how a new generation of cybercriminals is using the metaverse as a place to steal from unsuspecting investors. Read on for more!

Keep Reading

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Keep Reading

Upgrade Cash Rewards Visa® review

The Upgrade Cash Rewards Visa® is perfect for you who need a higher credit limit. Enjoy a card with no annual fee and cash back!

Keep ReadingYou may also like

Up to $15,000: VivaLoan review

Thinking of taking out a loan? Check out our VivaLoan review to discover if this product is for you! Enjoy personalized rates and terms!

Keep Reading

A small glossary of investment terms: a guide for starters!

We've made this glossary of investment terms to help you understand them better and start investing with confidence. Check this article.

Keep Reading

Citi® / AAdvantage® Executive World Elite Mastercard® application: how does it work?

Learn how to apply for a Citi® / AAdvantage® Executive World Elite Mastercard® quickly and online to earn the best miles. Read on!

Keep Reading