Loans

Apply through MaxCarLoan: Skip the Dealership

Learn how to apply for a loan through MaxCarLoan. The broker connects you with top lenders for the best car loan rates and terms: fast approval, no hassle.

Advertisement

Need the perfect car loan without the paperwork headache? MaxCarLoan finds you the best rates and terms!

Dreaming of a new car? Then, you want to know how to apply through MaxCarLoan, the marketplace, to make it a reality.

They connect you with a vast network of lenders, uncovering the most budget-friendly options for your perfect car. So, read on to learn the application process!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

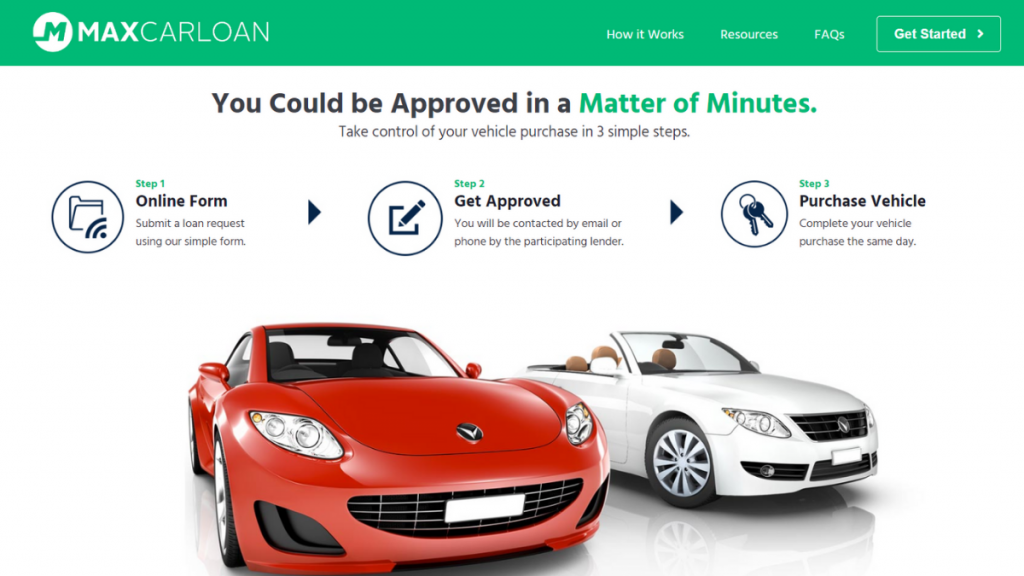

Online application

With MaxCarLoan, you can find funding options to buy a car that fits your budget in just a few minutes.

So, if you want to use MaxCarLoan to apply for an auto loan, follow the guide below.

Step 01- Submit an Online Form

To get a car loan, the first step is to go to the MaxCarLoan website. Once you’re there, you’ll fill out a form to request a loan.

It’s really easy and only takes about 5 minutes. Still, you can do it anywhere using your computer, tablet, or smartphone.

Advertisement

Step 02- Finding a Perfect Lender

After submitting your application, then a lender will get in touch with you through email or phone.

Then, you’ll receive an offer, and if you feel like proceeding, just accept it.

However, if you don’t, it’s okay, there is no obligation.

Step 03- Buying your Vehicle

Once you’ve sealed the deal, you can buy your car on the same day.

Then, just take your pre-approval to the dealership, choose your car, and complete the transaction.

Advertisement

Requirements

Their website does not display the requirements to get a loan through MaxCarloan.

However, most loan brokers consider some aspects before approving a loan application, such as:

- Credit score;

- Income;

- Employment history;

- Debt-to-income ratio.

So, when getting a loan, it’s important to understand these factors and how they can affect your loan eligibility and interest rates.

Apply using the app

If you’re looking to apply for a car loan with MaxCarLoan, you won’t be able to do so through an app on your phone.

Instead, you must visit their website to complete the application process.

MaxCarLoan vs. CarLoans.com

MaxCarLoan focuses only on auto loans and offers a quicker pre-approval process. So, it is great for people who want a simple and fast experience.

The second option is CarLoans.com, which offers more loan choices and might also have some direct lending opportunities.

Overall, the approval times and terms may vary depending on the lender you choose for both lenders.

So, the best choice for you is the one that suits your needs. Have a look at the comparison below.

MaxCarLoan

- APR: N/A;

- Loan Purpose: Car loan;

- Loan Amounts: Depends on the lender;

- Credit Needed: All credit types are considered;

- Origination Fee: Not applied;

- Late Fee: Not applied;

- Early Payoff Penalty: Not applied.

CarLoans.com

- APR: From 3.2% to 24% ( depending on your creditworthiness);

- Loan Purpose: Auto loans;

- Loan Amounts: N/A;

- Credit Needed: No minimum credit score is required;

- Origination Fee: Depends on the lender;

- Late Fee: Depends on the lender;

- Early Payoff Penalty: Depends on the lender.

Learn how to apply for a personal loan with CarLoans.com easily in our post below!

Learn to apply easily for CarLoans.com

Have you been thinking of buying a new car? Then learn how to apply for CarLoans.com! Get approved in 2 minutes! Keep reading!

Trending Topics

How to create an easy budget plan in 5 steps

Find out how to create a budget. Here are the steps to start and stick with a budget that will work for you.

Keep Reading

Learn how to calculate your credit scores!

Having a good credit score is very important for your financial life. Keep reading to learn how to calculate your credit score!

Keep Reading

American Airlines AAdvantage® MileUp® application: how does it work?

Find out if the American Airlines AAdvantage® MileUp® is right for you, and learn how to apply here. Read on!

Keep ReadingYou may also like

Hawaiian Airlines: Follow this guide to track the best prices!

Find out the best ways to buy cheap Hawaiian Airlines flights in this review. Keep reading for more information!

Keep Reading

First Latitude Select Mastercard® Secured Credit Card review

Give a fresh start to ruined credit with the First Latitude Select Mastercard® Secured Credit Card. Read our review to learn more!

Keep Reading

How to request US Bank Altitude® Go Visa Signature® Card

See how to apply for the US Bank Altitude® Go Visa Signature® credit card today and enjoy cash back, lower rates, rewards, and more!

Keep Reading