Investments

What is a CD: how it works, interest and more!

If you're new to investments, take a look at Certificates of Deposit. It is an excellent option to play safe but earn more than a savings account. Keep reading to learn more about CDs.

Advertisement

Certificates of Deposit: a safe investment to get a return on it

Do you know what is a CD? We are not talking about “compact disc”, the old-gone media to listen to music. Every time you read the CD initials on this article, you should think about Certificates of Deposit.

CDs look like savings accounts, but many conditions are different. This is a safe type of investment, where you have a guarantee of return and low risk.

After all, not everybody wants to actively trade assets and take big risks in the investment field. You can play it safe and your money will still grow. Not as much as it would on a higher-risk type of investment, but you can still get a good amount back.

With so many options, it’s hard to know where you should invest your hard-earned money. Some people will tell you that this investment is the best, or that, or that other, and so on.

Truth is, each one will have its own preference. And there is no one-size-fits-all when it comes to investment. Understanding your investment style is essential to picking the best one for you. Maybe you’ll like what the Certificates of Deposit have to offer. And you can always diversify your portfolio. Cand and should.

So, let’s learn one more thing about investment and broaden our vocabulary and our knowledge in this field.

How to prepare for a recession?

A recession might be underway, and it’s best to be ready for it. Here are some tips on what you can do now to help cushion the blow when the next economic downturn happen

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

What is a Certificate of Deposit (CD)?

If you have some money in your savings account and would like to let it grow a little more, you can put a part of it into a CD. Maybe you’ve heard about buying CDs, but it is actually a type of account where you’ll agree to deposit your money for a specific term.

The longer you agree to let your money untouched, the more interest you will receive upon it. So, it is a good way to keep your money safe and growing. Savings accounts don’t pay high rates on your money, and sometimes they won’t even cover inflation.

You will make an agreement with the bank to determine the terms of your CD. When your CD matures, you will be able to withdraw your initial investment plus every earning from the interest that accrued on it. But if you decide to take your money before the due date, you will suffer a penalty and will receive way less than you would if you’ve waited till it matures.

Because of this penalty, you have to be sure about putting your money into a Cd. We recommend that you have an alternative fund for any emergency, then you will not have to use the money from your certificate of deposit.

Do CDs have fees?

It is not usual for a CD to have monthly or annual maintenance fees. This is an advantage of investing in it. However, most will charge a fee if you decide to withdraw your principal before the CD matures.

Avoid paying this fee by letting your CD untouched. Even if interests start rising, stick to your original plan. Remember that your CD is FDIC insured, so your money is safe there.

Advertisement

How does CDs interest work?

Have you heard about compound interest? If you don’t, you will get happier the next time you hear about it.

So, how do banks calculate the interest on your CD? They do it through the APY, which means annual percentage yield. But it doesn’t mean that you’ll get it once a year. This APY has a daily or monthly proportion that accrues on your account.

So, you receive this proportional interest on your account that adds to your principal. Next time the bank calculates your interest it will count the previous interest that was added to your principal. This is excellent, because the more you earn, the more you’ll earn.

Also, CDs have a fixed rate. This will be good when bank rates fall, but maybe you’ll regret it when interest rises. Well, you can’t win every match.

How much interest will I earn on a CD?

The rate you’ll get on your investment depends on some conditions. First, each bank or credit company will have its own offers. It is good to research them on the market before closing the deal.

Another factor that will impact is the initial investment you’re willing to put on your Certificate of Deposit. The higher the amount, the higher your earnings.

But the most important factor about a CD is time. The longer you’re willing to let your money on your account without touching it, the higher will be the interest rate. This happens because the deal gets more interesting for the bank, as they will have more time to work your money and make it grow.

Advertisement

Do CDs pay interest monthly?

You will trust your money to a bank to work on it during that period. Each bank will work on its way. Most will calculate it through the APY (annual percentage yield). Some will pay interest daily.

But most will pay it quarterly or monthly. You can check it on your account statement. However, you don’t have access to your funds or the interest accrued on them until your CD matures.

Investment alternatives to a CD: learn more!

CD is not the only safe investment suitable for a beginner. If you’re saving for your retirement, you can think about investing in annuities. It can give you a good steady income when you’re retired.

Look for a good insurance company to invest in annuities and grant a good retirement for yourself. To learn more about them you can read the following content we’ve made about it.

Understanding Annuities as an Investment: a guide

Do you know how to have annuities as an investment? If you don't even know what an annuity is, don't worry. You can learn more about this topic by reading this article.

Trending Topics

Net First Platinum credit card review: is it legit and worth it?

To purchase at the Horizon Outlet, you need a merchandise credit card like the Net First Platinum. Learn more about this card here.

Keep Reading

Citi Rewards+® Card review: No annual fee and extra rewards on purchases

The Citi Rewards+® Card review will give you all the details you need about this card's features, rewards, and pros and cons. Keep reading!

Keep Reading

Southwest Rapid Rewards® Plus Credit Card review

Look into our Southwest Rapid Rewards® Plus Credit Card review to familiarize yourself with its traveling advantages. Keep reading!

Keep ReadingYou may also like

Learn to apply easily for LoanPionner

Read on to learn how to apply easily for a loan with LoanPionner. Up to $5K for any purpose and fast funding! Read on!

Keep Reading

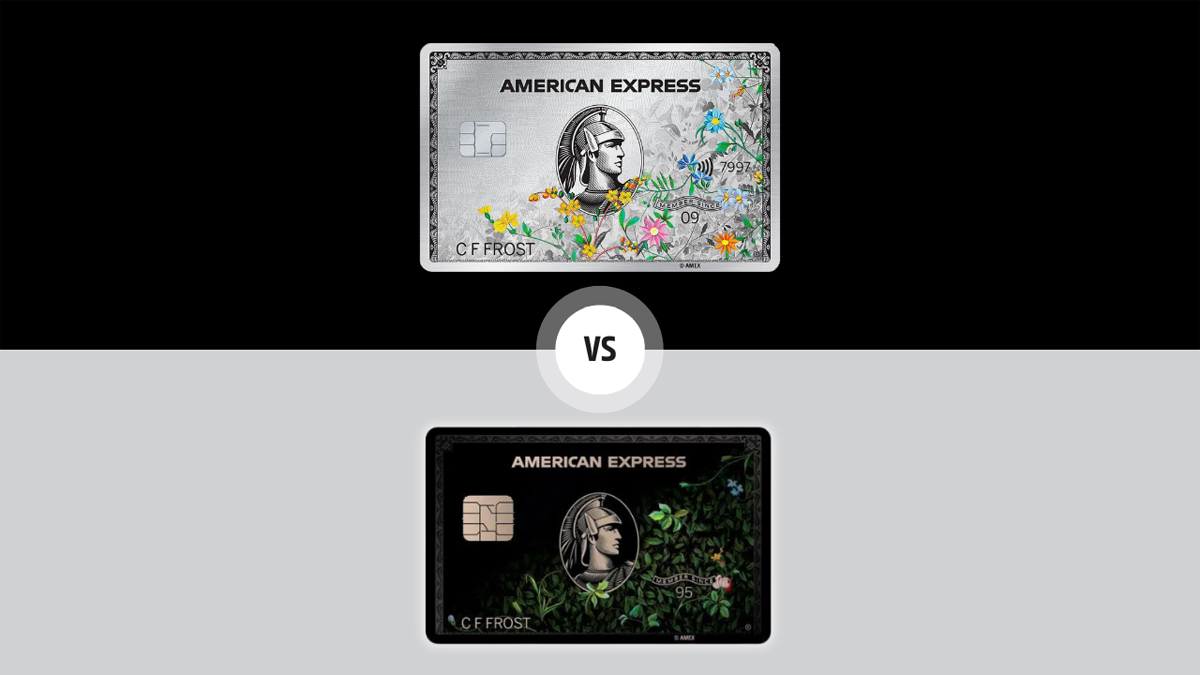

The Centurion® Card or The Platinum Card® from American Express: choose the best!

The Centurion® Card or The Platinum Card® from American Express? We've made a comparison to help you decide which is best.

Keep Reading

HSBC Premier Checking review: Is the 75,000 minimum balance worth it?

This HSBC Premier Checking review brings a scoop on account details, benefits, drawbacks, and more. Open your account for free. Read on!

Keep Reading