Accounts

How to open an Axos High Yield Savings Account easily

If you're looking for an online savings account, the Axos High-Yield Savings account is a good place to start. Learn about its features and application process here!

Advertisement

Axos High Yield Savings Account application: Competitive APYs for all balances.

The Axos High Yield Savings Account is a solid option for anyone looking for an online savings account to earn interests on their savings. Axos Bank doesn’t require clients to keep a minimum balance in order to gain interest. However, new customers need to deposit a minimum of $250 to open the account.

There are no monthly or maintenance fees and the Annual Percentage Yield (APY) is 0,61%. The bank offers easy access to funds by providing a free ATM card upon request.

That means customers can withdraw money without having to transfer it to a checking account.

Axos does not have physical branches and all of their services are online only. Customers can manage their accounts via internet banking or reach customer services 24/7 through text messages, online chats, phone or email.

To learn how to open an Axos High Yield Savings Account, keep reading the content below.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Opening an Axos High Yield Savings Account online is easy and can be done in just a few minutes. First, access Axos’ official website and hover your mouse over the “bank” option on the top menu. Then, select the “high yield savings” under the “savings” alternative. After that, click on “open an account”.

The bank will redirect you to another page with three options. If you’re a new customer, click on that alternative and fill out the form with your name and contact info. Axos will require you to create a username and password for the next step. Once you’ve done that, click on “start application” and follow the directives provided by the institution.

Apply using the app

You can open the account via mobile by following the same steps listed above. First you’ll need to download the app – which is free and available in all online app stores. With the Axos app, you can also manage your account and have access to one of the best banking apps available for clients with a savings account.

Advertisement

Axos High Yield Savings Account vs. Sable Bank Account

But maybe what you’re looking for isn’t exactly a savings account – even if a great one. In that case, we can help you with another option. Meet the Sable Bank account. Sable is an online account that also doesn’t charge any fees and offers a grand deal of goods and services to everyone with zero bureaucracy. See the comparison below for some of its key features and follow the link if you want to learn how to apply for it.

| Axos High Yield Savings Account | Sable Bank Account | |

| APY | Up to 0.61% | None |

| Minimum Balance | $250 to open an account | Not required |

| Maintenance Fees | None | No maintenance fees |

How to apply for Sable bank Account?

Opening your Sable account is simple, and your account will be fee-free with a debit card and cashback. Isn't it great? Learn how to get one for yourself.

Trending Topics

A 101 guide on how to invest your money: tips for beginners

Do you want to know how to invest your money? This article is for you! Here you will learn more and find easy tips to start investing.

Keep Reading

Application for The Centurion® Card from American Express: how does it work?

Do you have what it takes to ask for The Centurion® Card from American Express? Here is the step-by-step to make your requisition.

Keep Reading

Petal 2 “Cash Back, No Fees” Visa Credit Card review

Looking for a no hidden fees, cash-back credit card? Check out this Petal 2 "Cash Back, No Fees" Visa Credit Card review. Read on!

Keep ReadingYou may also like

Application for the Citi® Double Cash Card: how does it work?

Learn all you need to apply for the Citi® Double Cash Card and enjoy a card with no annual fee and double reward points in every purchase.

Keep Reading

PNC points® Visa® Credit Card review: 100K bonus points

Our review of the PNC points® Visa® Credit Card covers its perks and drawbacks. Read on to learn how you can earn up to 7 points!

Keep Reading

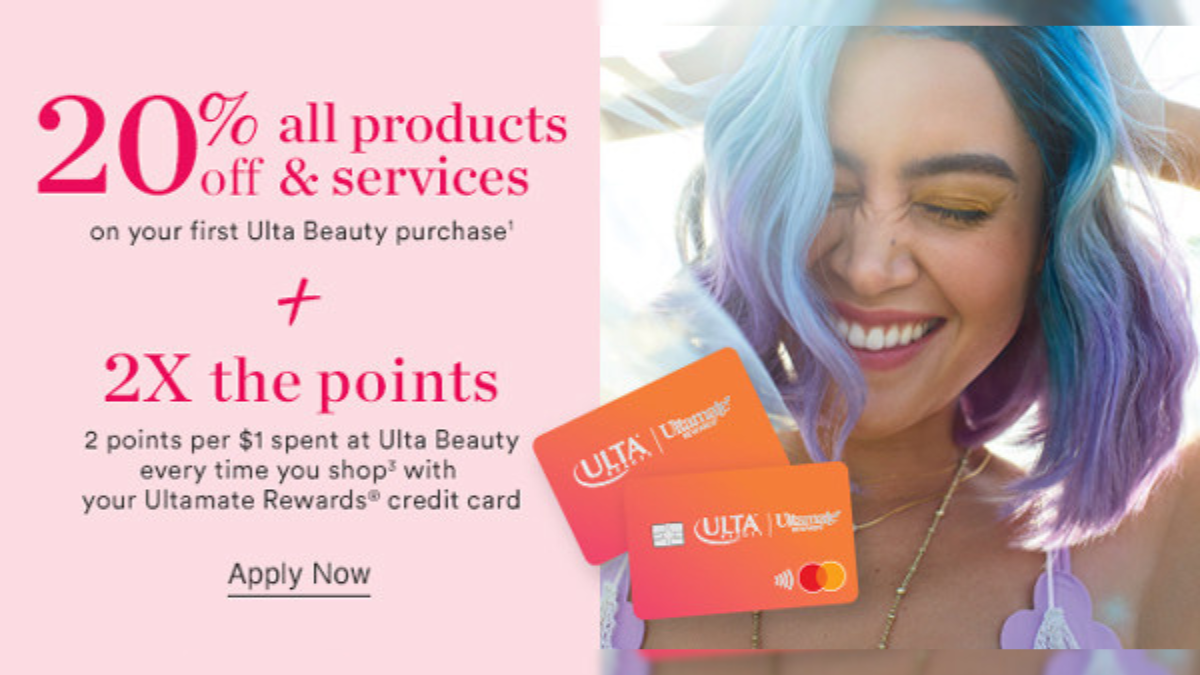

Beauty on a Budget? An Ulta Credit Card Honest Review

Earn 20% off your first beauty purchase at Ulta with the credit card in our review: Ulta Credit Card. Find out other benefits here!

Keep Reading