Reviews

American Express® Gold Card application: how does it work?

Amex card can be one of the best ones in the market! You can earn travel and shopping rewards with the American Express® Gold Card! So, read on to learn about the application process!

Advertisement

American Express® Gold Card: the perfect card for those who like to travel and dine

If you’re looking for a travel and shopping rewards credit card that comes with some extra perks, the American Express® Gold Card may be a good option.

But how does the application process work, and what are the requirements? Keep reading to learn more.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

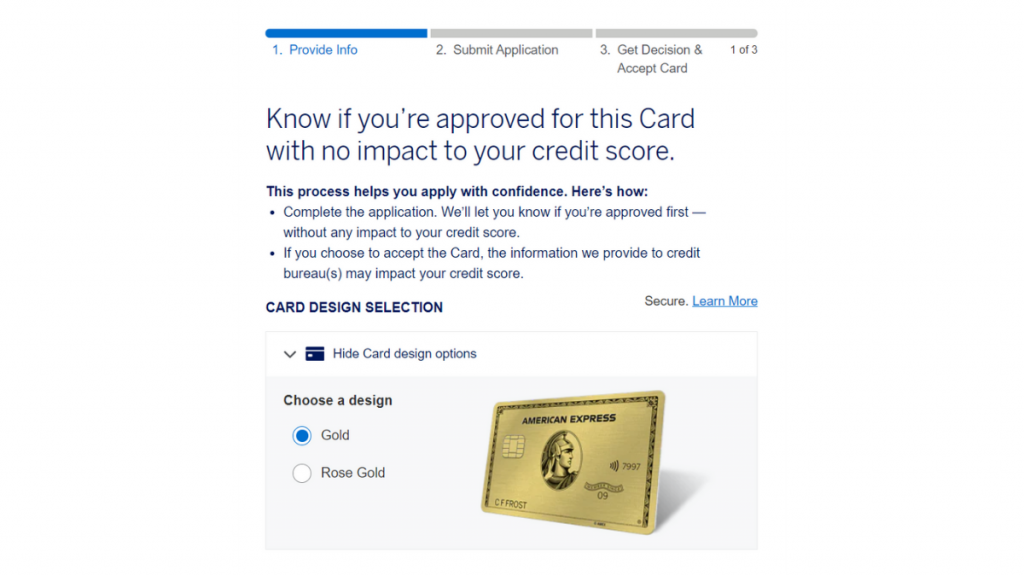

Apply online

The Amex Gold Card application starts with a pre-qualification process. Before you try to apply for one, make sure you meet the requirements:

- You must be at least 18 years old.

- You need to have a valid social security number.

- You need to be an American citizen or authorized resident.

- You ought to have at least a good score.

If you fit the profile, you are ready to pre-qualification. First, visit the American Express website and fill out the pre-qualification form.

Then you’ll have to provide some typical personal and financial information. Also, you can read the terms and conditions.

When you submit it, you’ll have a response in seconds declaring if you are approved or not to get an American Express® Gold Card.

If you do, you’ll receive a text message to download the app and manage your account.

Apply using the app

When you download the American Express® Gold Card app, you can see your account and access the card’s features.

Then you will be able to order your physical card – pick the gold or pink design – and activate it to use online and in-stores in the U.S and worldwide.

Also, you can use the app to manage your account, check your balance and see rewards terms and redemption options.

The app is available to Androids and iPhones. However, you can not use it to qualify and apply for a card.

Instead, you’ll only access it with an authorized account if you are approved. If you want to apply, visit the American Express website.

Advertisement

American Express® Gold Card vs. Bank of America® Customized Cash Rewards credit card

If you aren’t sure about the American Express® Gold Card, look at the Bank of America® Customized Cash Rewards credit card.

This option offers up to 3% cash back for travel (you choose the category). It has no annual fee and is also a smart choice for travelers.

Below, you’ll find an overview of both cards’ features. If you decide to go with the Bank of America® Customized Cash Rewards credit card, read the article by the end of the page.

American Express® Gold Card

- Credit Score: Good/ Excellent;

- Annual Fee: $250;

- Regular APR: See Pay Over Time APR;

- Welcome bonus: 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Rewards: 4x points at worldwide restaurants and delivery in the U.S; 4x points at U.S. supermarkets (up to $25,000 in purchases/year);

- Other rewards: 3x points on flights booked through airlines or on amextravel.com; and 1x point on other qualifying purchases.

- See Rates & Fees

Advertisement

Bank of America® Customized Cash Rewards credit card

- Credit Score: Excellent;

- Annual Fee: $0;

- Regular APR: 16.24% to 26.24% variable for purchases;

- Welcome bonus: $200 online cash rewards after at least $1,000 in purchases within the first 3 months after opening the account;

- Rewards: up to 3% cashback in an eligible category you choose; 2% cash back at grocery stores and wholesale clubs; and 1% cash back on any other purchase.

How to apply for Bank of America® Customized Cash

Learn how to apply for the Bank of America® Customized Cash Rewards and get yourself a credit card with a rewards program that you can tailor to your spending habits.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

GO2bank™ Secured Visa® Credit Card review: no annual fee

Do you need a secured card? In this GO2bankTM Secured Visa® Credit Card review, you'll find out all about this card. Keep reading!

Keep Reading

Learn to apply for the Achieve Personal Loan (formerly FreedomPlus)

Looking to take out a personal loan? Learn how to apply for an Achieve Personal Loan and get access to funds quickly. Qualify for up to $50K.

Keep Reading

Chase Freedom Flex℠ review: is it worth it?

Chase Freedom Flex℠ is outstanding when it comes to its benefits, like cash back and no annual fee. Check the review about it!

Keep ReadingYou may also like

Juno Checking Account application: how does it work?

Don't miss out on high-interest rates and 5% cashback! Learn how to apply for the Juno Checking account now. Stay tuned!

Keep Reading

How to Invest in a Mutual Fund: Essential Techniques for Success

Find out the essential techniques on how to invest in a mutual fund and reach investment success. Learn more!

Keep Reading

Blue Cash Preferred® Card from American Express review

Do you need a cash-back card for your daily expenses? Know how to get one in this Cash Preferred® Card from American Express review. Read on!

Keep Reading