Credit Cards

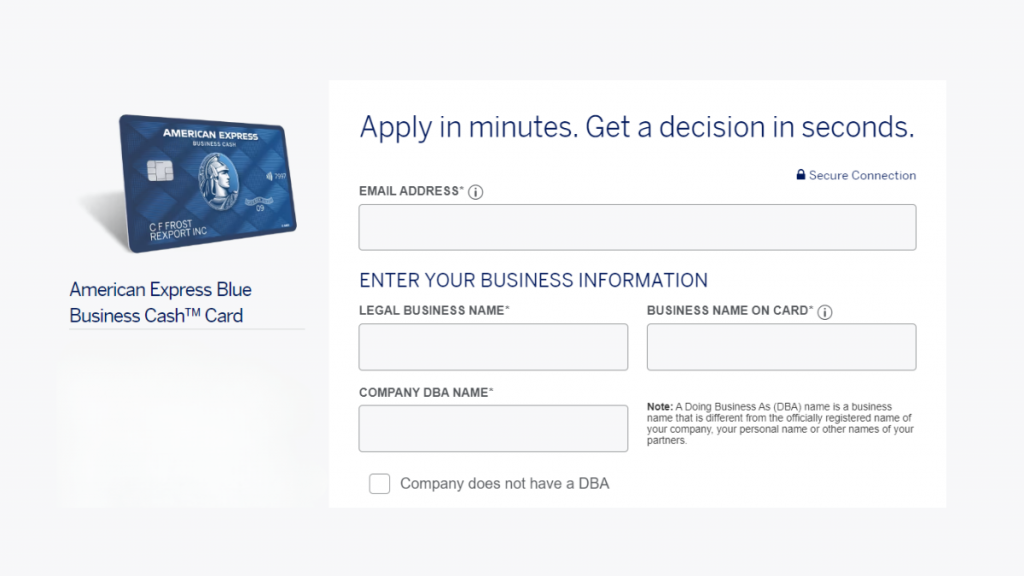

Apply for The American Express Blue Business Cash™ Card

Take advantage of this great cash rewards card from American Express for small business owners. Learn to apply for The American Express Blue Business Cash™ Card.

Advertisement

Enjoy 0% intro APR on purchases for 12 months!

Here is how to apply for The American Express Blue Business Cash™ Card, a cut-out for small business owners to keep their expenses organized and maximize rewards.

Interested in learning more? Keep reading as we will walk through every step of applying successfully. Stay tuned!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

American Express cards have a straightforward online application process. Here are a few things to keep in mind when applying.

Eligibility

First, you must meet some requirements to apply for The American Express Blue Business Cash™ Card.

Your credit score plays an important role here: Make sure it’s at least good or excellent. Also, check out their business requirements to ensure you fit the profile.

Advertisement

Applying

First, head to the American Express website, and find The American Express Blue Business Cash™ Card.

Then fill out the application form, including the following:

- Personal and business information;

- Income and business address;

- Business type.

After completing your application, read the fine print, and ensure you agree with the terms, fees, rates, and conditions.

Finally, you’ll submit the form and wait for approval feedback.

If Amex approves your application, you’ll receive The American Express Blue Business Cash™ Card in 7-10 business days.

Apply using the app

The American Express app can be used after you apply for your card and get it approved.

For example, cardholders can manage their expenses, make payments, and check balances.

Advertisement

The American Express Blue Business Cash™ Card vs. Bank of America Platinum Plus® Mastercard® Business Card

These credit cards are suitable for business owners looking for a welcome bonus and are especially interested in a long 0% intro APR period.

The Blue Business Cash Card offers an introductory period of 0% APR on purchases for 12 months from account opening.

On the other hand, the Bank of America Platinum Plus® Mastercard® Business Card has an introductory period of 0% APR on purchases for 7 billing cycles.

Also, none of these cards have an annual fee. So, it’s up to you! Which card is the best option for your business? Look at their features below before you male your mind.

The American Express Blue Business Cash™ Card

- Credit Score: Good-excellent;

- Annual Fee: $0;

- Purchase APR: 0% intro APR on purchases for 12 months of account opening, then 18.49% – 26.49% variable;

- Welcome Bonus: Earn a $250 statement credit after you make $3,000 in purchases on your Card in your first 3 months.

- Rewards: Earn 2% cash back on eligible business purchases (up to $50k per calendar year) and 1% on all other eligible purchases after the first $50k spent on your credit card. Cash back earned is automatically credited to your statement.

- See Rates & Fees

Bank of America Platinum Plus® Mastercard® Business Card

- Credit Score: Excellent;

- Annual Fee: $0;

- Purchase APR: 0% APR during the first 7 billing cycles, 16.24% to 27.24% variable APR after that;

- Cash Advance APR: 29.24% variable APR;

- Welcome Bonus: $300 online statement credit after making at least $3,000 purchases during the first 90 days of account opening;

- Rewards: N/A.

How to apply for the Bank of America Platinum Plus® Mastercard® Business Card? It’s simple. Just check out our post below!

Apply for Bank of America Platinum Plus® Business

Need help to apply for the Bank of America Platinum Plus® Mastercard® Business Card? The keep reading! Ensure 0% intro APR and more!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Upgrade Personal Loan review: how does it work and is it good?

Wondering if you should take a loan? Here's a detailed Upgrade Personal Loan review of how it works, what the benefits are, and more!

Keep Reading

First Phase Visa® Card review

The First Phase Visa® Card review is about a credit card designed to repair credit. If you find yourself in this situation, keep reading!

Keep Reading

A major drop and stablecoin collapse cause a wild week among cryptocurrencies

In the past week, the prices of Bitcoin and other cryptocurrencies have seen major dips while a stablecoin has taken a plunge.

Keep ReadingYou may also like

Learn to apply for the Achieve Personal Loan (formerly FreedomPlus)

Looking to take out a personal loan? Learn how to apply for an Achieve Personal Loan and get access to funds quickly. Qualify for up to $50K.

Keep Reading

Federal Pell Grant: see how to apply

Find out if you're eligible to apply for the Federal Pell Grant. Ensure up to $7,395 to cover educational costs!

Keep Reading

Blue Cash Preferred® Card from American Express review

Do you need a cash-back card for your daily expenses? Know how to get one in this Cash Preferred® Card from American Express review. Read on!

Keep Reading