News

Twitter shareholders filed a lawsuit against Elon Musk

Elon Musk’s Twitter deal started a new chapter last week when the company’s shareholders filed a lawsuit against the CEO of Tesla and SpaceX. Read more below!

Advertisement

Investors claim he drove down Twitter stock prices to renegotiate his buyout.

It seems that Elon Musk’s Twitter deal just found another bump in the road. Last Wednesday, Twitter shareholders filed a lawsuit against the CEO of Tesla accusing Musk of unlawful conduct. According to them, Musk sowed doubt about his intentions to buy the social media website on purpose.

The document filed by Twitter shareholders claims that the entrepreneur wanted to drive down Twitter’s stock prices in order to either walk away from the deal or to force the company to renegotiate the deal at a much lower purchase price than his initial $44 billion bid. The lawsuit was filed in the District Court for the Northern District of California and has the San Francisco-based Twitter as a defendant. The company seeks compensation for damages as well as class action status.

Last month, the billionaire made an offer to buy Twitter for $44 billion. However, a few weeks later, Musk tweeted that the deal was on hold until the social media company could prove that bots and spam accounts were indeed less than 5% of its user base. Many financial experts viewed Musk’s action as a strategy to renegotiate the initial bid.

In the lawsuit, Twitter shareholders note that Musk renounced his due diligence in his offer to buy the company. What that means is that by doing so, Musk also gave up his right to know about Twitter’s non-public finances.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Elon Musk vs. Twitter Shareholders

To make matters worse, the issue with fake accounts and bots on Twitter has been going on for years. Last year, the company paid over $809 million to settle a claim it was overstating its monthly user figures. In addition, Twitter has disclosed its bot accounts estimates for many years. While providing the info to the Securities and Exchange Commission, the company has always cautioned that its estimate might be inaccurate and too low.

In order to assist with the acquisition, Elon Musk has been selling stock of his electric car company. However, Tesla shares have dropped significantly in value since the billionaire announced his Twitter deal in late April.

Concerning the decreasing value of Tesla’s shares, the lawsuit claims the entrepreneur has been diminishing the social media website. Twitter shareholders also claim Musk violated the non-disclosure and non-disparagement clauses of his contract. They believe that by doing so, Musk attempted to reduce Twitter’s stock price and use that as an excuse to renegotiate the deal. On Thursday, Twitter’s shares closed at $39.54. That is approximately 27% below Musk’s offer price, when the shares were at $54.20.

Before Musk announced his bid to acquire the social media website, Musk had disclosed that he had bought a stake in the company. However, the lawsuit states that the billionaire failed to disclose the stake within the required timeframe by the SEC. The legal document claims his eventual disclosure was misleading. That is because he used a term meant for passive investors, which he was not, because he was interested in buying Twitter.

By failing to disclose his increased stake on time, Musk benefited by over $156 million. The Twitter shareholders lawsuit claims that the Tesla CEO engaged in market manipulation by buying Twitter stock at a lower price than he would have if investors knew he was increasing his holdings.

Follow the link below to learn more about Elon Musk’s Twitter deal.

Elon Musk announces Twitter bid on hold

The billionaire is waiting for Twitter's confirmation about its spam and fake accounts before continuing the deal.

Trending Topics

DoorDash Rewards Mastercard® review: Get up to 4% cash back on Food

We have the perfect card to earn $100 cash back bonus! Discover all about the DoorDash Rewards Mastercard® in this review. Read on!

Keep Reading

Best secured credit cards with no credit check: easiest to get!

Pick one of the best secured credit cards with no credit check to fix your credit score. This will help you in the future for sure!

Keep Reading

Secured vs unsecured credit card: which one is right for you?

Wondering if you should get a secured vs. unsecured credit card? Here's what you need to know about both options. Read on!

Keep ReadingYou may also like

American Express® Gold Card application: how does it work?

If you need a card to earn travel and shopping rewards, read on and learn about the application process for the American Express® Gold Card!

Keep Reading

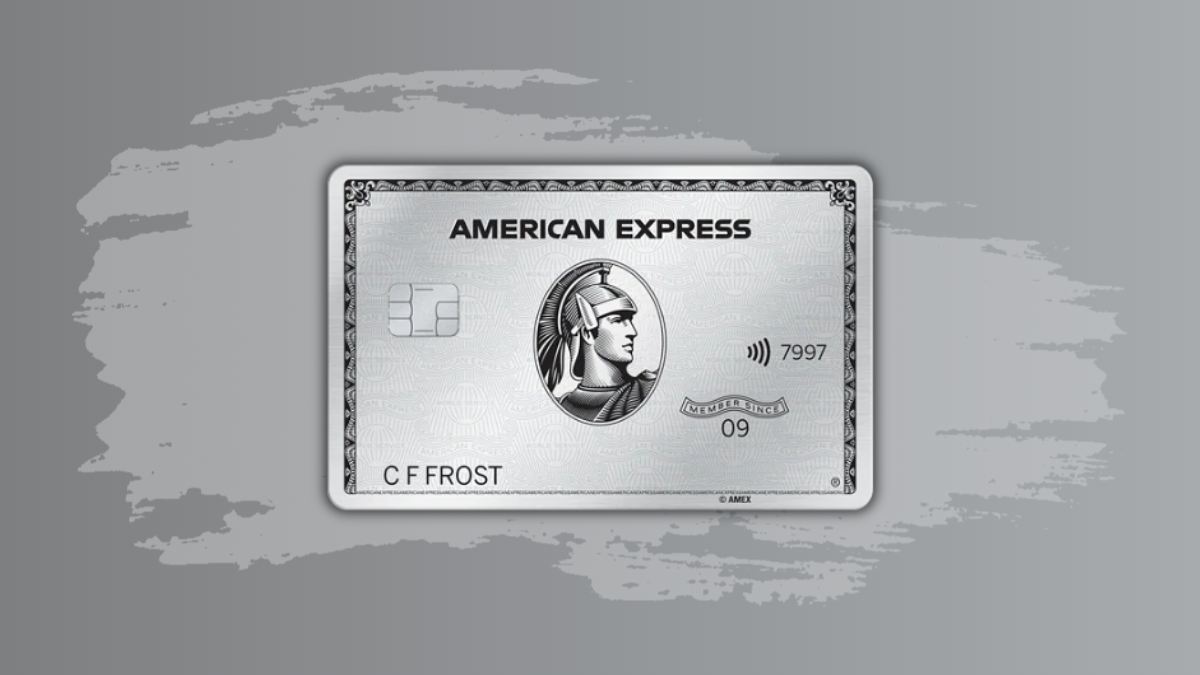

Apply for The Platinum Card® from American Express

It is simple to apply for The Platinum Card® from American Express. If you love getting benefits and traveling the world, apply now for it.

Keep Reading

How to use anxiety apps: regain your peace of mind

If your mind is not helping you, learn how to deal with your anxiety with one of these apps. It's easier than you think!

Keep Reading