Learn about a card that can help you build credit easily!

Chime Credit Builder Visa: easy like a debit card, but improves your credit score!

Advertisement

Are you tired of looking for a decent credit card to build your credit? So take a rest, because you’ve just found the perfect credit card for you. The Chime Credit Builder is a real Visa credit card that requests no credit check for new applicants. Solve your damaged or inexistent credit score without paying any fee for it.

Are you tired of looking for a decent credit card to build your credit? So take a rest, because you’ve just found the perfect credit card for you. The Chime Credit Builder is a real Visa credit card that requests no credit check for new applicants. Solve your damaged or inexistent credit score without paying any fee for it.

You will remain in the same website

The major benefit of this card is how simple and efficient it is. Check what you'll get when you start using it:

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Whether you're striving to buy a home, secure a loan, or simply enjoy better interest rates, a solid credit history can open doors to countless opportunities.

The Chime Credit Builder Visa Card is a financial tool designed to help you improve your credit profile.

Strengths and Special Offerings

- Credit Building with Every Purchase: The Chime Credit Builder Visa Card is unique in its approach to credit building. Instead of requiring a hefty deposit, it links to a Chime spending account. With every purchase you make, a portion of the amount is set aside in a credit-building account.

- No Annual Fees or Interest Charges: Unlike traditional credit cards, this card has no annual fees or interest charges. You only pay for what you spend, and there are no hidden fees that could catch you by surprise. This transparent pricing makes it an excellent choice for those looking to build their credit without incurring unnecessary costs.

- Access to the Chime App: Chime's user-friendly mobile app provides tools to help you manage your finances. It includes features such as transaction tracking, budgeting tools, and real-time alerts for account activity.

Limitations to Consider

- No Rewards or Cashback: If you are looking for a credit card that offers these perks, the Chime Credit Builder Visa Card may not be the best choice for your specific needs.

- Deposit Required: Although it doesn't require a hefty deposit like a secured credit card, it does necessitate an initial deposit into your Chime spending account. This deposit is used as collateral to secure the card.

The Chime Credit Builder Visa Card is a valuable tool for those seeking to build or repair their credit. With its innovative approach, it encourages responsible spending and financial management.

If you're ready to take control of your financial future and enhance your credit score, the Chime Credit Builder Visa Card is worth considering.

It's an accessible and affordable option that can empower you to achieve your financial goals. Learn more about the card and take the first step towards building a brighter financial future with Chime.

The Chime Credit Card has no introductory credit limit. The Credit Builder Secured Credit Card has a credit limit equal to the amount of your security deposit. Chime caps this credit card's maximum allowable credit line at $10,000.

Hurting your credit is not a problem using the Chime Credit Builder Visa credit card because Chime does not report your monthly payments. So, by making regular, on-time payments, you'll have the potential to raise your credit rating. However, your credit rating may suffer if you are late with payments.

People with no credit history or a poor credit score shouldn't have too much issue getting approved for a Chime Credit Builder Secured Visa® Credit Card because there is no requirement for a credit check. If you open a Chime Credit Builder account, you won't have to worry about any hidden fees, whether annual or transaction fees, or even account maintenance costs.

Chime Credit Builder Visa Credit Card application

Like everything on the Chime Credit Builder Visa card, the application process is simple, easy, and efficient. If that's something you appreciate, read on to apply!

If the Chime Credit Builder Visa credit card is not what you've been looking for in a credit card, we can still help you out!

With the Applied Bank® Gold Preferred® Secured Visa® Card, you'll get incredible perks and have a chance of approval even with a low credit score!

Moreover, you can even build your credit over time if you use this card responsibly!

So, check out our post below to find out how the application process for this card works!

Applied Bank® Gold Preferred® Secured Visa® Card

Wondering how to apply for the Applied Bank® Gold Preferred® Secured Visa® Card? Learn everything you need to know here, including application requirements.

Trending Topics

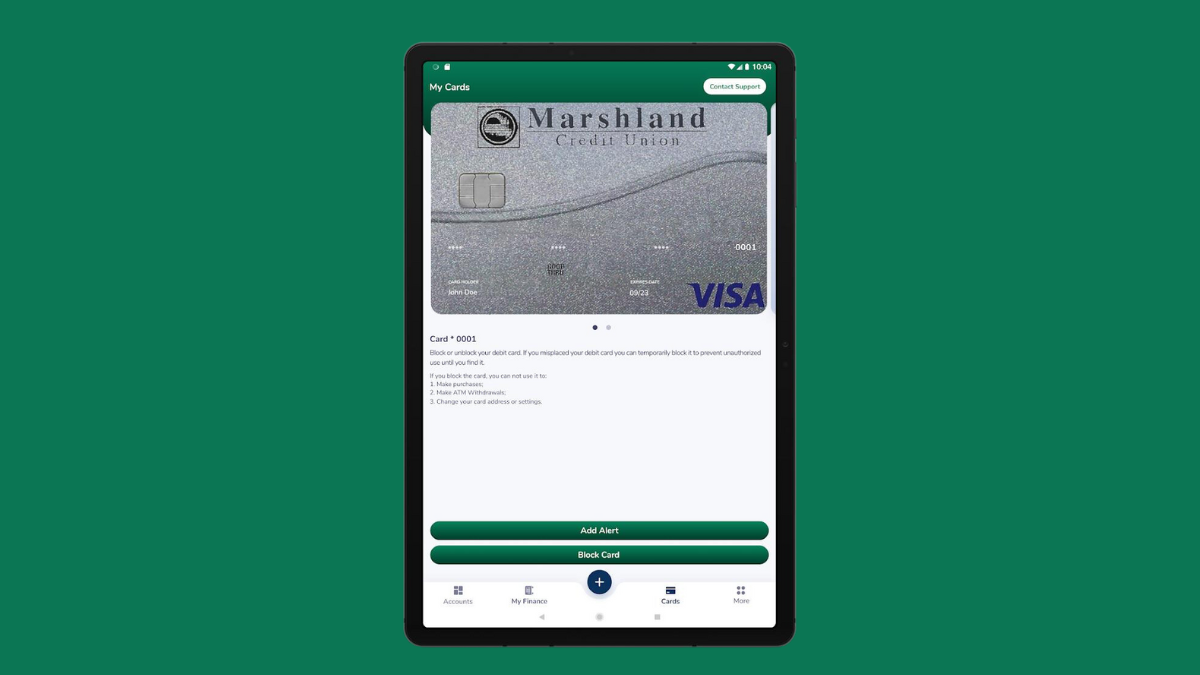

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Keep Reading

Delta SkyMiles® Reserve American Express Card review

Read our Delta SkyMiles® Reserve American Express Card review if you want a top-of-the-line credit card with travel benefits!

Keep Reading

Bad credit accepted: apply for BankAmericard® Secured Credit Card

Discover how to apply for the BankAmericard® Secured Credit Card - start with a security deposit of $200 and build credit fast! Read on!

Keep ReadingYou may also like

The hidden cost of banking: 6 common bank fees you may not know about

Millions of people are fed up with the fees banks charge. Take a closer look at 6 common bank fees and how to avoid them. Keep reading!

Keep Reading

0% intro APR: Apply for Bank of America® Travel Rewards

Apply for the Bank of America® Travel Rewards credit card and earn points on travel purchases. Follow our step-by-step guide!

Keep Reading

Best investments for beginner investors: an easy guide on funds and more!

You can find the best investments for beginner investors here, on this content. Don't waste any more time and learn about this topic.

Keep Reading