News

How to fight back inflation hitting American households

Inflation is quickly raising prices for households in essential areas of their monthly budgets. Find out how you can protect your finances from the impact of rising prices.

Advertisement

Even though consumer prices are rising, there are ways to still come out on top.

The ongoing inflation is rapidly raising prices for American households in the three core areas of their monthly planning: food, housing and energy. This current situation is making it unavoidable for consumers to hit a financial wall. Even with salaries rising faster than they ever were before.

But even in times such as this, there are ways for American workers to turn things around. It all comes down to their investing, their jobs and spending habits. According to financial experts, there’s many ways to lessen the impact of consumer prices.

Andy Bexley, a financial planner at The Planning Center, compares what is going on in America as navigating through a storm on a tiny boat. Meaning even if you can’t control the ocean or the storm, you can take charge of what’s happening in your little boat. That is an important reminder that even though inflation is out of a person’s hand, they still have control over the little things.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Energy, food and housing prices

The price of groceries and utilities grew up to 10% in the last year. That is the biggest annual raise since the 80s. According to the Labor Department, prices were up across all food categories.

Housing prices, like rent, increased around 5% in the last 12 months. That is considered the fastest annual pace since the 90s. Household costs, like natural gas and electricity also rose 21.6% and 11.1%, respectively, during the last year.

The conflict between Russia and Ukraine contributed to a major rise in gas prices. Gasoline prices were responsible for more than 50% of overall ongoing inflation in April. However, those prices have fallen recently since oil prices were down.

So what can consumers do to diminish the inflation’s financial impact in their households?

Ask your employer for a raise, or look for another job

Something is happening in America right now that hasn’t been seen in a long time: the job market is on fire. More companies are hiring and layoffs are approaching historic lows. Another good news is that employers are raising salaries much quicker, too.

So, instead of losing sleep over how much money they’re spending because of inflation, workers can use this new situation as a leverage to make more money at their jobs. How? Either by asking for a raise or to look after higher-paying opportunities. Now is also a great time to negotiate better work-related expenses. Meaning, working from home for a couple of days can reduce transportation costs.

Advertisement

Invest in I bonds

A solid deal for consumers who are currently saving money for a big purchase in the next couple of years. I bonds are basically a risk-free investment with a rate that is tied to the Consumer Price Index. That said, investors can rest assured that their savings are protected. The Treasury Direct allows each person to save up to $10 annually.

It’s important to note, however, that this kind of investment should not count as emergency savings because the money gets locked for a minimum of 12 months.

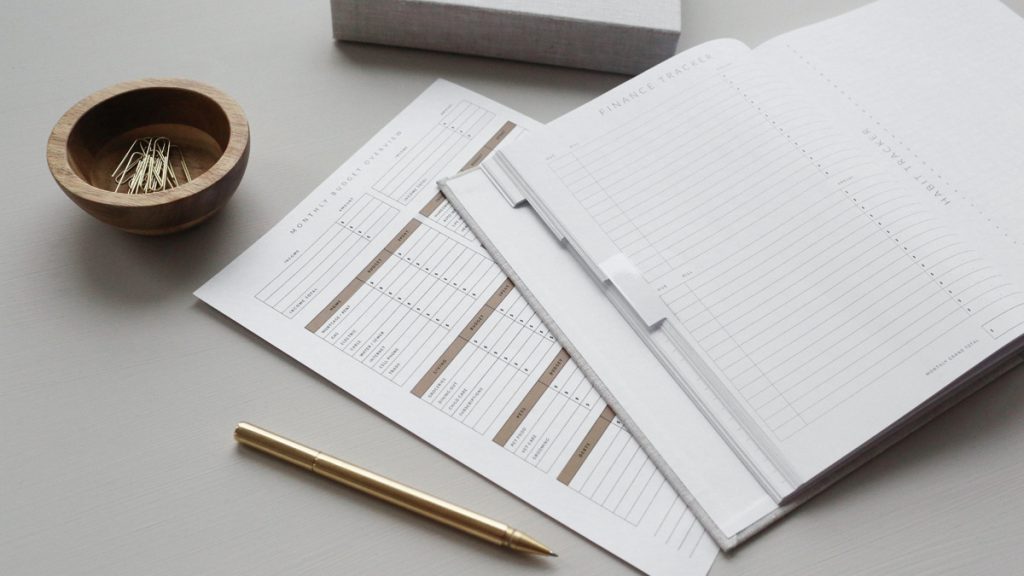

Review your spending habits

Last but not least, it’s essential for consumers to examine their spending habits to calculate their own personal inflation rate. The CPI is a national average, which means it might not reflect all households. For instance, vegetarians don’t have to worry about the cost of meat. Or, a household that prefers to ride bikes to work is safe from gas prices.

It’s important to review the monthly budget and figure out where exactly the ongoing inflation is hitting the hardest. An emergency fund is also helpful in these situations. So if you need any help on building one for yourself, follow the link below for some useful tips!

What is an emergency fund and why do you need one?

Learn the importance of having an emergency fund and why you need to build one right away!

Trending Topics

Electro Finance Lease review: how does it work and is it trustworthy?

Check our Electro Finance Lease review to learn a new and improved way to get the products you want with the financing you need!

Keep Reading

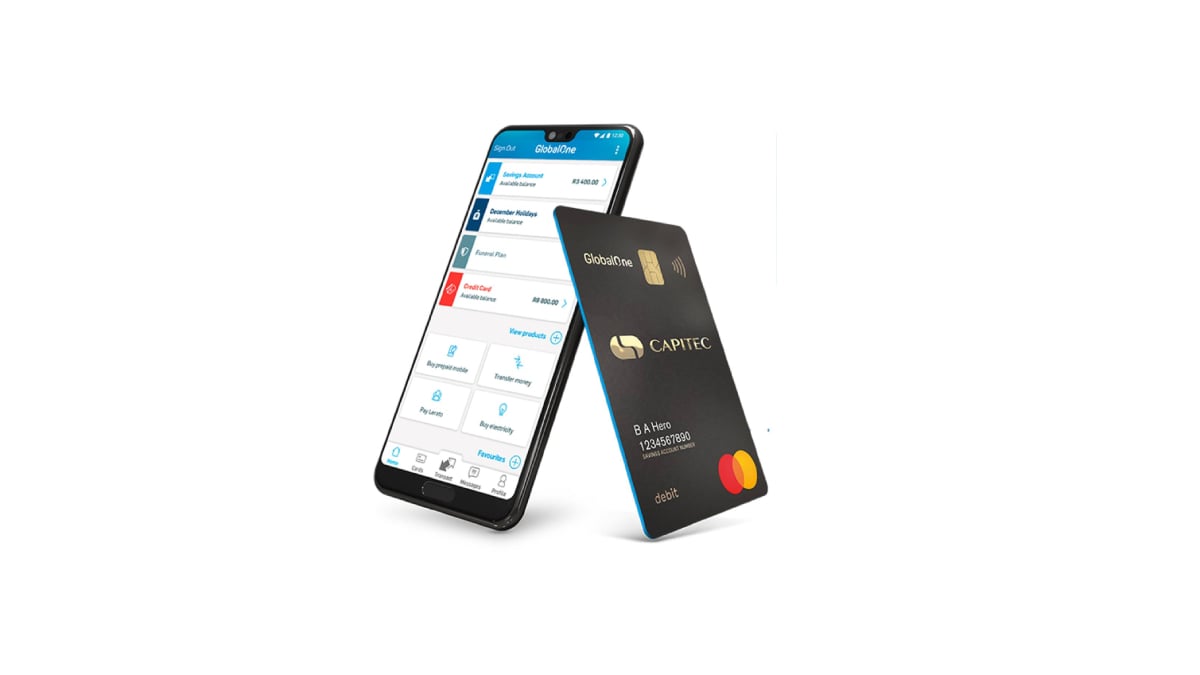

Learn how to download the Capitec Bank App

Find out how to quickly and easily make the Capitec Bank App download. Read on to learn how to enjoy banking online with this app!

Keep Reading

Capital One Venture X Rewards Credit Card review: a journey of extra miles starts here

Check out the Capital One Venture X Rewards Credit Card review to find out it's great perks, like extra miles. Read on!

Keep ReadingYou may also like

The Plum Card® from American Express review

Are you ready for this The Plum Card® from American Express review? Then read on! Pay early and enjoy 1.5% cash back!

Keep Reading

Alaska Airlines Visa® Credit Card review

Is the Alaska Airlines Visa® Credit Card worth it? Read this review to find out what it offers and how you can earn miles!

Keep Reading

Application for the Luxury Gold card: how does it work?

Your wallet will get heavier with the Luxury Gold card. Take it to your best trips. Learn how to apply for this golden credit card.

Keep Reading