Credit Cards

First Digital Mastercard® application: how does it work?

Achieving a great credit score doesn't have to be difficult, and the First Digital Mastercard® can help you get there. So if you're ready to take your finances to the next level, keep reading to learn how to apply!

Advertisement

All information about The Centurion® Card from American Express has been collected independently by The Mad Capitalist.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

First Digital Mastercard®: Apply now and get your credit score back on track!

There are a lot of credit cards on the market these days. With so many options, it can be hard to know which one is right for you. But if you’re looking for a card that can repair your damaged credit history and help you build a solid financial future, the First Digital Mastercard® might be a good choice.

This is an unsecured card, which means it doesn’t require a security deposit to provide an initial credit line. It has nationwide Mastercard coverage and reports to all three major credit bureaus in the country.

So, if you want to learn how to apply for this credit card, keep reading and we’ll take you through the easy application process.

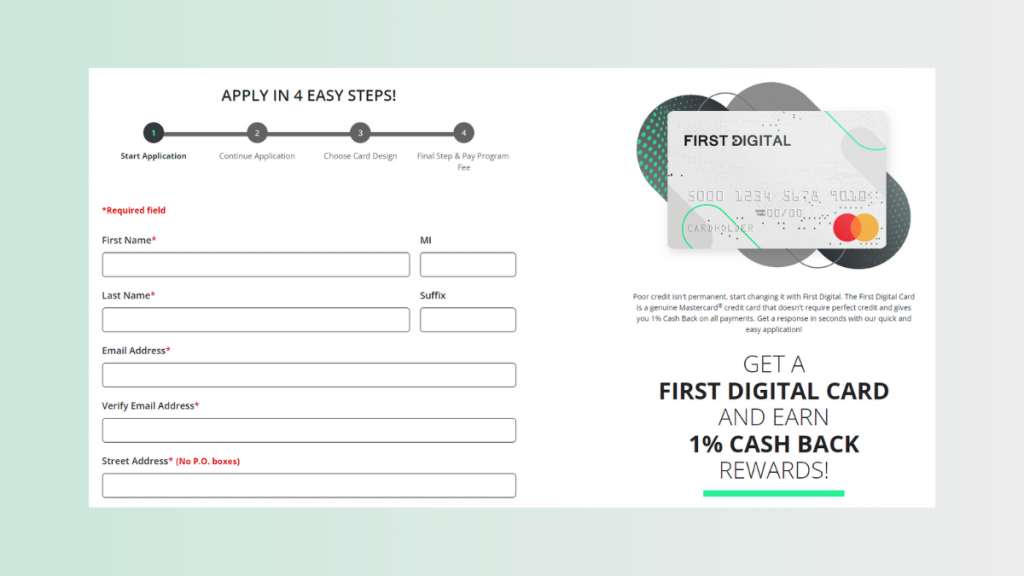

Apply online

New cardholders interested in the First Digital Mastercard® need to complete an online application form at First Digital’s website. You’ll need to fill in your personal information and confirm you are a US resident before clicking the “Continue” button.

First Digital states that approval takes only 60 seconds. Once the request is approved, it takes 3 weeks to set up your account and receive your new credit card in the mail.

Advertisement

Apply using the app

Sadly, First Digital does not provide a mobile app for card management or requests. Every new application goes through their online form located on the official website.

You cannot apply for this card on the telephone either, but you can call First Digital with any inquiries about the product at (844) 358-0074.

First Digital Mastercard® vs. The Centurion® Card from American Express

Maybe the First Digital Mastercard® doesn’t offer nearly enough perks and benefits to keep your interest. But do you have what it takes for The Centurion® Card from American Express?

This incredibly exclusive product is perfect for frequent travelers, but you must get an invitation first to apply for it.

See below all the perks and features this card has to offer and follow the link for an invitation request.

| First Digital Mastercard® | The Centurion® Card from American Express | |

| Credit Score | Poor/Damaged/Fair. | Excellent. |

| Annual Fee | $75.00 for the first year. After that, $48.00 annually. | $5000 ($10,000 initial fee). |

| Regular APR | 35.99%. | Prime Rate + 21.99% variable. |

| Welcome bonus | N/A. | Membership Rewards® Points – variable to each client Terms Apply. |

| Rewards | 1% cash back. | 1X Membership Rewards® Points for each dollar spent on eligible purchases Terms Apply. |

How to apply for the American Express Centurion

See how to get an invitation for The Centurion® Card from American Express.

Trending Topics

Petal® 1 “No Annual Fee” Visa® Credit Card review: is it legit and worth it?

Petal® 1 "No Annual Fee" Visa® Credit Card will help boost your score. In this post, we'll take a closer look at its benefits!

Keep Reading

Federal Pell Grant: receive up to $7,395

Do you want to know more about the Federal Pell Grant? We've got! Learn how this benefit will help you cover your education costs!

Keep Reading

Apply for MoneyLion Loans: Easy Credit Builder

Stuck in credit limbo? Keep reading to learn how to apply for MoneyLion Loans to the rescue! NO hard inquiry!

Keep ReadingYou may also like

Cheap WestJet flights: low fares from $49.99

Learn more about WestJet cheap flights to 108 destinations, their baggage policy, and how to check- in online!

Keep Reading

DoorDash Rewards Mastercard® review: Get up to 4% cash back on Food

We have the perfect card to earn $100 cash back bonus! Discover all about the DoorDash Rewards Mastercard® in this review. Read on!

Keep Reading

Citi Premier® Card review: The perfect card for traveling?

Do you need a card with travel rewards? Weigh the pros and cons, and learn how this card works in the Citi Premier® Card review. Read on!

Keep Reading