Loans

Apply for MoneyLion Loans: Easy Credit Builder

MoneyLion Loans lets you borrow smart and build credit simultaneously- Learn how to apply now, skip the hard pull, and watch your score soar with each on-time payment! Keep reading!

Advertisement

Get a loan without a hard inquiry, and improve your score over time

Is low credit holding you back? Then get the application guide that changes everything! This post unveils the secrets to apply for MoneyLion Loans.

Their credit builder loans come with a soft pull, opening up new financial opportunities for you. So, keep reading to learn how to apply right now!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Online application

If you’re struggling with bad credit and looking for ways to improve it, then you might find a credit builder loan from MoneyLion Loans helpful.

By paying a monthly membership fee of $19.99, you can apply for a loan with a soft pull.

Then if your application gets approved, your payments will be reported to a credit bureau, which can help to build your credit score over time.

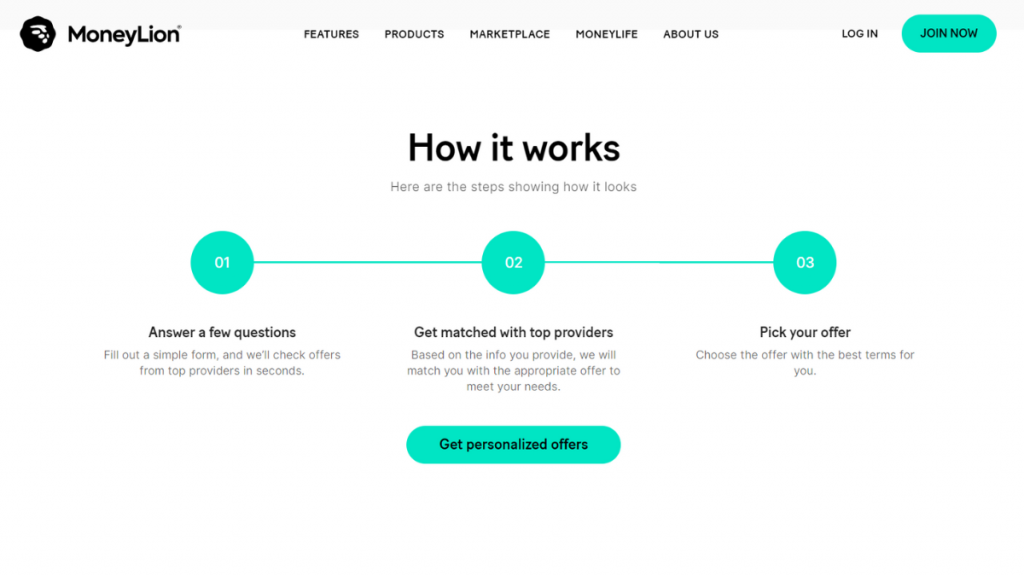

Here are the three simple steps you need to follow to apply for a MoneyLion Loans credit-builder loan:

1. Create a MoneyLion account

You can apply for a credit-builder loan via the MoneyLion desktop website or mobile app.

Firstly, create a MoneyLion account by providing your full name and address.

Advertisement

2. Apply for a Credit Builder Plus membership

Once you have created your MoneyLion account, then you can sign up for a Credit Builder Plus membership, allowing you to request a credit-builder loan.

3. Complete the application process

Finally, to complete the loan application process, you must provide additional information, such as your full name, email address, Social Security number, home address, and a verifiable phone number.

You will also need a bank account that has been in good standing for at least 60 days and shows steady income through deposits.

Advertisement

Requirements

When applying for a credit builder loan, you must be a member of the Credit Builder Plus membership. Then, to apply, you must:

- Be a US citizen or permanent resident;

- Be at least 18 years old;

- Have a Social Security number;

- Have a valid checking account.

Apply using the app

You can also apply by downloading the MoneyLion app, which will allow you to complete the application process on your phone.

The app is free so you can find it on both the Apple App Store and the Google Play Store.

MoneyLion Loans vs. SimpleLoans 123

MoneyLion Loans offers loans that can help you improve your credit score while also giving you benefits like free credit monitoring.

SimpleLoans 123, on the other hand, is a platform that connects you with lenders who can provide you with a personal loan of up to $35,000 for any purpose.

So, you can choose between the two based on your needs and preferences.

MoneyLion Loans

- APR: 5.99% to 29.99%;

- Loan Purpose: Credit-builder;

- Loan Amounts: Up to $10,000;

- Credit Needed: All credit types are considered;

- Origination Fee: N/A;

- Late Fee: N/A;

- Early Payoff Penalty: N/A.

SimpleLoans 123

- APR: Varies by lender;

- Loan Purpose: Personal and Vehicle loans;

- Loan Amounts: $100-$35,000;

- Credit Needed: All credit scores accepted;

- Origination Fee: Varies by the lender;

- Late Fee: Varies by the lender;

- Early Payoff Penalty: Varies by lender.

Do you want to get a personal loan through SimpleLoans 123? Then keep reading to get an overview of the application below.

Apply for SimpleLoans123: Fast-track Approval

Unlock financial freedom! Apply for the SimpleLoans123 in just 3 steps with our easy-to-follow guide. Read on!

Trending Topics

The Plum Card® from American Express review

Are you ready for this The Plum Card® from American Express review? Then read on! Pay early and enjoy 1.5% cash back!

Keep Reading

Chase College Checking℠ application: how does it work?

Wondering if the Chase College Checking℠ account is for you? Read on and learn how to apply and get a $100 sign-up bonus and more!

Keep Reading

Wells Fargo Autograph℠ Card review

Read our Wells Fargo Autograph™ Credit Card review, and learn how to enjoy multiple benefits. No annual fee, cash back rewards!

Keep ReadingYou may also like

Blue Cash Preferred® Card from American Express review

Do you need a cash-back card for your daily expenses? Know how to get one in this Cash Preferred® Card from American Express review. Read on!

Keep Reading

The American Express Blue Business Cash™ Card review

Learn how to earn cash back and improve your business' workflow with our The American Express Blue Business Cash™ Card review!

Keep Reading

Discover it® Miles Credit Card application: how does it work?

Learn how to apply for the Discover it® Miles Credit Card. Pay no annual fee and earn miles on purchases. Read on and learn more.

Keep Reading