Credit Cards

BMO Ascend World Elite®* Mastercard®* Review

Experience elite travel benefits with the BMO Ascend World Elite®* Mastercard®*. Enjoy top-tier rewards, comprehensive insurance, and exclusive access to luxurious travel perks.

Advertisement

Enjoy a generous welcome bonus and up to 5x points on purchases!

Are you looking for a financial solution with an impressive set of rewards? Then this BMO Ascend World Elite®* Mastercard®* review is for you.

This cards offers points on every purchase, which are easily redeemable. Not to mention a fantastic welcome bonus! Curious? Then read on to see if this is the card for you.

Apply for the BMO Ascend World Elite®* Mastercard®

Learn how you can easily apply for the BMO Ascend World Elite®* Mastercard®* and start earning more value on your spending.

| Credit Score | Good/Excellent. |

| Annual Fee | $150 (waived in the first year as a member) |

| Regular APR | 20.99% on purchases; 23.99% for cash advances (21.99% for Quebec residents). |

| Welcome bonus | Earn up 60,000 bonus points. (Minimum spending required) |

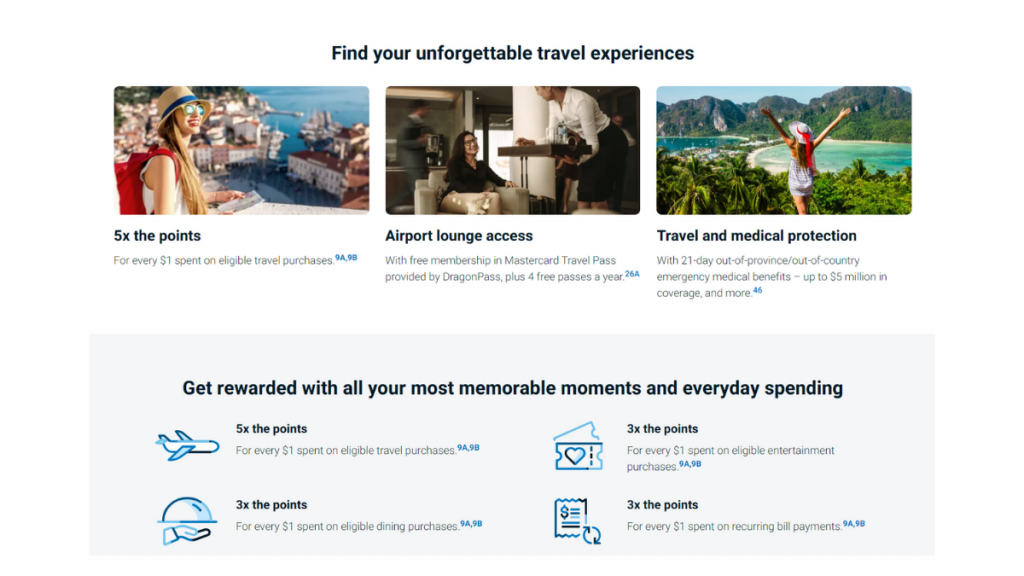

| Rewards | 5x points on travel 3x points on dining, entertainment, and recurring bills 1x points on every other purchase |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

BMO Ascend World Elite®* Mastercard®*: how does it work?

A good rewards rate and the generous welcome bonus are just some of the benefits you’ll get with the BMO Ascend World Elite®* Mastercard®*.

With this card, you’ll be able to enjoy the reliability of a Mastercard signature that has excellent acceptance everywhere.

Although it has good travel benefits, it is not the best option to take abroad because it charges foreign transaction fees.

But you can use it to purchase your air tickets and rent cars while earning points to redeem for more trips.

You can count on four complimentary visits to airport lounges and the great travel insurance coverage granted by Mastercard.

BMO Ascend World Elite®* Mastercard®*: should you get one?

If you’re looking for a credit card with reward points and no complicated bonus categories, the BMO Ascend World Elite®* Mastercard®* is a good option.

Advertisement

Pros

- The welcome bonus will give you 60,000 bonus points and you won’t pay the annual fee for the first year.

- Flexible reward points program, which allows you to redeem them for travel, merchandise, a statement credit, or investment at BMO.

- Excellent travel insurance.

- Earn four complimentary access to airport lounges and membership in Mastercard Airport Experience.

Cons

- Required a good or excellent credit score and a minimum annual income for the application process.

- It is not the best option to use abroad because it charges a foreign transaction fee.

- Has a $150 annual fee after the first year.

Advertisement

Credit scores required

BMO has a high standard for this card. To have one, you need a good or excellent credit score.

Also, you need a good total annual income too, of at least $80,000 – or $150,000 per household.

BMO Ascend World Elite®* application: how to do?

This review brought to you everything this card has to offer. Did you like it? Are you considering getting one for yourself?

To apply for it is easy, and you can do it right now. Read the next content here to learn how to ask for your new credit card.

Apply for the BMO Ascend World Elite®* Mastercard®

Learn how you can easily apply for the BMO Ascend World Elite®* Mastercard®* and start earning more value on your spending.

Trending Topics

Walmart MoneyCard® review: Perfect for Walmart shoppers

Check our Walmart MoneyCard® review to learn how this card can make your shopping much easier and rewarding!

Keep Reading

Citi Premier® Card review: The perfect card for traveling?

Do you need a card with travel rewards? Weigh the pros and cons, and learn how this card works in the Citi Premier® Card review. Read on!

Keep Reading

A guide to the best online banks in Canada 2022

Learn what you need to know about the best online banks in Canada and make an informed decision about your finances. Read on for more!

Keep ReadingYou may also like

Learn to apply easily for the LightStream Personal Loan

Ready to apply for a Lightstream Personal Loan? Look no further! We've got all the information you need right here! Borrow up to $100K fast!

Keep Reading

Apply for the Delta SkyMiles® Gold American Express Card

Applying for The Delta SkyMiles® Gold American Express Card is easy! Find out if you're eligible, and apply online today!

Keep Reading

How to travel for free using miles: a guide for beginners

Discover how to travel for free, why you should be earning and saving miles instead of paying with cash, and the best ways. Read on!

Keep Reading