Credit Cards

Apply for the BMO Ascend World Elite®* Mastercard®*

Learn how to apply for the BMO Ascend World Elite®* Mastercard®* for unparalleled travel experiences. Enjoy elite rewards, comprehensive insurance, and access to exclusive luxury perks. Elevate your travel game.

Advertisement

Earn generous points on travel, groceries, daily expenses, and more!

If you’d like to learn how to apply for the BMO Ascend World Elite®* Mastercard®*, we have prepared a detailed step-by-step guide to help.

See how to easily get this card and enjoy its benefits, such as a generous welcome bonus and high rewards on every purchase you make.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

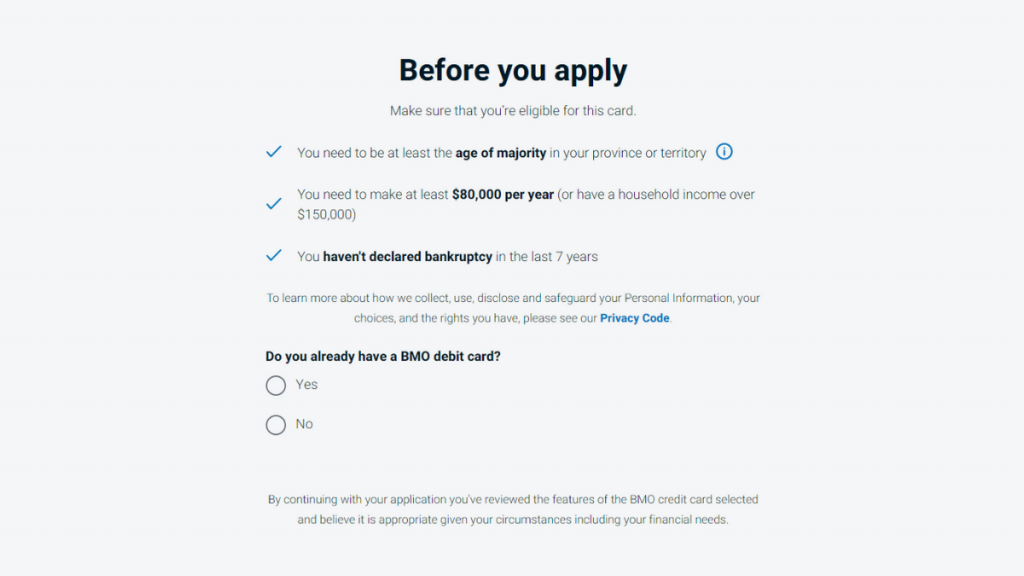

To apply for the BMO Ascend World Elite®* Mastercard®* you need to fulfill these requirements:

- Be a Canadian resident with at least 18 or 19 yo (depending on your province).

- Have an annual income of at least $80,000. You have the option to declare your household income of at least $150,000.

- Good or excellent credit score.

- No bankruptcy in the last 7 years.

Find the BMO Ascend World Elite®* Mastercard®* on BMO’s website and click to view its details. Learn about its benefits and features on this page.

Review the card’s features, benefits, and eligibility on its page. Understanding these details is crucial for a smooth application.

Ready to apply? Click ‘Apply Now’ on the card’s page. Fill in the online application with your personal and financial information.

After filling out the form, double-check your information. Submit your application and await a response. If approved, your card will arrive by mail.

Apply using the app

As soon as you become a BMO Ascend World Elite®* Mastercard®* cardholder, you’ll get to download the app to manage your account.

It has many features, and is so safe that BMO guarantees to reimburse your money if someone gets to break into the app.

However, to apply for the BMO Ascend World Elite®* Mastercard®*, you need to visit their website and fill out the onlie application.

Advertisement

BMO Ascend World Elite®* Mastercard®* vs. BMO CashBack® Business Mastercard®*

The BMO Ascend World Elite®* Mastercard®* offers unparalleled travel perks and rewards. Ideal for those who love luxury and convenience on their journeys.

Alternatively, consider the BMO CashBack® Business Mastercard®*. It’s perfect for business owners seeking valuable business benefits.

| BMO Ascend World Elite®* Mastercard®* | BMO CashBack® Business Mastercard®* | |

| Credit Score | Good/Excellent. | Good/Excellent. |

| Annual Fee | $150 (waived in the first year as a member) | $0 |

| Regular APR | 20.99% on purchases; 23.99% for cash advances (21.99% for Quebec residents). | 19.99% interest on purchases. 22.99% interest on advance. |

| Welcome bonus | Earn up 60,000 bonus points. (Minimum spending required) | 10% cash back on gas, office supplies and cellphone and internet bill payments for 3 months! *Tems apply |

| Rewards | 5x points on travel; 3x points on dining, entertainment, and recurring bills; 1x points on every other purchase. | 1.75% back at Shell gas stations; 1.5% on gas, internet bills, phone bills and office supplies; 0.75% on everything else. |

Discover more about the BMO CashBack® Business Mastercard®* and its advantages. Ready to apply? Check the link below for the application process.

Apply for the BMO CashBack® Business Mastercard®*

Learn how to easily apply for the BMO CashBack® Business Mastercard®* and enjoy its many perks.

Trending Topics

Unique Platinum Card review: Elevate your spending power

Looking to elevate your spending power? Then don't miss our Unique Platinum Card review! 0% APR and amazing benefits! Read on!

Keep Reading

Secured vs unsecured credit card: which one is right for you?

Wondering if you should get a secured vs. unsecured credit card? Here's what you need to know about both options. Read on!

Keep Reading

What is a good credit score to rent a house?

Find out what is the minimum credit score to rent a house and make the renting process as smooth as possible! Keep reading and learn more!

Keep ReadingYou may also like

How to stop smartphone hackers? Follow these 10 FBI tips

Cybercrime is still on the rise and hackers are getting craftier. Protect your devices with these ten easy FBI tips. Read on for more!

Keep Reading

Freedom Gold credit card review: is it legit and worth it?

This card is perfect for online shoppers. Get your Freedom Gold credit card to buy at the Horizon Outlet website with benefits.

Keep Reading

Learn to apply easily for the Blue Sky Financial Mortgage

Apply for the Blue Sky Financial Mortgage with this guide. Find the perfect lender for your needs! Enjoy personalized rates! Read on!

Keep Reading