Loans

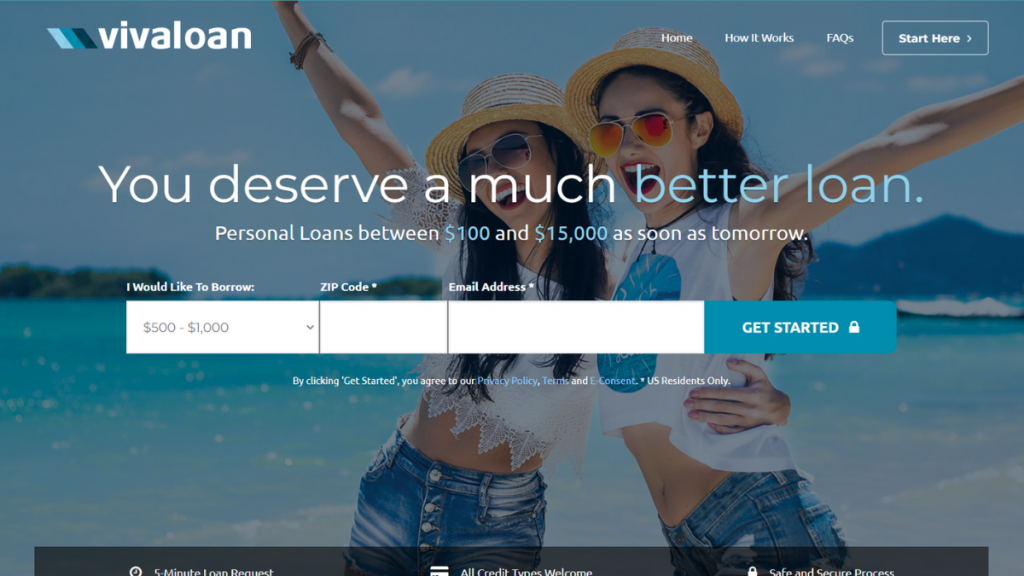

Up to $15,000: VivaLoan review

Uncover the details of VivaLoan, a short-term loan option that can help you get funds quickly. Get the money you need with any type of credit!

Advertisement

VivaLoan: Your loan released in a record time of 24 hours

If you’re in the market for quick cash, this VivaLoan review could be just what you need. But with so many loan options around, it can be tough to know which to choose.

Apply easily for VivaLoan

Discover how to apply for a VivaLoan in easy steps – borrow up to $15,000 in no time! Find affordable rates to match your personal needs!

That’s why we’ve decided to put together this review of VivaLoans. Here, we’ll provide an honest assessment. So stick around and read on if you want to learn more!

- APR: Not disclosed, but it will vary depending on your credit and other factors;

- Loan Purpose: Debt/Credit Card Consolidation, Unexpected Expenses, Major Purchase, Home Improvement, Medical Expenses, and Vacation;

- Loan Amounts: $100 to $15,000;

- Credit Needed: All types of credit are accepted;

- Origination Fee: Not disclosed;

- Late Fee: Not disclosed;

- Early Payoff Penalty: Not disclosed.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

What is VivaLoan?

VivaLoan of this review offers an easy way for consumers to connect with prospective lenders.

After all, the loan request form requires minimal effort and only requires the necessary information.

Moreover, VivaLoan allows customers access to potential lenders from its direct network across the United States and transmits loan requests to those participating companies.

Besides, depending on the customer’s needs, VivaLoan offers a variety of loan amounts ranging from $100 to $15,000 for various purposes.

In this sense, you can use this loan for debt/credit card consolidation, unexpected expenses, major purchases, home improvement, medical expenses, and more.

Is VivaLoan good?

VivaLoan, presented in this review, is an excellent choice for those looking for emergency funding or solutions to tide them over in a tight spot.

With VivaLoan’s loan offerings, you can access funds for various credit needs, from tuition fees to house renovations.

The entire process is designed to be very fast and efficient – the application takes no more than minutes.

But while VivaLoan has several advantages, it may not always suit those who wish to borrow a larger amount. After all, VivaLoan typically limits its loans to $15,000.

Furthermore, interest rates may vary depending on your credit score – a higher score will significantly reduce your APR rate. Check out the pros and cons.

Advertisement

Pros

- Loans available for various types of credit;

- Various purposes are allowed for the use of money;

- Extremely fast application and release (same day);

- Various lender options are available.

Cons

- Relatively low loan amounts (up to $15,000);

- APR can be high as per the credit score.

Advertisement

Does VivaLoan check credit scores?

Yes. The VivaLoan in this review checks the credit score of all applicants. However, as there are several different creditors, the scoring criteria change.

So, even if you don’t have a very good credit score, you can apply and connect with a compatible creditor. Then, you should review the terms to make the final loan decision.

Want to apply for VivaLoan? We will help you!

As you saw in this review, VivaLoan is a type of loan for personal purposes with various possibilities. After all, you can count on many different lenders and varying APRs.

In addition, people with bad credit scores can also apply. Find out now how to apply for this option and get your loan on the same day.

Apply easily for VivaLoan

Discover how to apply for a VivaLoan in easy steps – borrow up to $15,000 in no time! Find affordable rates to match your personal needs!

Trending Topics

Application for the U.S. Bank Cash+™ Visa Signature® card: how does it work?

If you're good with cashback management, the U.S. Bank Cash+™ Visa Signature® card is for you. Learn how to apply for it.

Keep Reading

Women, Infants, and Children (WIC): nutritional support for families

Learn about the Women, Infants, and Children (WIC) program's services, who is eligible to, and how to apply for benefits. Keep reading!

Keep Reading

How to apply and get verified on the Buy On Trust Lending easily

No credit? No problem. Learn how to apply for a Buy On Trust account, get the brand name products you love, and pay for them over time.

Keep ReadingYou may also like

Western Union® Netspend® Prepaid Mastercard® review

Manage your finances with ease using the Western Union® Netspend® Prepaid Mastercard® of this review. No credit check required!

Keep Reading

Learn to easily apply for the Upgrade Personal Loan

Are you looking for personal loans of up to $50,000? If so, read our post to learn how to apply for Upgrade Personal Loan!

Keep Reading

Solicitud para la Destiny Mastercard®: ¿cómo funciona?

Si no tienes un buen puntaje de crédito, no te preocupes. Puedes solicitar la Destiny Mastercard y mejorarlo. Aprende cómo solicitarla.

Keep Reading