Debit Cards

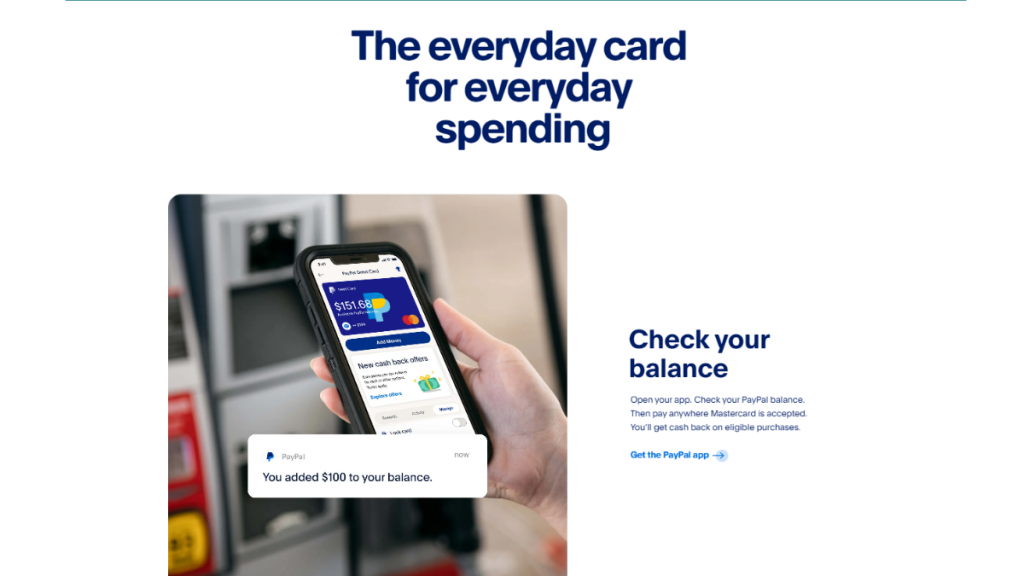

Earn cash back: Apply for the PayPal Debit Card

Apply for a PayPal Debit Card now! Ensure a convenient banking experience and cash back on purchases! Keep reading and learn more!

Advertisement

How do you apply for the PayPal Debit Card? Who is it for? Answers here!

Are you eager to apply for a PayPal Debit Card but unsure of the process? In this post, you’ll find a detailed, step-by-step guide to the application process.

If you want to obtain your very own PayPal Debit Card in no time, dive in to learn how to get it and enjoy its benefits. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

To apply for the PayPal Debit Card online, go to the official card page on their website.

Then you must follow the step-by-step instructions to request your personalized card. So to be eligible, make sure you:

- Have a PayPal Balance account (which you can set up without any fees);

- Are an active PayPal member without any ongoing issues in the Resolution Center.

The best part is using your card details right after signing up and creating your Debit Card pin.

So you can shop online even before receiving the physical card.

And here’s the great news: the PayPal Debit Card doesn’t require a credit check, making it hassle-free to get started.

So go ahead and apply for your PayPal Debit Card today, and enjoy the convenience and flexibility it offers for your online and in-person transactions.

Apply using the app

You can download the PayPal app directly from your app store and then start your application process for the PayPal Debit Card using it.

So follow their instructions, and you might finish your application in minutes. Their app is available for Androids and iOS systems.

Advertisement

PayPal Debit Card vs. Extra Debit Card

Two debit cards beyond ordinary: the PayPal Debit Card and Extra Debit Card, offer more than purchase power but make your life easier.

On the one side, the PayPal Debit Card offers points you can redeem for cash back on eligible purchases.

Conversely, the extra Debit Card helps you build your credit score without a security deposit or hard score checks.

Which debit card fits your finances better? Analyze their features below to figure out!

PayPal Debit Card

- Credit Score: No credit score is required;

- Annual Fee: No monthly or annual fees;

- Purchase APR: N/A;

- Cash Advance APR: N/A;

- Welcome Bonus: No welcome bonus;

- Rewards: Points on eligible purchases.

Advertisement

Extra Debit Card

- Credit Score: N/A;

- Annual Fee: Credit building plan: $149 per year/ Credit building plan + Rewards: $199 per year;

- Regular APR: 0%;

- Welcome bonus: N/A;

- Rewards: 1% on purchases.

Read our post below to learn how to apply for the Extra Debit Card and build your score. So stay with us and learn!

Extra Debit Card application: how does it work?

Get the extra credit score you need without a credit card. Learn how to apply for an Extra Debit Card! Earn points on select transactions!

Trending Topics

Prime Visa Credit Card: is it worth it?

Learn why the Prime Visa Credit Card might be an excellent fit for you with its cash back rewards and generous welcome bonus!

Keep Reading

A 101 guide on what is cryptocurrency: start investing now!

If you want to keep up with the crypto market, you need to know what cryptocurrency is. We'll tell you everything about it in this article.

Keep Reading

BMO Ascend World Elite®* Mastercard®* Review

Maximize travel with BMO Ascend World Elite®* Mastercard®*: top rewards, extensive insurance, luxury perks. Elevate your journeys!"

Keep ReadingYou may also like

Ally Bank increased its APY rates to 0,90%

Ally Bank has been increasing its APY rates for customers. Check out the latest increase and see just how much you can earn.

Keep Reading

Learn to apply easily for the Citrus Loans

Are you wondering how to apply for a loan with Citrus Loans? Here are some tips that will help you. Read on!

Keep Reading

Personal loan interest rate: what is it?

Wondering what is a personal loan interest rate? Get all the information you need here, including average rates and how to get the best deal.

Keep Reading