Credit Cards

Prime Visa Credit Card: is it worth it?

Looking for the right credit card to suit your lifestyle? Find out why the Prime Visa Credit Card is the perfect choice. Learn more about its features and benefits in our full review!

Advertisement

Prime Visa Credit Card review: Earn up to 5% back on selected purchases!

Are you an Amazon loyalist looking for the perfect card to reward your spending habits? Then the Prime Visa Credit Card might be the right fit for your lifestyle!

In this review, we’ll take a look at this product’s main features and its perks and drawbacks. So, read on to learn more about what this card can do for you!

How do you get the Prime Visa Credit Card?

If you're an Amazon Prime member, the Prime Visa Credit Card is a great way to earn rewards on your purchases. Learn how to apply here!

| Credit Score | Good – Excellent. |

| Annual Fee | $0. |

| Regular APR | 19.49% – 27.49% variable. |

| Welcome bonus | Get a $100 Amazon Gift Card instantly upon approval exclusively for Prime members. |

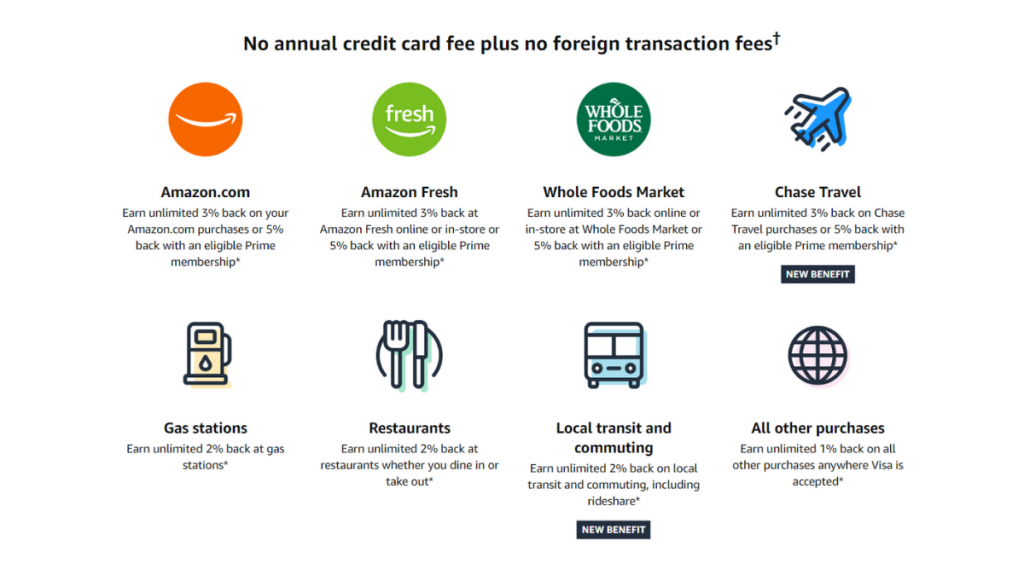

| Rewards | Earn unlimited 5% back at Amazon.com, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases with an eligible Prime membership, unlimited 2% back at gas stations, restaurants, and on local transit and commuting (including rideshare), and unlimited 1% on all other purchases. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Prime Visa Credit Card

Issued by Chase and with a Visa Signature, the Prime Visa is accepted worldwide.

This product offers a 0% annual fee as well as no foreign transaction fees, which is perfect for any international purchases or traveling.

As rewards go, if you’re a frequent Amazon or Whole Foods customer, no other product can benefit you more.

You get 5% cash back from buying selected items at those places, and the flexible redemption options could mean anything from credit statements to money in your pocket.

But that’s not all! This card also provides a 2% cash back rate at restaurants, gas stations, and local transit. And you can get 1% back from any other purchase.

When you sign-up for a new account, Amazon throws in a handsome $100 gift card that you can use in whichever way you’d like (terms apply).

You must be an Amazon Prime member to be eligible for the card. The biggest downside to this product is that there is no intro APR for balance transfer or purchases.

Plus, if you don’t shop at Amazon or Whole Foods so much, it’ll be harder to maximize your earnings with this product.

Prime Visa Credit Card: should you get one?

If you’re an Amazon loyalist and a Whole Foods enthusiast, this is the best rewards card in the market for you, but it’s not limited to just those two options.

The 2% cash back on dining, for instance, can be used in your favor if you order in or out frequently.

Unlike many store-branded cards, you can use the Prime Visa card anywhere in the world that accepts Visa and earns bonus rewards with it.

You do have to be an Amazon Prime member to get it, and if you don’t shop much at Amazon or Whole Foods, many other options could benefit you more.

See the pros and cons of the Prime Visa Credit Card below.

Advertisement

Pros

- Get a $100 Amazon Gift Card instantly upon approval exclusively for Prime members.

- Earn unlimited 5% back at Amazon.com, Amazon Fresh, and Whole Foods Market with an eligible Prime membership.

- Earn unlimited 5% back on Chase Travel purchases with an eligible Prime membership.

- Earn unlimited 2% back at gas stations, restaurants, and on local transit and commuting (including rideshare).

- Earn unlimited 1% back on all other purchases.

- No annual credit card fee.

- No more waiting. Redeem daily rewards at Amazon.com as soon as the next day.

- Member FDIC.

Cons

- Only available to Amazon Prime members.

- No 0% intro APR.

Advertisement

Credit score required

Like most rewards cards in the market, you need a credit score between good and excellent to get approved for an Prime Visa Credit Card.

Anything ranging from 690 to 850 in your FICO score could qualify you for an application.

Prime Visa Credit Card application: how to apply

Are you interested in signing up for the Prime Visa after learning just how much it can benefit you? We can help!

Follow the link below for more details about the application process and start earning rewards today!

How do you get the Prime Visa Credit Card?

If you're an Amazon Prime member, the Prime Visa Credit Card is a great way to earn rewards on your purchases. Learn how to apply here!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Cheap United Airlines flights: Travel on budget in the U.S or across the world!

Learn how to find United Airlines cheap flights to many different destinations. Read on to learn more where to find them!

Keep Reading

How many credit cards should I have?

How many credit cards should I have? Here is an answer in detail. Learn how to pick a number and the benefits. Read on!

Keep Reading

What is a checking account and how can it benefit you: find out here!

A checking account can offer you convenience, security, and flexibility - find out what is a checking account and get the best one!

Keep ReadingYou may also like

Choose the best Social Welfare Programs for you!

Check out our guide to learn more about the social welfare programs available in the U.S., including who is eligible. Keep reading!

Keep Reading

Apply for the Delta SkyMiles® Reserve American Express Card

Do you need a card to make your travel experiences better? Read to learn about the Delta SkyMiles® Reserve American Express Card application!

Keep Reading

How to travel for free using miles: a guide for beginners

Discover how to travel for free, why you should be earning and saving miles instead of paying with cash, and the best ways. Read on!

Keep Reading