Reviews

Juno Debit Card application: how does it work?

Apply for a Juno Debit Card and get all the benefits of a traditional banking account without visiting a physical branch. Read on!

Advertisement

Juno Debit Card: Apply in less than 5 minutes!

Have you ever considered receiving part of your paycheck in crypto? If so, then you may be interested in a Juno Debit Card.

It allows you to earn cash back on your purchases and has everything you need online in the app. Keep reading to understand how the application process works.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The Juno Debit card is an extension of the Juno checking account. Because of that, you will be able to ask for your card as soon as you open an account with Juno.

The process is simple and online. You can provide your personal information, so they will analyze your profile and open your account in less than 5 minutes.

To be eligible, you must be at least 18 years old and be a resident of the USA. As an immigrant, you can also open an account if you have a valid Social Security number in the country.

Apply using the app

You can apply for a Juno account on their website and then manage your card and account in the app.

Advertisement

Juno Debit Card vs. Sable Debit Card

Juno and Sable are both cards that have online management and respond to an online account.

However, while Juno offers interesting crypto features, Sable offers 1% cash back on some companies, such as Spotify and Netflix. Have a look at what both cards have to offer you.

Juno Debit Card

- Credit Score: There’s no minimum credit score required;

- Annual Fee: There’s no annual fee for the basic card;

- Regular APR: Not applied;

- Welcome bonus: Earn a $100 bonus on your first direct deposit of $250 or more (terms apply);

- Rewards: 10% cash back on crypto or cash purchases (valid until October 15, 2022); 5% cash back eligible retailers.

Advertisement

Sable Debit Card

- Credit Score: Not required. All types of score;

- Annual Fee: No annual fee;

- Regular APR: No APR;

- Welcome bonus: None;

- Rewards: 2% cash back on eligible brands; 1% cash back on eligible purchases.

Now, if you like the Sable Debit Card, there’s a post about its application below!

How to apply for a Sable Debit Card

Applying for a Sable card is an excellent idea. Open your account online and get your debit card with no fees. This article will show you how to get a Sable card.

Trending Topics

Reflex® Platinum Mastercard® credit card review: is it worth it?

The Reflex® Platinum Mastercard® credit card is a solid choice for anyone looking to rebuild their credit scores. Learn more in our review!

Keep Reading

Another bad week for Tesla’s stock prices

Tesla shares took another big hit this week. Will the latest fall endanger Elon Musk's deal to acquire Twitter? Read on for more!

Keep Reading

Application for the Citi® Double Cash Card: how does it work?

Learn all you need to apply for the Citi® Double Cash Card and enjoy a card with no annual fee and double reward points in every purchase.

Keep ReadingYou may also like

Apply for SoFi Student Loans: up to 100% financing

Students seeking financial assistance for education can apply online for SoFi Student Loans. Find affordable loan options for you!

Keep Reading

How to build credit with a secured credit card

Are you starting your credit history from scratch? Discover how to use secured credit cards to build credit. Stay tuned!

Keep Reading

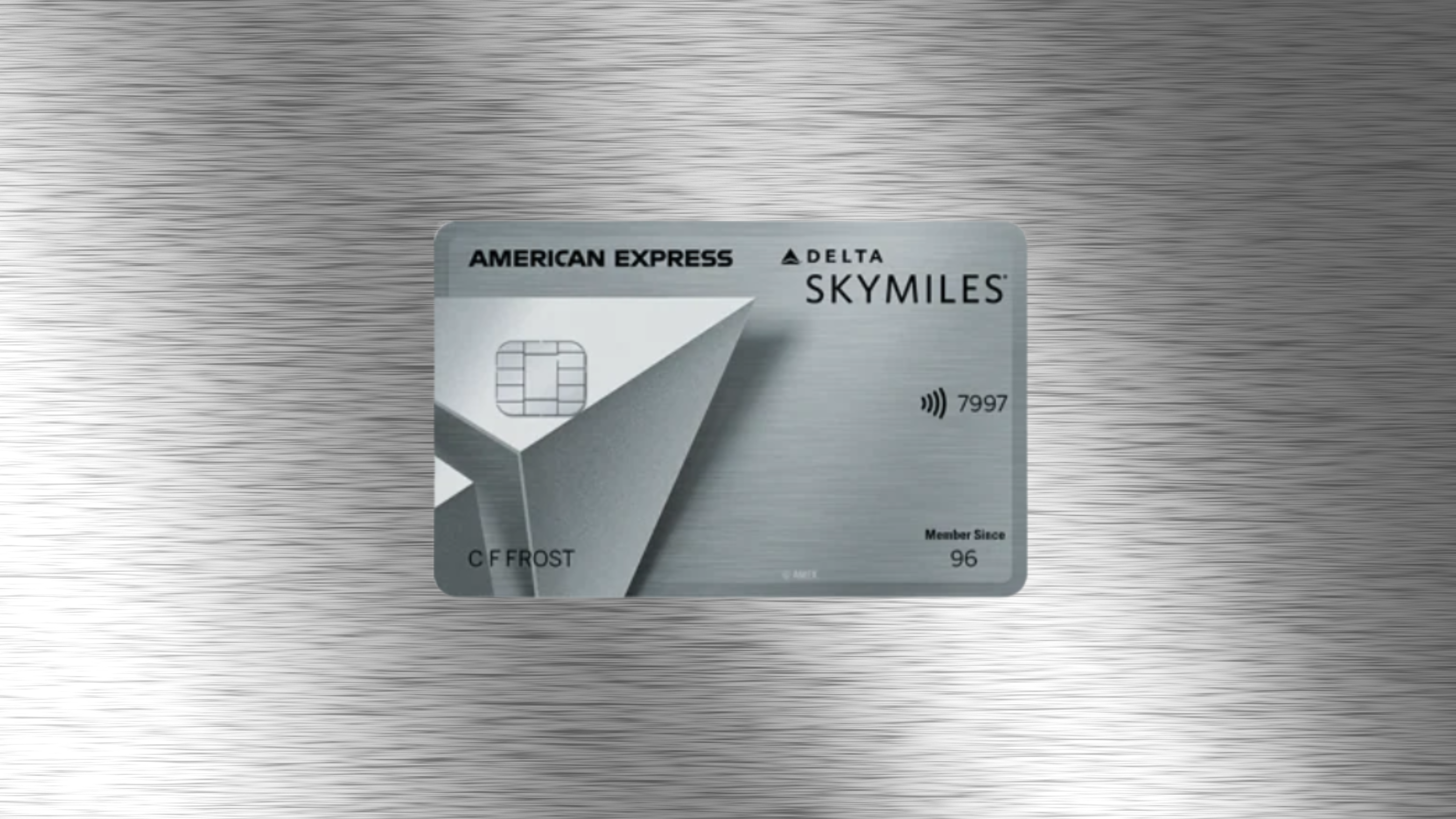

Delta SkyMiles® Platinum American Express Card review

See the Delta SkyMiles® Platinum American Express Card review to take advantage of premium travel benefits. Keep reading!

Keep Reading