Loans

Apply for SoFi Student Loans: up to 100% financing

Looking to secure your future with a SoFi Student Loan? Relax, we've got you covered. Read on and discover how to apply for this student loan - no fees!

Advertisement

Get qualified for a student loan without worrying about fees or credit checks!

Starting college with insufficient funds? No problem! We have a treasure map to guide you on how to apply for SoFi student loans!

SoFi offers loans that can be your ticket to the academic world with low rates and no fees. So, stay tuned to learn how to master your application!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Online application

SoFi Bank offers private student loans for undergraduates, graduates, Law and MBA, and even parent loans so that you can pay or refinance your finance education.

Also, this lender has variable or fixed-rate loan options, no fees, and diverse payment options.

Without further ado, here is how to apply for SoFi private student loans.

Step 1: Applying Online

If you’re considering taking out a student loan from a private lender, you can apply directly through SoFi’s website.

The first step is to visit their website and check what interest rate you might qualify for.

Then, you’ll be able to see if you’re approved before you actually apply, and at this stage, you can also consider adding a cosigner to your application.

Advertisement

Step 02: Selecting your rate and repayment

Choose fixed or variable rates for your loan and select from four repayment options. You can start paying during college or after you graduate.

Step 03: Closing the deal

Finally, you can now submit more information about yourself and your education.

To do this, you will then need to upload pictures of your documents and sign some paperwork electronically. SoFi will take care of the rest.

Advertisement

Requirements

Firstly, you should make sure you are attending a school that qualifies for SoFi private student loans.

Also, they will check your income and credit score, as well as employment information. It is also valid if you choose a cosigned loan.

Also, you need to be a U.S. citizen or permanent resident.

Apply using the app

It’s not possible to apply for student loans in the app. Visit the website and follow the guide above.

Other options for students: Deserve® EDU Mastercard for Students

A student card can be a great addition to your academic journey. It often comes with low rates, no fees, and good rewards.

If you’re a student looking to start building your credit score, the Deserve® EDU Mastercard is an excellent option.

Not only does it let you earn 1% cash back on all your purchases, but it also comes with cell phone protection.

- Credit Score: No credit score is required;

- Annual Fee: $0;

- Purchase APR: 22.99% (variable);

- Cash Advance APR: 22.99% (variable);

- Welcome Bonus: N/A;

- Rewards: 1% cash back on all purchases.

Ready to start your studies with a credit card that helps build credit and saves money? Apply for the Deserve® EDU Mastercard for Students. Read to learn how.

How to apply for a Deserve® EDU Mastercard?

Learn the step-by-step process to easily apply for a Deserve® EDU Mastercard for Students.

Trending Topics

Interest rates might reach levels not seen since 2007

In its April’s Economic Update, CUNA revealed that as inflation slows, interest rates might exceed 2007’s economic levels. Read more now.

Keep Reading

Red Arrow Loans review: how does it work and is it good?

Read our Read Arrow Loans review to learn more about this company and compare it to others in the market. Check it out!

Keep Reading

Federal Pell Grant: see how to apply

Find out if you're eligible to apply for the Federal Pell Grant. Ensure up to $7,395 to cover educational costs!

Keep ReadingYou may also like

WWE Netspend® Prepaid Mastercard®: apply today

Get the WWE Netspend® Prepaid Mastercard® today and enjoy its advantages, such as low monthly fees, no purchase, or cash advance fees.

Keep Reading

Types of checking accounts: find the best one for your needs

Need a checking account but not sure where to start? Check out our guide to the different types of checking accounts. Keep reading!

Keep Reading

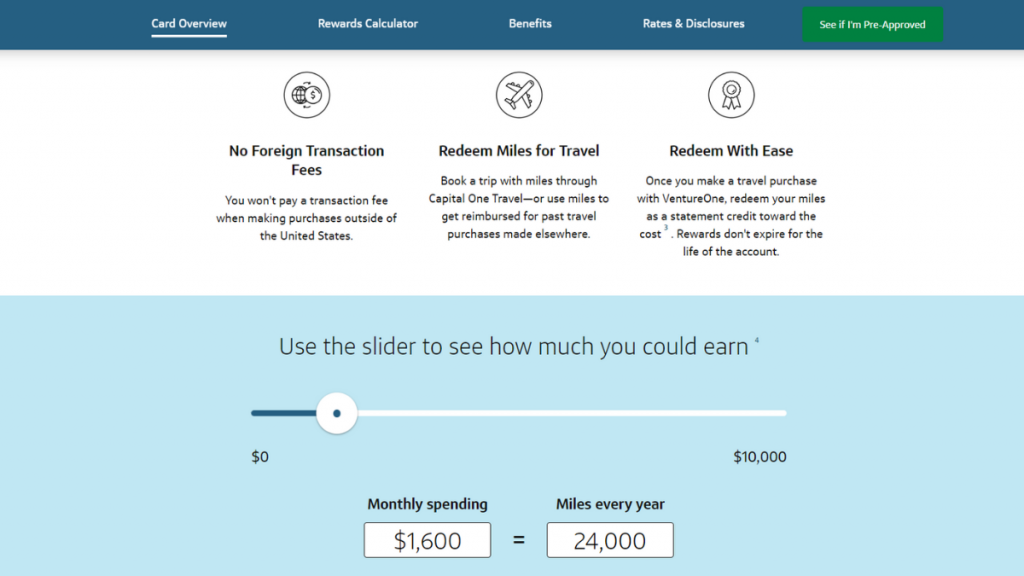

Application for the Capital One Bank: how does it work?

Once you open your account, you will have access to a Capital One card with all the convenience and high-quality service this bank can offer.

Keep Reading