Credit Cards

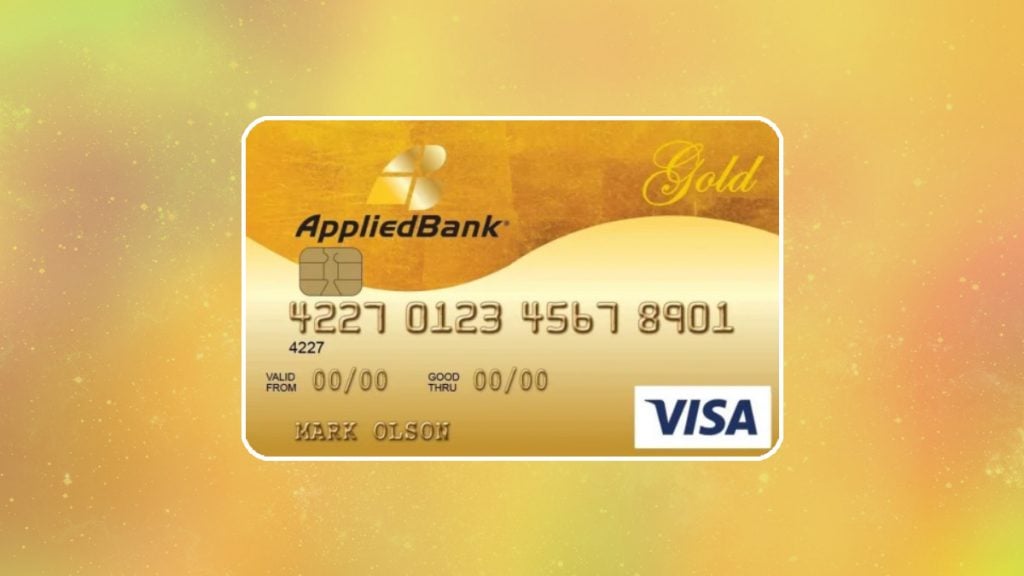

Applied Bank® Gold Preferred® Secured Visa® Credit Card review

Find out if the Applied Bank® Gold Preferred® Secured Visa® Credit Card is right for you. Learn how to apply, what features it has and whether or not a credit check is required.

Advertisement

Applied Bank® Gold Preferred® Secured Visa® Credit Card: The perfect card to improve your bad credit score.

When it comes to your credit, it’s important to have a card that works for you. The Applied Bank® Gold Preferred® Secured Visa® Credit Card is perfect for those who want to build or strengthen their credit. With a modest annual fee and a low fixed interest rate, this card has everything you need to get your finances back on track.

So if you want to start your path on the way to a better and healthier financial future, keep reading our Applied Bank® Gold Preferred® Secured review to learn what this product can do to help you get there.

How to apply for the Gold Preferred® Secured Card?

Learn the application process for the Applied Bank® Gold Preferred® Secured Visa® Credit Card and start rebuilding your credit with the right tools.

- Credit Score: Any credit score has a chance of approval.

- Annual Fee: The card charges a $48 annual fee.

- Regular APR: 9.99% fixed APR.

- Welcome Bonus: There is no welcome bonus.

- Rewards: There are no rewards.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Applied Bank® Gold Preferred® Secured Visa® Credit Card: how does it work?

The Gold Preferred® Secured Visa® Credit Card is a secured credit card, which means you need to make a security deposit in order for it to work. The security deposit is the same as your credit line. Applied Bank requires a $200 minimum, but you can choose an initial spending limit up to $1,000. Over time, you can increase that amount up to $5,000 with additional funding.

The card charges a $48 annual fee and has 9.99% fixed APR. For people with bad or no credit history, this product can be a powerful ally in building and repairing a damaged credit score. The bank doesn’t perform a credit check and reports all payments to the credit bureaus. Therefore, approval rates are higher for everyone who needs to start doing some damage control on their personal rating.

Gold Preferred® Secured Visa® Credit Card: should you get one?

The Gold Preferred® Secured Visa® Credit Card has a number of features that make it a great option for people who are rebuilding their credit. But there are also some drawbacks to consider before applying. Let’s take a closer look at the pros and cons.

Advertisement

Pros

- No credit checks;

- Low fixed APR;

- Reports to all main credit bureaus;

- Flexible security deposit.

Cons

- No welcome bonus or rewards;

- Charges an annual fee;

- Charges a foreign transaction fee;

Advertisement

Credit score required

There is no minimum credit score required. Applied Bank doesn’t even perform credit checks on new applications. Therefore, all credit levels are welcome to apply for this product.

Gold Preferred® Secured Visa® Credit Card application: how to do it?

After learning everything this card has to offer, it’s time to learn about its application process. You can find out if you’ve been approved in just a minute for a new card, and the online process makes it all much easier. Follow the link below for more details!

How to apply for the Gold Preferred® Secured Card?

Learn the application process for the Applied Bank® Gold Preferred® Secured Visa® Credit Card and start rebuilding your credit with the right tools.

Trending Topics

Earn cash back: Apply for the PayPal Debit Card

Discover the easiest way to apply for the PayPal Debit Card online - no monthly fee and convenient banking experience! Keep reading!

Keep Reading

Child and Adult Care Food Program (CACFP): see how to apply

Learn how to apply for CACFP Child and Adult Care Food Program (CACFP) and ensure access to nutritious food! Keep reading and understand how!

Keep Reading

Discover it® Balance Transfer Credit Card application: how does it work?

Get the lowdown on how to apply for Discover it® Balance Transfer Credit Card! Enjoy 0% intro APR and more! Keep reading!

Keep ReadingYou may also like

Hassle-free process: Apply for Avant Credit Card

Building better credit has never been easier. Apply for an Avant Credit Card online with a soft pull and enjoy the benefits immediately!

Keep Reading

0% intro APR: Apply for Discover It® Student Cash Back Card

Looking to apply for the Discover It® Student Cash Back Card? Discover all the steps in this guide - earn up to 5% cash back on purchases!

Keep Reading

Interest rates might reach levels not seen since 2007

In its April’s Economic Update, CUNA revealed that as inflation slows, interest rates might exceed 2007’s economic levels. Read more now.

Keep Reading