Credit Cards

Upgrade Cash Rewards Visa® review

Are you looking for a new credit card with no annual fee? Maybe the Upgrade Cash Rewards Visa® is the right choice for you. This article will show you its benefits.

Advertisement

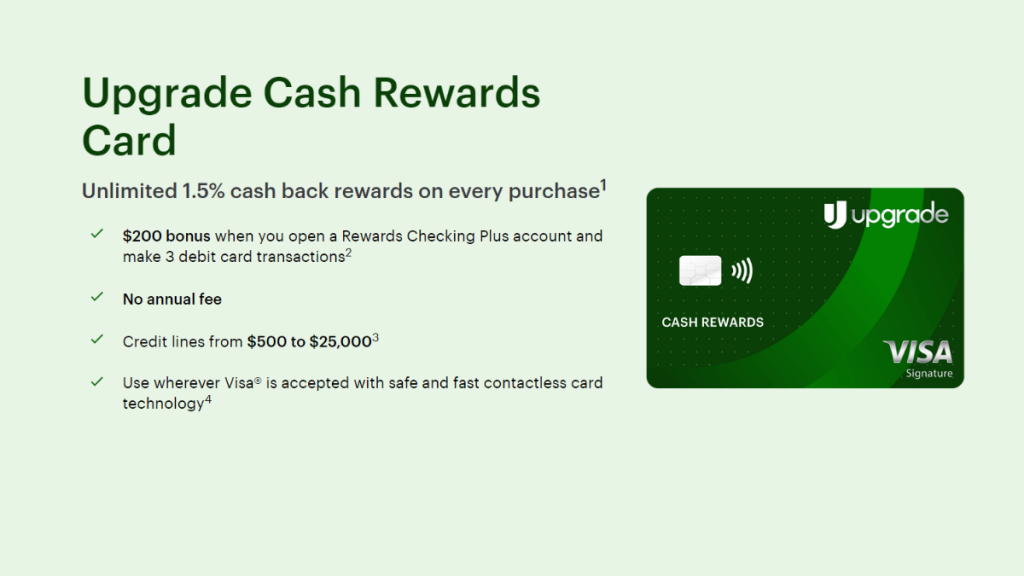

Upgrade Cash Rewards Visa® review: high credit limits with unlimited cash back

The Upgrade Cash Rewards Visa® is different from other credit cards, and you’ll learn all about it in this review. When it comes to your finances, it’s important to have the right tools in your arsenal. A great way to start is by upgrading your regular credit card to one that offers better rewards.

In this blog post, we’ll take a look at the features of the Upgrade Cash Rewards Visa® and see if it might be a good fit for you. With bonus rewards on everyday purchases and no annual fee, this card offers a lot! Keep reading to learn more.

- Credit Score: Fair to Excellent;

- Annual Fee: $0;

- Regular APR: 14.99% – 29.99% variable APR;

- Welcome bonus: $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions.

- Rewards: 1.5% cashback, unlimited, earned every time you pay your credit card bill.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Upgrade Cash Rewards Visa®: is it legit?

If you need to make a slightly larger purchase but don’t want to take out a loan, using a regular credit card can cost you a lot in interest. The Upgrade Cash Rewards Visa® is perfect for this case.

Should you get this card?

This card is a go-to for people who frequently carry a balance and ends up paying a lot of interest upon it.

Advertisement

Pros

- $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions*.

- 3% unlimited cash back on every purchase in Home, Health, and Auto categories

- No annual fee

- Enjoy Visa Signature benefits, like Roadside Dispatch, Price Protection, Extended Warranty and more

- Shop smarter with Upgrade Shopping! Get exclusive savings at stores, restaurants, and more

- No touch payments with contactless technology built in

- See if you qualify in seconds with no impact to your credit score

- Great for large purchases with predictable payments you can budget for

- Mobile app to access your account anytime, anywhere

- Use your card anywhere Visa is accepted

- Relax knowing that you are protected in case of unauthorized transactions with Visa’s Zero Liability Policy

Cons

- Just a few applicants will get higher credit limits. Most will get less than $20,000.

- This card is unavailable in DC, IA, WV, WI, GA and MA.

Advertisement

Credit scores required

Upgrade will not exclude any application just because it is not a person with a good or excellent score. If you have an average credit score, you can apply and have a chance of being approved.

However, the credit limit and APR conditions will differ depending on your creditworthiness.

Upgrade Cash Rewards Visa® application: how to do it?

The Upgrade Cash Rewards Visa® can be an excellent addition to your wallet, especially if you usually carry your card balance and don’t want to pay interest on the full amount from one month to the next.

Would you like to have this card? If yes, follow the instructions below to discover the application process.

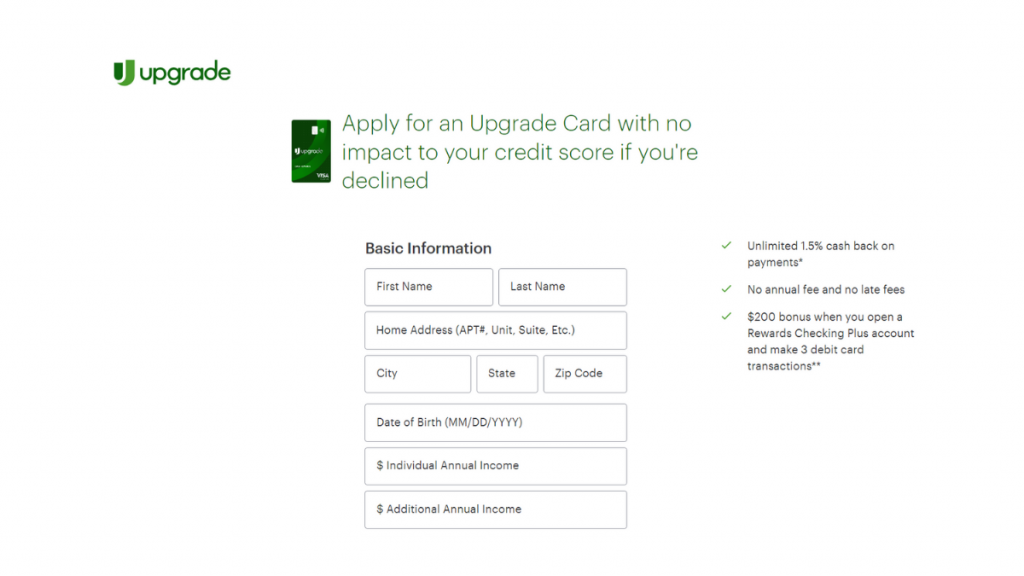

Apply online

You can pre-qualify for an Upgrade Cash Rewards credit line. If you like the offer you receive, you can then proceed with the application.

On the Upgrade website, look for the card you chose and get started with your application. It consists of a simple form that asks for basic information. Just your full name, complete address, birthday, and income.

Also, create an account with a password and you’re ready to go. Upgrade will check which credit line you qualify for, and you’ll receive the offer in your email.

Moreover, you should know that this card is unavailable in DC, IA, WV, WI, GA and MA.

Apply using the app

Upgrade has a mobile app for you. Once you complete the application form on the website and conclude the application process, you can download it to check your balance, manage your expenses, and track your credit score.

Upgrade Cash Rewards Visa® vs. Upgrade Triple Cash Rewards Visa®

But Upgrade doesn’t have only one credit card. It also has the Upgrade Triple Cash Rewards Visa®, with the same features but double as much cash back as the Upgrade Cash Rewards Visa®.

Upgrade Cash Rewards Visa®

- Credit Score: You can get it with an average score;

- Annual Fee: Zero;

- Regular APR: 14.99% – 29.99% variable APR;

- Welcome bonus: $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions.

- Rewards: 1.5% cashback.

Upgrade Triple Cash Rewards Visa®

- Credit Score: Fair to excellent;

- Annual Fee: No annual fee;

- Regular APR: Variable 14.99% to 29.99 APR, depending on your creditworthiness;

- Welcome bonus: $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions.

- Rewards: Earn 3% cash back on selected categories and 1% cash back on everything else.

To apply for an Upgrade Triple Cash Rewards Visa®, check the following content with some tips about it.

How to get the Upgrade Triple Cash Rewards Visa®?

Apply for an Upgrade Triple Cash Rewards Visa®. You can make a big purchase and split your balance into fixed-rate installments.

Welcome Bonus Disclosure: *To qualify for the welcome bonus, you must open and fund a new Rewards Checking Preferred account through Upgrade and make 3 qualifying debit card transactions from your Rewards Checking Preferred account within 60 days of the date the Rewards Checking Preferred account is opened. If you have previously opened a checking account through Upgrade or do not open a Rewards Checking Preferred account as part of this application process, you are not eligible for this welcome bonus offer. Your Upgrade Card and Rewards Checking Preferred account must be open and in good standing to receive a bonus. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade Visa® Debit Card Agreement and Disclosures for more information. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking Preferred account as a one-time payout credit within 60 days after meeting the conditions. This one-time bonus is available through this Upgrade Card offer and may not be available for other Upgrade Card offers.

Trending Topics

Apply for The American Express Blue Business Cash™ Card

Follow this guide to apply for The American Express Blue Business Cash™ Card, and make the most out of your business expenses. Read on!

Keep Reading

Capital One Walmart Rewards® Mastercard® review: is it worth it?

The Capital One Walmart Rewards® Mastercard® offers both savings and rewards that could make it your top choice for everyday shopping!

Keep Reading

The most common myths about your credit score

There are a lot of credit score myths. Find out the truth behind the top five misconceptions people have. Read on!

Keep ReadingYou may also like

Cheap JetBlue Airways flights: Incredible offers every day!

Learm how to find JetBlue Airways cheap flights on their website. It's easy! Just follow these simple steps.

Keep Reading

R.I.A. Federal Credit Union Mastercard® Classic Card review

Looking for a credit card with no hidden fees? Check out our review of the R.I.A. Federal Credit Union Mastercard® Classic Card!

Keep Reading

Appy for the Neo Credit Card: No annual fee!

Learn how to apply for the Neo Credit Card and unlock high cashback rewards with a seamless digital banking. Start now!

Keep Reading