Reviews

Upgrade Cash Rewards Visa® application: how does it work?

You can apply for an Upgrade Cash Rewards Visa® in a couple of minutes without leaving your house to do it. Learn how to apply online for your new credit card.

Advertisement

Upgrade Cash Rewards Visa®: 1.5% cash back on every purchase

You can apply for the Upgrade Cash Rewards Visa® to get cash back for everyday purchases. The card has no annual fee, making it an excellent option for anyone looking for a good rewards card.

In this post, we’ll take a closer look at how the application process for this card works. You can apply even if you don’t have a perfect credit score, and the credit limit it has to offer are high. You can get up to a $25,000 credit line depending on your creditworthiness.

So if you’re interested in learning more about this unique credit card, keep reading!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Advertisement

Apply online

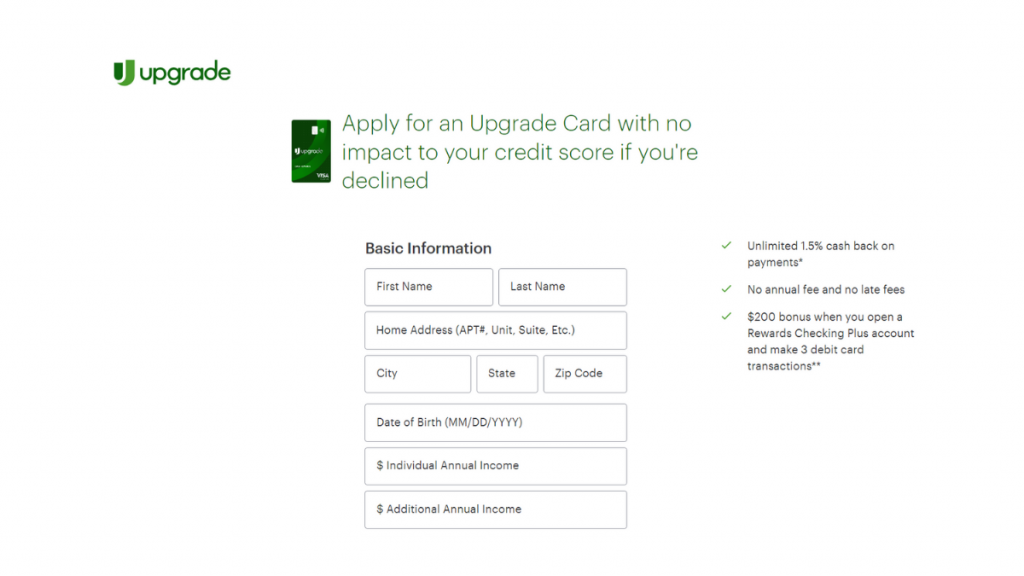

You can pre-qualify for an Upgrade Cash Rewards credit line. If you like the offer you receive, you can then proceed with the application.

On the Upgrade website, look for the card you chose and get started with your application. It consists of a simple form that asks for basic information. Just your full name, complete address, birthday, and income.

Also, create an account with a password and you’re ready to go. Upgrade will check which credit line you qualify for, and you’ll receive the offer in your email.

Moreover, you should know that this card is unavailable in DC, IA, WV and WI.

Apply using the app

Upgrade has a mobile app for you. Once you complete the application form on the website and conclude the application process, you can download it to check your balance, manage your expenses, and track your credit score.

Advertisement

Upgrade Cash Rewards Visa® vs. Upgrade Triple Cash Rewards Visa®

But Upgrade doesn’t have only one credit card. It also has the Upgrade Triple Cash Rewards Visa®, with the same features but double as much cash back as the Upgrade Cash Rewards Visa®.

Upgrade Cash Rewards Visa®

- Credit Score: You can get it with an average score;

- Annual Fee: Zero;

- Regular APR: 14.99% – 29.99% variable APR;

- Welcome bonus: $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions;

- Rewards: 1.5% cashback.

Advertisement

Upgrade Triple Cash Rewards Visa®

- Credit Score: Fair to excellent;

- Annual Fee: No annual fee;

- Regular APR: Variable 14.99% to 29.99 APR, depending on your creditworthiness;

- Welcome bonus: $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions;

- Rewards: Earn 3% cash back on selected categories and 1% cash back on everything else.

To apply for an Upgrade Triple Cash Rewards Visa®, check the following content with some tips about it.

How to get the Upgrade Triple Cash Rewards Visa®?

Apply for an Upgrade Triple Cash Rewards Visa®. You can make a big purchase and split your balance into fixed-rate installments.

*Disclaimer: To qualify for the welcome bonus, you must open and fund a new Rewards Checking Plus account through Upgrade and make 3 qualifying debit card transactions from your Rewards Checking Plus account within 60 days of the date the Rewards Checking Plus account is opened. If you have previously opened a checking account through Upgrade or do not open a Rewards Checking Plus account as part of this application process, you are not eligible for this welcome bonus offer.

Your Upgrade Card and Rewards Checking Plus account must be open and in good standing to receive a bonus. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade Visa® Debit Card Agreement and Disclosures for more information. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking Plus account as a one-time payout credit within 60 days after meeting the conditions.

Trending Topics

Learn to apply easily for the SoFi Mortgage

Do you want to apply for a mortgage with SoFi mortgage? Read on to a complete guideline that covers all you need to know.

Keep Reading

Apply for Plain Green Loans: Your Swift Financial Solution

Discover the simplicity to apply for Plain Green Loans. Quick cash, no origination fees. Your financial solution, your way.

Keep Reading

Southwest Rapid Rewards® Priority Credit Card application

A thorough guide to apply for the Southwest Rapid Rewards® Priority Credit Card waits for you here. Check it out!

Keep ReadingYou may also like

Merrick Bank Personal Loan review: how does it work and is it good?

In this Merrick Bank Personal Loan review, you will learn about how it works, and the pros and cons of their personal loan products.

Keep Reading

Citi Simplicity® Card review: a simple way to get rid of fees

Discover everything from features to how to get rid of standard fees in the Citi Simplicity® Card review. Check it out!

Keep Reading

Citi® Diamond Preferred® Card application: how does it work?

Find out all about the application process for a Citi® Diamond Preferred® Card and see how you can save with the long intro APR!

Keep Reading