Loans

Apply for Plain Green Loans: Your Swift Financial Solution

Looking for swift financial solutions? Explore how to apply for Plain Green Loans today. Unlock rapid funding, flexible loan amounts, and transparent terms. Stay tuned!

Advertisement

Learn how to apply online and get quick funding

In a financial bind? Apply for Plain Green Loans to experience rapid funding, flexible loan amounts, and transparent terms.

Your path to quick and accessible financial support starts here. Read on to find out how to make your application in only a few steps. Stay tuned!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Online application

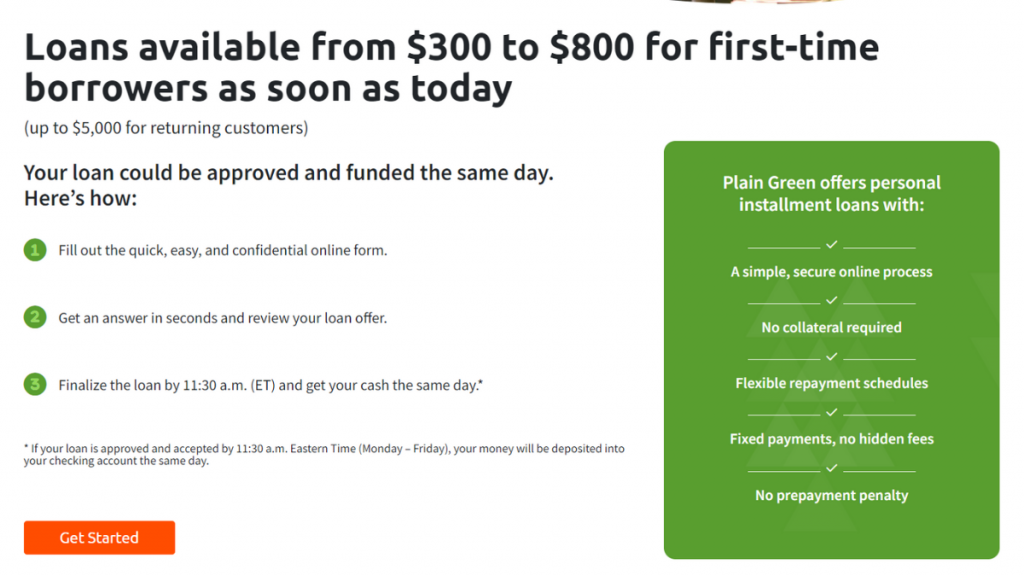

To apply for a loan from Plain Green, you must complete an online application.

However, it’s important to note that you won’t be able to determine if you pre-qualify for the loan.

Additionally, the website doesn’t have a tool to help you estimate how much interest you’ll be charged on the loan.

If you want to apply for a Plain Green Loans online, just follow these simple steps:

- Firstly, visit the Plain Green Loans website.

- Then, fill out the online application form with your personal and financial information.

- After that, review and agree to the loan terms and conditions.

- Submit your application and wait for a decision.

- Then, review the loan offer and accept the terms.

- Sign the loan agreement electronically.

- Finally, receive the funds in your bank account within one business day.

Requirements

Plain Green Loans are available in 24 states and are offered to American citizens or permanent residents.

This public must have a valid security number as well as a checking account to get a loan with Plain Green.

Also, to qualify for this opportunity, you must have a monthly income of at least $1,000 and be at least 18 years old or have reached the age of majority in your state.

Finally, the minimum credit score required has not been disclosed.

Advertisement

Apply using the app

The application through an app is not possible.

Plain Green Loans vs. Avant Personal Loans

Plain Green Loans are for smaller amounts, usually between $300 and $5,000; you must pay them back quickly.

On the other hand, Avant Personal Loans are for larger amounts of money, usually between $2,000 and $35,000, and they are meant for people with good credit scores.

However, the most significant difference is that Plain Green Loans have higher interest rates than Avant Personal Loans, and you must pay them back in less time.

Avant Personal Loans have lower interest rates and longer repayment terms, so you have more time to repay them.

So, if you’re trying to decide between the two, see our comparison below to see which might be right for you.

Advertisement

Plain Green Loans

- APR: From 349% to 599%;

- Loan Purpose: Car repairs, broken appliances, medical care, unexpected bills, moving costs, family emergencies;

- Loan Amounts: From $300 to $5.000;

- Credit Needed: Not disclosed;

- Origination Fee: No origination fee;

- Late Fee: Not disclosed;

- Early Payoff Penalty: No early payoff penalty.

Avant Personal Loans

- APR: 9.95% – 35.95%;

- Loan Purpose: Home renovations and debt consolidation;

- Loan Amounts: $2,000 – $35,000;

- Credit Needed: 600 – 700;

- Origination Fee: 4.75% of the loan amount;

- Late Fee: $25;

- Early Payoff Penalty: N/A.

If you’re considering getting a personal loan from Avant, then see our post below!

How to apply for Avant Personal Loan

Do you want to apply for the Avant Loan? It's fast, easy, and secure. Stay here to learn more.

Trending Topics

Juno Checking Account review: Access crypto in a flash!

Ready to earn more? Check out our Juno Checking Account review and learn how you can be rewarded with 5% APY. Start now!

Keep Reading

Chase Freedom Flex℠ review: is it worth it?

Chase Freedom Flex℠ is outstanding when it comes to its benefits, like cash back and no annual fee. Check the review about it!

Keep Reading

US Bank Altitude® Go Visa Signature® Card review: is it worth it?

Enjoy introductory bonus and restaurant rewards with the US Bank Altitude® Go Visa Signature® credit card. Learn all about it!

Keep ReadingYou may also like

The Mad Capitalist recommendation – Ally Bank Mortgage

Discover how the Ally Bank Mortgage works, and find out more about the advantages, drawbacks, and terms to get it!

Keep Reading

Apply for the Shop Your Way Mastercard®: $0 annual fee

Find out how to apply for the Shop Your Way Mastercard® and increase your purchase points. Get the step-by-step here! Stay tuned!

Keep Reading

Types of loans: understand which one is best for you

Check out this guide to learn about the different types of loans available and find the one that's right for your needs. Read on!

Keep Reading