Credit Cards

Application for the Upgrade Triple Cash Rewards Visa®: how does it work?

Don't know how to apply for your Upgrade Triple Cash Rewards Visa®? Don't worry. This article has every piece of information you need to get this card and enjoy its benefits.

Advertisement

Upgrade Triple Cash Rewards Visa®: with a $0 annual fee you can get up to 3% cash back

To apply for an Upgrade Triple Cash Rewards Visa® is not difficult at all. You can do it entirely online, by yourself, within minutes. Isn’t the internet marvelous?

Remember its benefits: fixed-rate installments to pay your card’s balance and up to $25,000 credit limit.

The icing on the cake is up to the 3% cash back on selected purchases and 1% on everything else.

To enjoy all these benefits, keep reading and follow these steps to apply for your new credit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Advertisement

Apply online

First, let’s not make any credit score hard inquiry if you don’t even know if you like the offer, right? Upgrade will make a soft pull with no harm to your score to present you with an offer. If you agree with the rates you got, you can proceed with the application process.

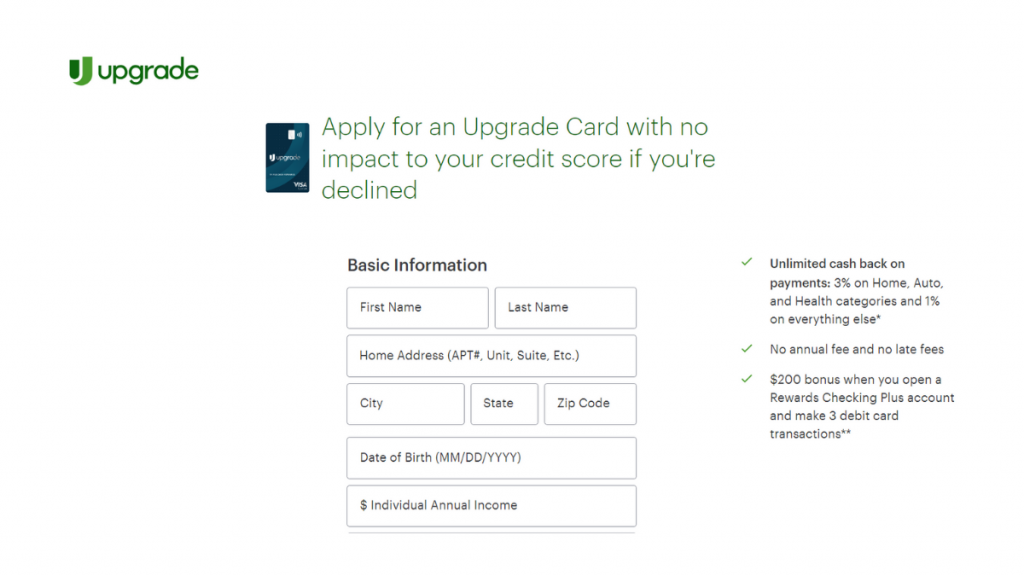

To pre-qualify, it’s very simple. Access the Upgrade website, and find the Upgrade Triple Cash Rewards Visa®. To get started, fill out the form with some basic information, like your full name, address, date of birth, and income.

Create your account with an email and a password. To submit it, you have to read some terms and agree with them. Once you hit the “apply now”, Upgrade will analyze your application and answer with an offer.

Plus, before you apply, you should know that this card is unavailable in DC, IA, WV, and WI.

Upgrade Triple Cash Rewards Visa® vs. Upgrade Bitcoin Rewards Visa®

If you’re not sure about this card, Upgrade has more than one credit card option. You can choose to get cash back as a reward with the Upgrade Triple Cash Rewards Visa®, or you can get bitcoins with the Upgrade Bitcoin Rewards Visa®.

Both have outstanding payment options with a high credit limit available (according to your creditworthiness, you can get up to a $25,000 credit limit).

Advertisement

Upgrade Triple Cash Rewards Visa®

- Credit Score: Excellent, Good, Fair, Average.

- Annual Fee: $0 annual fee.

- Regular APR: Variable 14.99% to 29.99 APR.

- Welcome bonus: $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions.

- Rewards: Earn 3% cash back on selected categories and 1% cash back on everything else.

Upgrade Bitcoin Rewards Visa®

- Credit Score: Fair to excellent.

- Annual Fee: $0.

- Regular APR: 14.99% to 29.99% variable APR.

- Welcome bonus: $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions.

- Rewards: Earn 1.5% back as Bitcoins in every purchase.

Are you interested in cryptocurrencies? This card can be your entry into the crypto market. You have nothing to lose, and you might enjoy dealing with crypto. The following article will show you how to apply for the Upgrade Bitcoin Rewards Visa®.

How to apply for an Upgrade Bitcoin Rewards Visa®?

Applying for an Upgrade Bitcoin Rewards Visa® is an excellent way to get your first Bitcoins or get more of them to your wallet. Learn how to apply for it.

Upgrade and make 3 qualifying debit card transactions from your Rewards Checking Plus account within 60 days of the date the Rewards Checking Plus account is opened. If you have previously opened a checking account through Upgrade or do not open a Rewards Checking Plus account as part of this application process, you are not eligible for this welcome bonus offer. Your Upgrade Card and Rewards Checking Plus account must be open and in good standing to receive a bonus. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade Visa® Debit Card Agreement and Disclosures for more information. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking Plus account as a one-time payout credit within 60 days after meeting the conditions.

Trending Topics

Learn to apply easily for the Red Arrow Loans

With Red Arrow Loans, you can apply quickly and easily and deposit the money into your account immediately. Read on to learn how!

Keep Reading

Can you get a credit card with no job?

Need a credit card but don't have an income? Find out if you can get a credit card with no job, and explore your possibilities. Read on!

Keep Reading

How to budget for an apartment

Discover how to make your money stretch! Find out how to budget for an apartment to secure that perfect place easily!

Keep ReadingYou may also like

Crafty in Minutes: 6 Incredible Apps to Learn Crochet

Master the art of crocheting with ease! Learn to crochet with the best apps and create unique projects. Start your exciting journey now.

Keep Reading

Citi® Diamond Preferred® Card review: Have a break on interest!

Discover how you can save money on interest for 21 months for balance transfers with the Citi® Diamond Preferred® Card review. Read on!

Keep Reading

Checking account pros and cons: what to consider before opening one

If you're looking for a new checking account, these are the pros and cons to consider before opening one. Find out if it's right for you!

Keep Reading