Credit Cards

Application for the Upgrade Bitcoin Rewards Visa®: how does it work?

Applying for an Upgrade Bitcoin Rewards Visa® is an excellent way to get your first Bitcoins or get more of them to your wallet. Learn how to apply for it and start benefiting.

Advertisement

Disclaimer: The Upgrade Bitcoin Rewards Card is no longer available for new applicants.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Upgrade Bitcoin Rewards Visa®: if the future is in cryptocurrencies, this card is your ticket to get there

If you’re tired of getting points or miles as rewards, the Upgrade Bitcoin Rewards Visa® has a different offer for you. What about getting bitcoins as cashback for every purchase? It’s an excellent way to get your first cryptocurrencies without risking the money from your bank account on them.

This card is suitable for people with average credit scores, so you can work on your score while getting rewards. The credit limit starts at $500, but depending on your creditworthiness you can get up to $25,000.

You have the option to pay your balance in monthly installments, like a loan, but with fixed interest rates. The app will help you track all your expenses and plan your budget to save money.

To get this card and start benefiting, keep reading and learn how to apply for it.

Apply online

If your credit score is not that good, you can still try to get it. Upgrade gives you the chance to pre-qualify with no hard inquiry on your credit score.

You will get an offer according to your financial history, and if you don’t qualify for this specific card, Upgrade will suggest other options, as they have more than one credit card.

To pre-qualify, access the Upgrade website, look for the Bitcoin Reward Visa, and hit the “get started” button. You’ll get redirected to a form that requests basic information.

Upgrades will ask for your full name, home address, date of birth, and annual income. Also, create an account with an email and a password. Read all the terms and conditions, and once you get it done you can submit your form. Wait for the response and proceed with the application process.

Plus, you should know that the card is unavailable in DC, IA, WV, WI, NH, HI.

Advertisement

Apply using the app

Upgrade offers an app for its members to manage their accounts. There, you can check your expenses and track how you’re spending your money.

This will help you to control your finances and budget your income. Once you get approved for your new credit card through the website, you can download the app and start using it.

Upgrade Bitcoin Rewards Visa® vs. Capital One Venture Rewards

We’ll show you another credit card option if you prefer miles as a reward for your purchases. Some people can find it confusing to use the Bitcoin rewards.

The Capital One Venture Rewards credit card offers 2 miles per dollar on every purchase and a generous welcome bonus. This card is perfect for you if you love traveling and have an excellent credit score.

| Upgrade Bitcoin Rewards Visa® | Capital One Venture Rewards Card | |

| Credit Score | Fair/Good/Excellent | Excellent |

| Annual Fee | $0 | $95 |

| Regular APR | 14.99% – 29.99% variable APR | 20.24%, 25.24%, or 28.24% variable APR for purchases and transfers (based on creditworthiness) |

| Welcome bonus* | $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions* | You can earn 75,000 bonus miles after you spend $4,000 on purchases in your first 3 months from account opening. *Terms apply. |

| Rewards | 1.5% cashback as Bitcoin on every purchase | 2 miles per dollar on every purchase 5 miles per dollar on car rentals and hotels* *Terms apply |

If you prefer a travel credit card, this is a great option. Many experts recommend it for its rewards and benefits. You can learn more about it and how to get one for yourself by reading the following content.

Application for the Capital One Venture Rewards

The Capital One Venture Rewards card could be a good option for you. It offers miles that can be used for travel rewards, and it's easy to use.

Disclaimer: The Upgrade Bitcoin Rewards Card is no longer available for new applicants.

Trending Topics

Qtrade Direct Investing Review: Build Your Wealth

Explore our Qtrade Direct Investing review for exceptional customer service and a user-friendly platform, ideal for smart investing choices.

Keep Reading

Net First Platinum credit card review: is it legit and worth it?

To purchase at the Horizon Outlet, you need a merchandise credit card like the Net First Platinum. Learn more about this card here.

Keep Reading

NASB Mortgage review: how does it work and is it good?

Read our NASB Mortgage review! Enjoy several loan options, including for self-employed and low-income borrowers! Stick with us and learn more!

Keep ReadingYou may also like

Aeroplan® Credit Card review: Up to 60,000 bonus points

This Aeroplan® Credit Card review is your one-stop for information about this card. Earn up to 3X points on every purchase! Read on!

Keep Reading

How to build credit as a college student

Are you wondering how to build credit as a college student? It's not too hard, and this guide will show you how. Read on!

Keep Reading

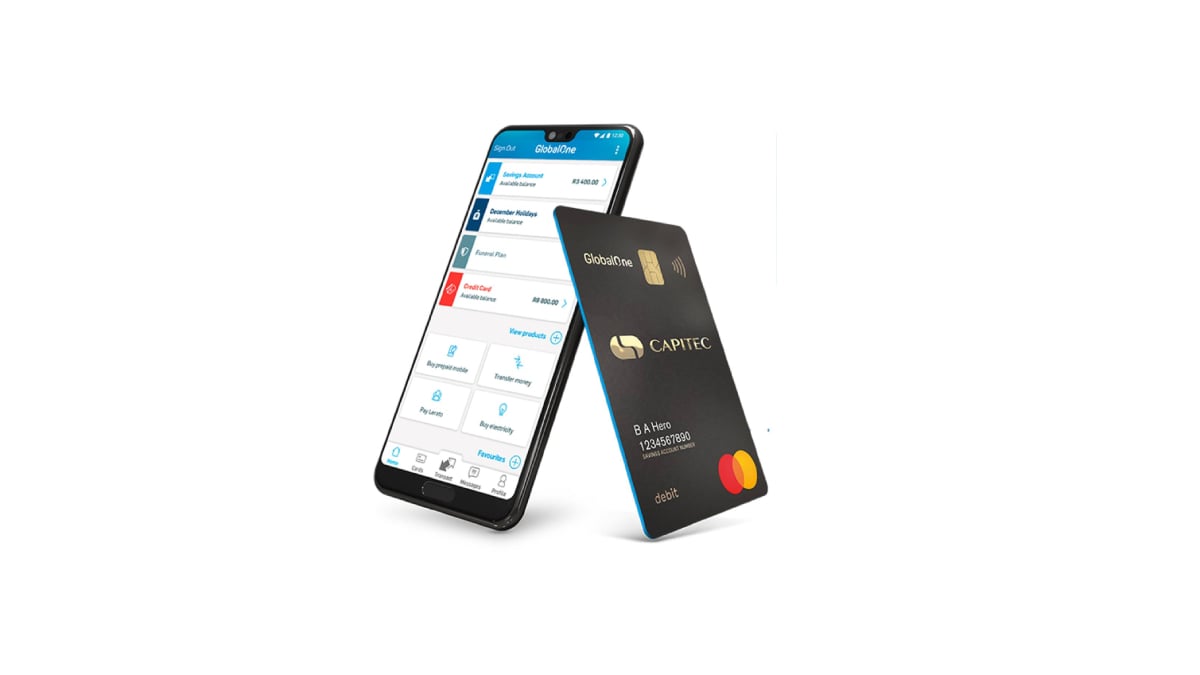

Learn how to download the Capitec Bank App

Find out how to quickly and easily make the Capitec Bank App download. Read on to learn how to enjoy banking online with this app!

Keep Reading