Investments

Qtrade Direct Investing Review: Build Your Wealth

Read our Qtrade Direct Investing review to learn about its top-notch customer service and intuitive trading platform. Ideal for both new and seasoned investors, Qtrade offers a streamlined experience for smart investment decisions.

Advertisement

Discover how Qtrade’s user-friendly platform revolutionizes investing!

In our comprehensive Qtrade Direct Investing review, we delve into what makes this platform a standout choice for investors.

With its streamlined trading experience, Qtrade is redefining online investing. Stay tuned as we uncover the features that could make it your go-to investment platform.

How to join the Qtrade investing?

It doesn't matter if you're a new investor or a experienced one. You can open an Qtrade investing account and improve your trading skills with the best online broker.

| Trading fees | Swap: $45/security One-time sales: $50* Credit sell out: $20* Foreign depository settlements: $100* *Terms apply. |

| Account minimum | No minimum. |

| Promotion | 30 days free trial |

| Investment choices | Stocks ETFs Mutual Funds Bonds New Issues GICs Options |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Qtrade investing: how does it work?

Qtrade is an online broker, where you can buy and sell your assets. You have the option to open a trading account or even registered accounts to let your money grow tax-free.

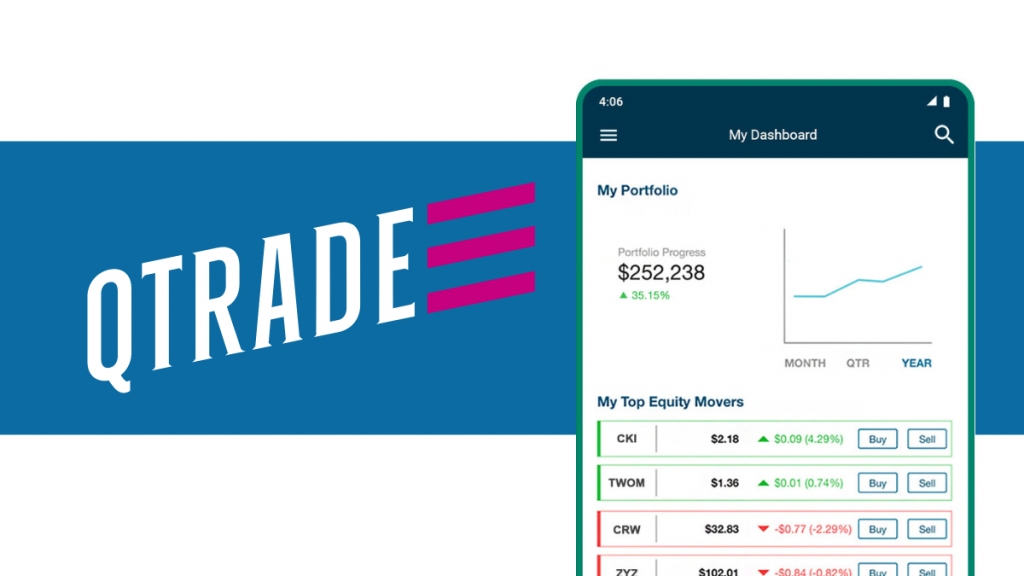

The platform is intuitive and shows important statistics that experienced investors will find very useful. This is an advantage over other platforms that lack some features.

You’ll see in this Qtrade investing review that using this platform can be beneficial for you.

The commissions have a simple structure with competitive prices. However, there are many administrative and account fees you’ll have to pay.

Some conditions can apply to waive the fees, but you have to fulfill many requirements.

Qtrade Direct Investing: should you invest with them?

In this Qtrade Direct Investing review, we’ll delve into the pros and cons of the platform, providing a balanced view. Read them below:

Advertisement

Pros

- The customer service is very efficient, and most of their customer and very satisfied with the excellent service.

- Your investments are safe, as Qtrade is a member of the CIPF (Canadian Investment Protection Funds). And, if there is any fraudulent activity in your account, you’ll get 100% reimbursed.

- Excellent options of registered accounts, like TFSA, Retirement Savings Plans, and others. These accounts are tax-sheltered or tax-deferred by the Government, and that’s why they are registered.

- You also have the option to open a trading account, which you can use for selling and buying stocks.

- If you have a more passive investment style and enjoy buying ETFs and Mutual Funds, you’ll find many options for commission-free ETFs.

- Young Investor Pricing: If you have between 18 and 30 years old, Qtrade will drop your commission fee and waive the administration fees. To get this benefit, you need to authorize a minimum $50 monthly transfer to your investor account with Qtrade.

- Intuitive dashboard to give you an overview of your portfolio and other features.

Cons

- Although many think it’s worth the price, some may think there are too many fees to pay – and they’re not the cheapest on the market.

- Qtrade has options for new investors. However, the experienced ones will benefit the most from this platform.

Advertisement

Is it worth it to join Qtrade investing?

It’s hard to find negative aspects in Qtrade, and it figures among the best platforms, even being considered the top #1.

So, if you take your investment really seriously, it is worth joining Qtrade and leveling up your investing game.

How to open an account at Qtrade investing?

After reading this Qtrade investing review, have you decided to open your account? Opening a brokerage account has a few requirements.

However, with some patience and having your documents in hand to fill out the application form, you can do with by yourself at your home.

And if you have any doubts, the customer service is there to help you. To learn more about how to open your account, check the following content.

How to start investing with Qtrade?

It doesn't matter if you're a new investor or a experienced one. You can open an Qtrade investing account and improve your trading skills with the best online broker.

Trending Topics

Earn back: Bank of America® Unlimited Cash Rewards Secured review

Read our Bank of America® Unlimited Cash Rewards Secured card review - earn 1.5% unlimited cash back and enjoy a $0 annual fee!

Keep Reading

Build Credit and Save Money: How to Download Super+

Download Super+ on your smartphone to save on gas, shopping, and more. Read on to learn how to have it on your device!

Keep Reading

SoFi Personal Loans review: how does it work and is it good?

In this SoFi Personal Loans review, you'll learn how it works, the benefits, and if they're a good fit for you. Read on!

Keep ReadingYou may also like

Cheap United Airlines flights: Travel on budget in the U.S or across the world!

Learn how to find United Airlines cheap flights to many different destinations. Read on to learn more where to find them!

Keep Reading

How to create an easy budget plan in 5 steps

Find out how to create a budget. Here are the steps to start and stick with a budget that will work for you.

Keep Reading

Blue Cash Preferred® Card from American Express review

Do you need a cash-back card for your daily expenses? Know how to get one in this Cash Preferred® Card from American Express review. Read on!

Keep Reading