Credit Cards

Unique Platinum Card review: Elevate your spending power

Maximize your spending - Unique Platinum Card brings amazing benefits for you! Build credit like a pro and enjoy no interest rate!

Advertisement

0% APR to improve your financial life

If you’re looking for a credit card with a high spending limit, without complications, then this Unique Platinum Card review is made for you!

Apply for Unique Platinum Card: quick and simple

Elevate your spending power with the Unique Platinum Card – apply today and enjoy exclusive benefits that only a select few can access.

This card allows you to spend big and take control of your finances. Keep reading and discover whether it’s a good fit for you.

- Credit Score: Poor – bad – limited;

- Annual Fee: Monthly membership fee of $19.95;

- Purchase APR: 0%;

- Cash Advance APR: N/A;

- Welcome Bonus: None;

- Rewards: None.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Unique Platinum Card: how does it work?

The Unique Platinum Card is a credit card that doesn’t offer any rewards or welcome bonuses.

However, it does offer a high credit limit that allows you to make big purchases without worrying about reaching your limit.

With a 0% APR, you won’t have to worry about interest charges as long as you pay off your balance in full each month.

In addition, this credit card helps individuals with limited credit scores build or rebuild it! Indeed, this is an easy-to-get credit card!

Unique Platinum Card: should you get one?

The decision to get the Unique Platinum Card ultimately depends on your financial goals and spending habits.

So here are some pros and cons to consider before making your decision.

Advertisement

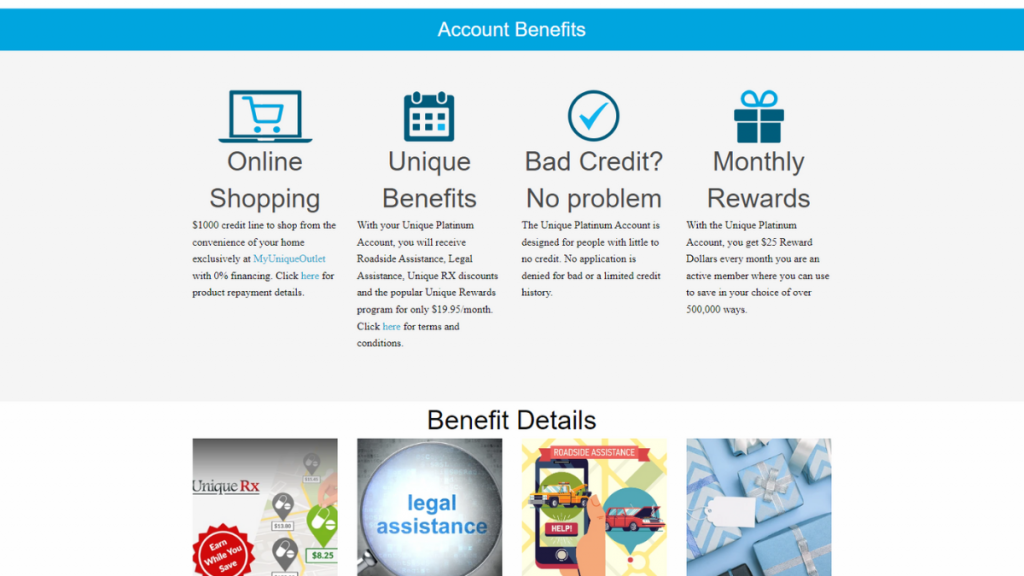

Pros

- High credit limit: With a high spending limit, you can make big purchases without worrying about reaching your credit limit;

- 0% purchase APR: With no interest charges on purchases, as long as you pay off your balance in full each month, you can save a considerable amount of money;

- Credit builder features: It helps you improve your credit score.

Cons

- It charges a monthly fee;

- No welcome bonus: The card doesn’t offer any welcome bonus to new cardholders, which may be a drawback for those looking for immediate benefits;

- No rewards program: While some may see this as a positive feature, others may miss out on the benefits of earning rewards on their purchases.

Advertisement

Credit score required

To be eligible for the Unique Platinum Card, you don’t need good credit. You can qualify for it with a lower credit score.

Unique Platinum Card application: how to do it?

If you’re interested in learning more about the Unique Platinum Card application process, check out our article about how to apply.

Moreover, we’ll provide detailed instructions on completing your application and answering any questions you may have about the process.

Apply for Unique Platinum Card: quick and simple

Elevate your spending power with the Unique Platinum Card – apply today and enjoy exclusive benefits that only a select few can access.

Trending Topics

First Progress Platinum Prestige Mastercard® Secured Credit Card review

Do you have bad credit? If so, read our review to learn all about the First Progress Platinum Prestige Mastercard® Secured Credit Card!

Keep Reading

U.S. Bank Cash+™ Visa Signature® credit card review: is it worth it?

The U.S. Bank Cash+™ Visa Signature® credit card will give you up to 5% cashback and charge you no annual fee. Check the review about it.

Keep Reading

Bank of America Business Advantage Travel Rewards Card review

Get a full Bank of America Business Advantage Travel Rewards Credit Card review. Enjoy 0% intro APR for 9 months and much more!

Keep ReadingYou may also like

High-yield savings vs. money market: find the best account for you

High-yield savings or money market? Find out the pros and cons and which account is best for saving your money. Keep reading!

Keep Reading

10 Types of Credit Cards You Should Know About

Discover 10 types of credit cards and make the perfect choice for your financial well-being. No more confusion, all in one place.

Keep Reading

Application for the Capital One Platinum Secured Credit Card: how does it work?

Learn how to apply for the Capital One Platinum Secured Credit Card and enjoy the benefits of a secured card without any hidden fees!

Keep Reading