Reviews

Merrick Bank Double Your Line® Secured Credit Card review

In this Merrick Bank Double Your Line® Secured Credit Card Review, you'll learn more about this secured card that offers customers a low annual fee and double limit. Keep reading!

Advertisement

Merrick Bank Double Your Line® Secured Credit Card: 2X more credit limit for you!

Are you feeling limited by your debit or prepaid card? Get the lowdown on this Merrick Bank’s Double Your Line® Secured Credit Card review and make an educated decision to embrace this unique product.

Apply for the Merick Bank Double your Line Secured

Ready to apply for the Merrick Bank Double Your Line® Secured Credit Card? Start improving your credit. Check out this post to learn more.

This review covers all angles so you can decide if it fits your lifestyle. After your reading, you’ll be able to make a more informed decision! Read on!

- Credit Score: Bad credit;

- Annual Fee: $36 for the first year, then cardholders will be billed $3 monthly for maintenance;

- Regular APR: Variable 21.20% on purchases and 26.20% on cash advances;

- Welcome bonus: No welcome bonuses;

- Rewards: No rewards.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Merrick Bank Double Your Line® Secured Credit Card: how does it work?

The best part about the Merrick Bank Double Your Line® Secured Credit Card is its namesake feature—the ability to double your credit line from $200 to $400 without making another deposit.

To qualify for this offer, all you have to do is make at least your minimum payment on time each month for the first seven months that your account is open. That’s it! It’s that simple.

Additionally, with the Merrick Bank Double Your Line® Secured Credit Card, you can get fraud coverage if your card is lost or stolen, access your account 24/7, and set up Auto Pay and account alerts to stay on track with payments.

Best of all, because this is a secured credit card, rather than a debit card or prepaid card, it helps build up your credit by reporting your payment information to all three major credit-reporting agencies.

Plus, you can get your FICO® Credit Score each month—all free of charge. Making this product an excellent credit builder card.

Fees and rates

- APR: A variable of 21.20% on purchases and 26.20% on cash Advance;

- Annual Fee: $36 for the first year, then a monthly fee of $3;

- Foreign Transaction Fee: 2%;

- Cash Advance: $10 or 4%, whichever is greater;

- Late Payment: up to $40.

Advertisement

Merrick Bank Double Your Line® Secured Credit Card: should you get one?

Before making a decision, considering the main details of this product is key! Then let’s compare the pros and cons of the Merrick Bank Double Your Line® Secured Credit Card.

Pros

- It helps improve your credit score;

- The security deposit is low;

- Low annual Fee;

- Reports your credit history to three credit bureaus in the country;

- Doubles your credit limit.

Advertisement

Cons

- It charges a foreign transaction fee;

- There are no rewards.

Credit score required

The credit score necessary to apply for the Merrick Bank Double Your Line® Secured Credit Card is bad credit. As a result, this credit card will help you improve your ruined score by reporting payments.

Merrick Bank Double Your Line® Secured Credit Card application: how to do it?

Discover how to apply for the Merrick Bank Double Your Line® Credit Card. Our guide will set you up quickly and easily, so you can enjoy all its helpful features. Read on!

Apply for the Merick Bank Double your Line Secured

Ready to apply for the Merrick Bank Double Your Line® Secured Credit Card? Start improving your credit. Check out this post to learn more.

Trending Topics

Apply for the Blue Cash Preferred® Card from American Express

Learn how to apply for the Blue Cash Preferred® Card from American Express and earn cash back. Keep reading!

Keep Reading

Capital One Savor Rewards Credit Card review: is it worth it?

Looking for a generous cash back card that offers rewards for entertainment? Check out this Capital One Savor Rewards Credit Card review!

Keep Reading

Regional Finance Personal Loans review: how does it work and is it good?

Check out this complete Regional Finance Personal Loans review to decide if this is the loan for your needs. Keep reading!

Keep ReadingYou may also like

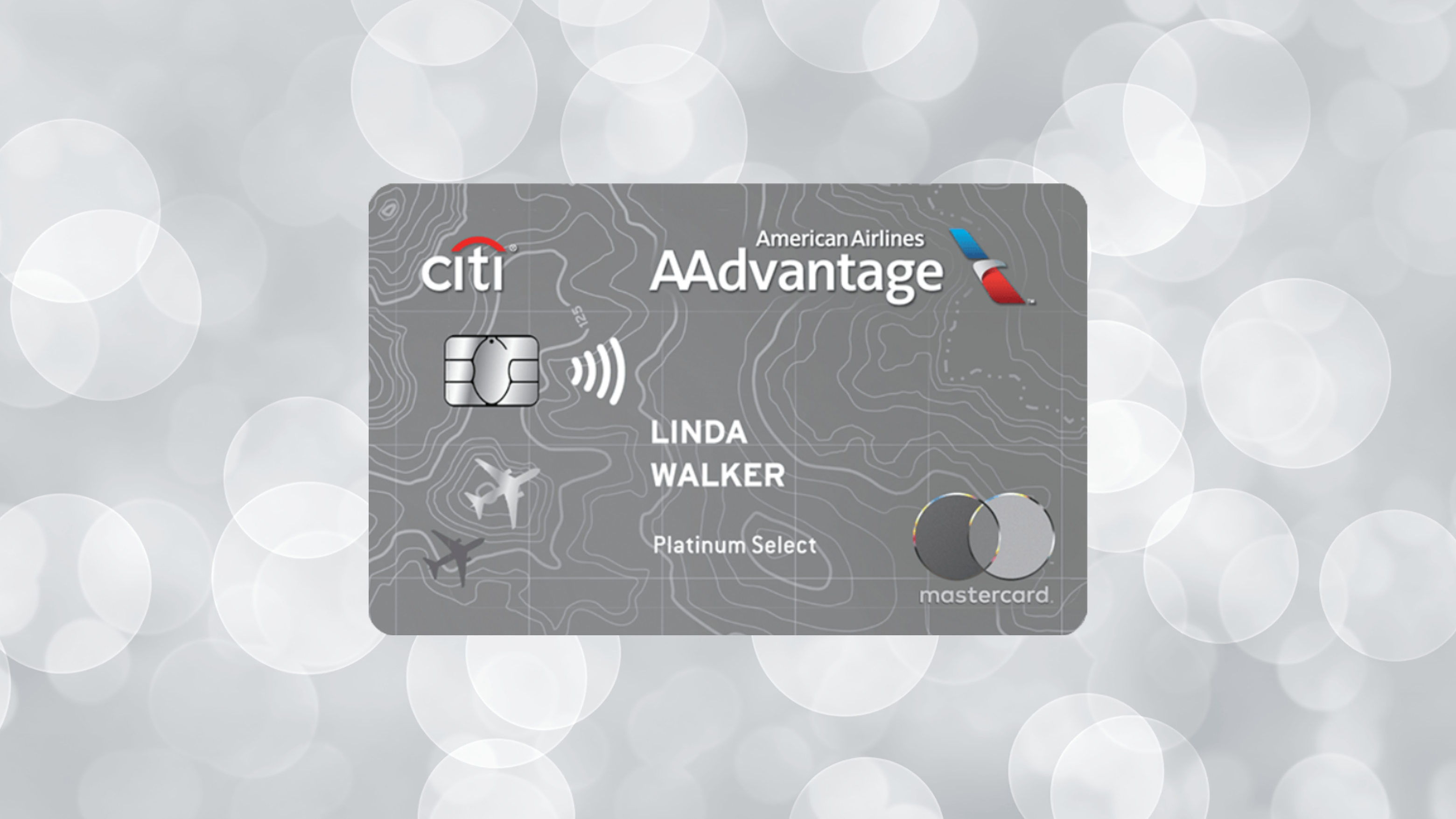

Citi® / AAdvantage® Platinum Select® World Elite Mastercard® application: how does it work?

Are you planning to apply for the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®? Check out this guide for the application!

Keep Reading

Choose the best mortgage for your finances

Need help determining which mortgage is best for you? Check out our guide to help you choose your mortgage. Keep reading!

Keep Reading

Best payment type if you are trying to stick to a budget

If you're looking for the best payment type to stick to a budget, check out the most popular options and their pros and cons.

Keep Reading