Credit Cards

Shop Your Way Mastercard® review: up to 5% cash back

Boost your points on Shop Your Way! Their credit card lets you earn rewards on all eligible purchases, enhancing your overall experience. Read on!

Advertisement

Collect points on gas, restaurants, and groceries!

Are you in search of a credit card that rewards your daily expenses? Your search ends here with the Shop Your Way Mastercard® review.

Apply for the Shop Your Way Mastercard®

Find out how to apply for the Shop Your Way Mastercard® and increase your purchase points. Get the step-by-step here! Stay tuned!

In this brief guide, we’ll provide a clear and concise overview of the card’s essential features and advantages, making it easy to make an informed decision. Read on!

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Purchase APR: 30.49% (variable);

- Cash Advance APR: 29.99% (variable);

- Welcome Bonus: Earn $75 in statement credits for every $500 spent on eligible purchases within the first 90 days with the Shop Your Way Mastercard® (up to $225);

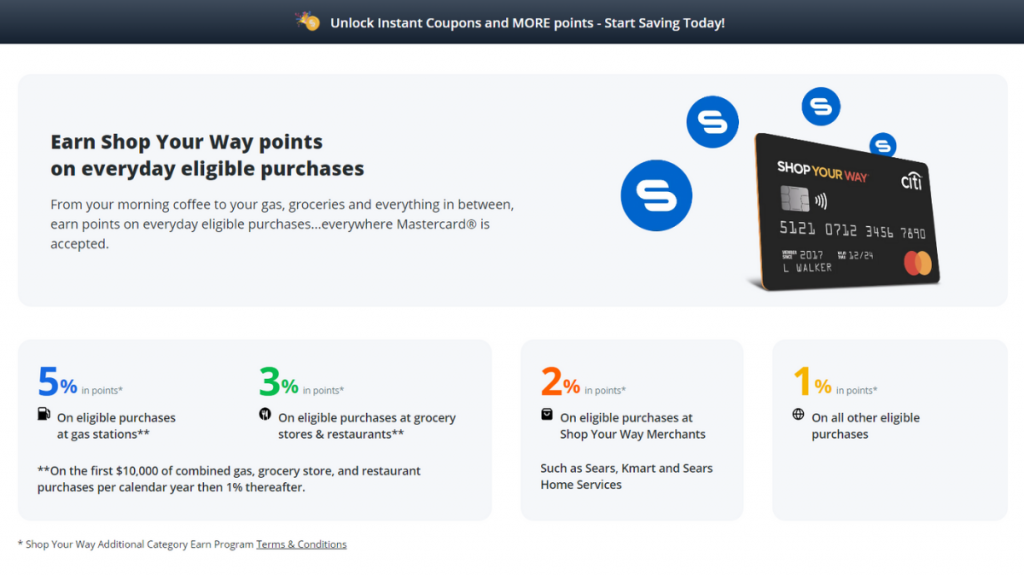

- Rewards: 5% in points on eligible purchases at gas stations, and 3% on eligible grocery stores and restaurants (up to $10,000 combined in the first year, then 1% after that); 2% in points on eligible Shop Your Way Merchants, and 1 point on all other eligible purchases.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Shop Your Way Mastercard®: how does it work?

Shop Your Way is a rewards program that allows you to earn points on your purchases.

The Shop Your Way Mastercard® is an extension of this program, offering even more benefits.

The is an excellent choice if you frequently shop at Sears and Kmart, want to accumulate points for future trips, and enjoy various travel and statement credits.

Welcome Bonus Explained

When you first get the card, you can earn a welcome bonus.

By making eligible purchases in the first 90 days, you can receive up to $225 in statement credits.

So, that’s a fantastic way to kickstart your rewards journey.

Advertisement

Rewards and Redemption

Earning and redeeming points with the Shop Your Way Mastercard® is simple.

You can browse available merchandise and use your points to shop through your Shop Your Way Account.

Also, you’ll enjoy other perks like coupons through the Shop Your Way program and online mobile access to your account.

Standard Benefits

This card comes with a range of standard benefits, such as:

- $0 liability on unauthorized charges;

- Extended warranty protection;

- Price protection;

- Identity theft protection.

Advertisement

Shop Your Way Mastercard®: should you get one?

Furthermore, to help you decide if the Shop Your Way Mastercard® is perfect for your finances, let’s review its pros and cons.

Pros

- No annual fee;

- Lucrative rewards on gas, groceries, and restaurants;

- Attractive welcome bonus;

- Access to Shop Your Way program perks;

- Mastercard acceptance worldwide.

Cons

- High variable APR;

- Limited redemption options.

Credit score required

Indeed, to get this credit card, you’ll need a higher credit score. Thus, good to excellent credit is required.

Shop Your Way Mastercard® application: how to do it?

Do you want to discover the best way to apply for the Shop Your Way Mastercard®? So, keep reading to get full instructions in our post below. So read on!

Apply for the Shop Your Way Mastercard®

Find out how to apply for the Shop Your Way Mastercard® and increase your purchase points. Get the step-by-step here! Stay tuned!

Trending Topics

Bank of America Customized Cash Rewards credit card review: is it worth it?

Is the Bank of America Customized Cash Rewards credit card right for you? See its benefits, such as cashback and $0 annual fee, and find out!

Keep Reading

Federal Pell Grant: see how to apply

Find out if you're eligible to apply for the Federal Pell Grant. Ensure up to $7,395 to cover educational costs!

Keep Reading

Chase Sapphire Reserve® review: Free airport lounge access worldwide

Read our Chase Sapphire Reserve® review. This rich travel card makes your adventures even brighter. Earn points. Check out our full post!

Keep ReadingYou may also like

Porte Mobile Banking application: how does it work?

Don't miss out; explore the incredible benefits of Porte Mobile Banking. See how to apply, step by step, now in our post! No ATM fees.

Keep Reading

Rewards program: what to consider before you choose a credit card

Discover what you should consider in a rewards program and what to look for in one. Read on to learn more!

Keep Reading

Upgrade Cash Rewards Visa® review

The Upgrade Cash Rewards Visa® is perfect for you who need a higher credit limit. Enjoy a card with no annual fee and cash back!

Keep Reading