Credit Cards

Apply for the Shop Your Way Mastercard®: $0 annual fee

Ready to apply for the Shop Your Way Mastercard®? Then read on! Earn up to 5% cash back on all your purchases + exclusive benefits!

Advertisement

Get your Shop Your Way Mastercard® with these quick online steps

Apply for the Shop Your Way Mastercard® in a few minutes. You have two convenient options: online or through the app.

In just a few simple steps, you can be on your way to enjoying the perks of this rewarding credit card. Keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

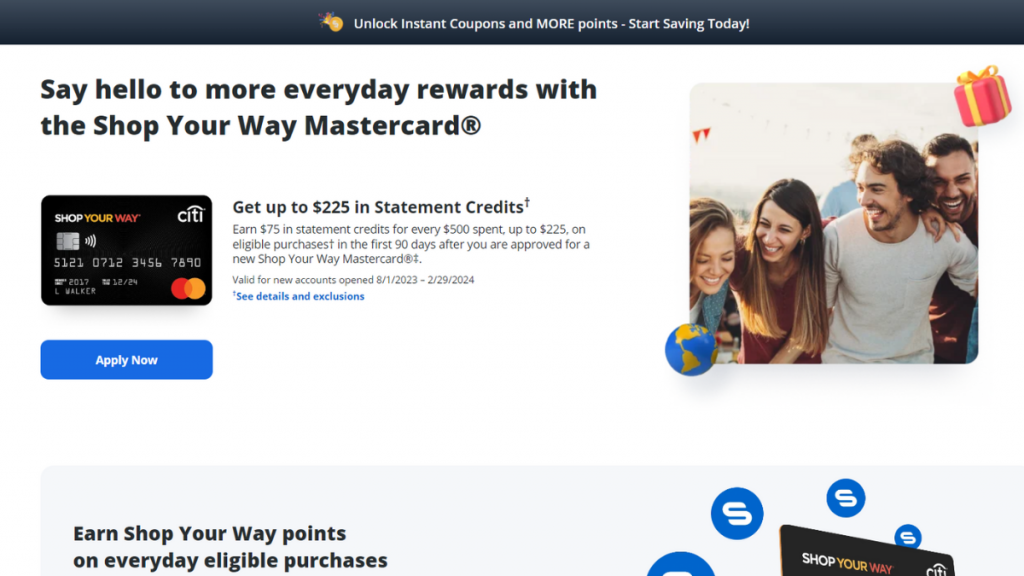

Apply online

If you want to apply for the Shop Your Way Mastercard®, simply start by visiting the Shop Your Way website.

Then locate the “Apply Now” button and proceed to the application tab.

The application form is intuitive, with four easy parts. Fill it out with the required information, such as personal and financial info.

By the end of the last step, make sure to read and agree with the terms. Then after submitting, you’ll receive a prompt response.

Apply using the app

The application for the Shop Your Way Mastercard® can only be accessed through the Shop Way website, not through the app.

Advertisement

Shop Your Way Mastercard® vs. Instacart Mastercard®

Both cards offer rewards for purchases, but there are some key differences.

The Shop Your Way Mastercard® rewards you for shopping at Sears, Kmart, and Lands’ End, while the Instacart Mastercard® rewards you for grocery shopping and dining out.

Also, the Shop Your Way Mastercard® offers a higher rewards rate for gas purchases, while the Instacart Mastercard® offers a higher rewards rate for Instacart purchases.

Finally, it depends on your spending habits and where you shop most frequently. Check them out below!

Shop Your Way Mastercard®

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Purchase APR: 30.49% (variable);

- Cash Advance APR: 29.99% (variable);

- Welcome Bonus: Earn $75 in statement credits for every $500 spent on eligible purchases within the first 90 days with the Shop Your Way Mastercard® (up to $225);

- Rewards: 5% in points on eligible purchases at gas stations, and 3% on eligible grocery stores and restaurants (up to $10,000 combined in the first year, then 1% after that); 2% in points on eligible Shop Your Way Merchants, and 1 point on all other eligible purchases.

Advertisement

Instacart Mastercard®

- Credit Score: Good – Excellent;

- Annual Fee: None;

- Purchase APR: 20.24%–28.99% (variable);

- Cash Advance APR: 29.99% (variable);

- Welcome Bonus: Get a free year of Instacart + (Instacart membership) and $100 free Instacart credit ( upon approval);

- Rewards: 5% cash back on Instantcart.com and the Instantcart app, 5% cash back on travels purchased over the phone with Chase Travel Center, 2% cash back at restaurants, gas stations, and eligible streaming services, plus 1% on everything else.

Learn more about the Instacart Mastercard® and how to apply for it in the post below. Check it out.

Apply for Instacart Mastercard® today

Apply for the Instacart Mastercard® quickly with our guide. Elevate your grocery shopping experience and enjoy exclusive rewards. Read on!

Trending Topics

Cheap flights on Momondo: find flights from $100!

Find Momondo cheap flights, locate the best deal on airline tickets, and save big on your upcoming trip. Find out more!

Keep Reading

What Is a FICO Score? Understand the Basics

Demystifying your credit: What is the FICO Score? Learn how to improve it and take charge of your finances with our guide!

Keep Reading

U.S. Bank Triple Cash Rewards Visa® Business Card review

Read this U.S. Bank Triple Cash Rewards Visa® Business Card review to learn about its bonus categories. Earn a $500 cash back bonus and more!

Keep ReadingYou may also like

Gemini Credit Card® application: how does it work?

The application for the Gemini Credit Card® is simple and quick. Earn up to 3% cash back on purchases and more! Read on!

Keep Reading

First Access Visa® Card review

Should you give this excellent credit card a try? Find out in the First Access Visa® Card review. Keep reading!

Keep Reading

How much does a home inspection cost?

Are you wondering what is the home inspection cost? Don't worry! We'll answer this and other questions for you! Keep reading to learn more!

Keep Reading