US

Sallie Mae Student Loan review: how does it work and is it good?

If you’re looking for a solid student loan option, the Sallie Mae Student Loan should certainly worth checking out.

Advertisement

Sallie Mae Student Loan: services and perks for part-time students and noncitizens alike.

In this Sallie Mae Student Loan review you will learn everything you need to know to make an informed decision about whether they fit your needs. Sallie Mae offers three types of student loans: Undergraduate student loans, Career training student loans and Graduate student loans.

Rates vary according to each loan category. Undergraduate student loans offer variable rates from 1.13% to 11.23%. You may also qualify for fixed rates from 3.5% to 12.6% depending on your creditworthiness. Career training student loans offer variable rates of 6.62% to 13.83% or fixed rates from 4.12% to 11.32%. For graduate students, rates vary according to the loan.

There are no application or origination fees, but late fees are 5%, up to a maximum of $25 dollars . Here are a few other numbers you should know about.

How to apply for the Sallie Mae Student Loan

See how to apply for the Sallie Mae student loan and get approved today!

| APR | Variable starting at 1.37% up to 11.48% |

| Loan Purpose | Student Loan |

| Loan Amounts | Up to cost of attendance |

| Credit Needed | Undisclosed |

| Terms | 5 to 15 years |

| Origination Fee | N/A |

| Late Fee | 5% ($25 max) |

| Early Payoff Penalty | N/A |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

What is the Sallie Mae Student Loan?

Sallie Mae is a U.S. corporation that provides private student loans to pay for a number of educational needs. Sallie Mae started in 1972 when congress passed it as a government-sponsored entity. In 2004 the lender became a private institution and continues to service student loans to this day.

But it is also a consumer bank, and therefore offers other products such as savings, cash-back-earning credit cards which help pay off student debt, among other tools to help individuals and families plan and pay for college.

Is the Sallie Mae Student Loan good?

Now that you have been introduced to Sallie Mae, it is time to check out its pros and cons.

Advertisement

Pros

- Accepts part-time students and noncitizens

- Offers perks like online tutoring and credit score tracking

- Fast cosigner release

Cons

- Requires a cosigner from most applicants

- Requires a hard credit check

- Little repayment term flexibility

Advertisement

Does Sallie Mae Student Loan check credit scores?

To get a Sallie Mae Student Loan you must be prepared to go through a hard credit inquiry. They do not specify minimum score requirements. Make sure you shop around for lenders who offer a soft credit check. If and when you decide to go for Sallie Mae, make sure your cosigner also has a good credit score.

Want to get a Sallie Mae Student Loan? We will help you!

After reading through this Sallie Mae Student Loan review, you may be ready to pull the trigger and start the application process. This is very easy to do. Everything is done online, and it takes only a few minutes. If you would like a more thorough guide on how to get your Sallie Mae Student Loan, just hit the link below and we’ll take you there.

How to apply for the Sallie Mae Student Loan

See how to apply for the Sallie Mae student loan and get approved today!

Trending Topics

Personal loan interest rate: what is it?

Wondering what is a personal loan interest rate? Get all the information you need here, including average rates and how to get the best deal.

Keep Reading

Learn to apply easily for the Happy Money Personal Loan

Do you want to apply for the Happy Money Personal Loan? This post will teach you how. Read on to learn more!

Keep Reading

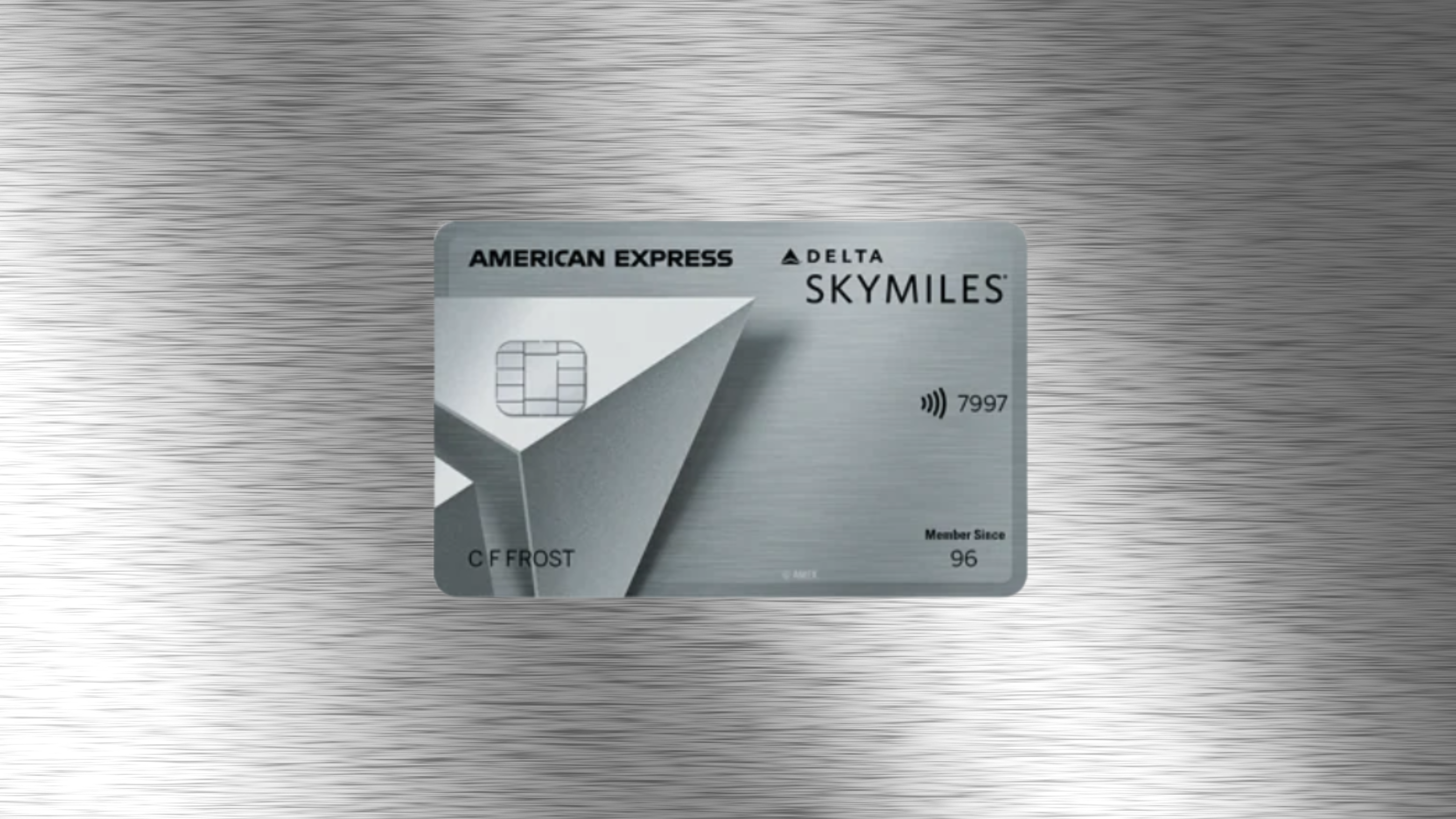

Delta SkyMiles® Platinum American Express Card review

See the Delta SkyMiles® Platinum American Express Card review to take advantage of premium travel benefits. Keep reading!

Keep ReadingYou may also like

Cheap JetBlue Airways flights: Incredible offers every day!

Learm how to find JetBlue Airways cheap flights on their website. It's easy! Just follow these simple steps.

Keep Reading

How to budget for an apartment

Discover how to make your money stretch! Find out how to budget for an apartment to secure that perfect place easily!

Keep Reading

Prosper Personal Loan review: how does it work and is it good?

Are you looking for a Prosper Personal Loan review? Keep reading to find out the pros and cons of this lender. Read on!

Keep Reading