Reviews

Revvi Card application: how does it work?

You don't need an excellent credit score to earn cash back on your purchases. Learn more about the Revvi Card application process and make your money worth more!

Advertisement

Revvi Card: Apply now to get 1% cashback

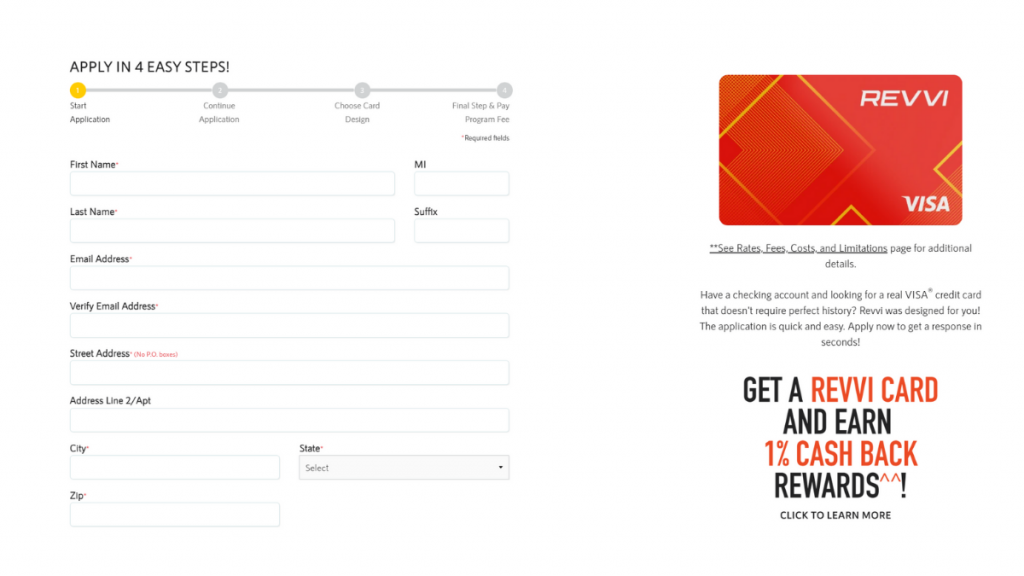

The Revvi Card application is quick and easy. However, before you apply, consider the following requirements.

- The application is secure and online, so make sure you have access to a computer with the internet;

- You must be 18 years old to apply, then review the policy for each state on their website;

- No credit checks are required; however, it targets those with bad or fair credit;

- They require a one-time program fee $95 that should be paid before opening your account. So make sure you have that amount;

- You must have a checking account to apply.

After that, go to their website and fill out the form. You’ll get a response in seconds!

Apply online

The application is online. Here’s the step-by-step to help you go as fast as 3 min.

So you will be prompted to fill out their application form. Then be ready to provide some personal and basic financial information.

Make sure to read the contracts and terms after you’ve finished. Then you may submit it.

Finally, remember to pay the $95 one-time program fee to start using it.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

It is not possible to use their app to request your Revvi Credit Card. Instead, use it to check balances and make transactions quickly.

Revvi Card vs. Total Visa® Card

If the Revvi Card doesn’t meet your needs, the Total Visa® is a similar alternative.

Both are above-average maintenance that lets you restore or establish credit with high chances of approval. Before you make your decision, compare them to see how they stack up.

Revvi Card

- Credit Score: Fair.

- Annual Fee: $75.00 1st year, $48.00 after.

- Regular APR: 35.99% on purchases.

- Fees: One-time program fee of $95. $8.25 monthly fee after 1st year. Late and return payment fees up to $41.

- Welcome bonus: N/A.

- Rewards: Earn 1% cash back rewards^^ on payments made to your Revvi Card.

- *See rates, fees, costs & limitations, and rewards for complete offer and Revvi Rewards details^^.

Total Visa® Card

- Credit Score: Fair/Bad Credit.

- Annual Fee: $75.00 1st year, $48.00 after.

- Regular APR: 35.99% on purchases and cash advances.

- Welcome bonus: N/A.

- Rewards: 1% cash back on card payments.

And if you are interested in knowing how to apply for the Total Visa® Card, check out our post below to find out!

How to apply to Total Visa

Learn how to apply for the Total Visa® credit card and get your credit history restored. It is a good solution if you want to rebuild your credit!

Trending Topics

Apply for the Navy Federal GO REWARDS®: earn up to 3 points

Apply for Navy Federal GO REWARDS® today - quick process and amazing rewards! Earn 15K bonus points within 90 days and more!

Keep Reading

8 smart ways to dig yourself out of debt

If you're looking for a way to get out of debt, read this content. We have the map to lead you out of this situation. But it depends on you.

Keep Reading

First Citizens Bank Secured Cash Back Credit Card application: how does it work?

Apply for the First Citizens Bank Secured Cash Back Credit Card. We'll show you how easy it is! Earn cash back on purchases!

Keep ReadingYou may also like

BOOST Platinum Card Review: Is it worth it?

Shop with the BOOST Platinum Card and enjoy $750 merchandise credit. No credit checks, perfect for low scores. Financial flexibility awaits!

Keep Reading

Federal Pell Grant: see how to apply

Find out if you're eligible to apply for the Federal Pell Grant. Ensure up to $7,395 to cover educational costs!

Keep Reading

Surge® Platinum Mastercard® credit card review: credit limit even for the lowest scores

Read the Surge® Platinum Mastercard® credit card review. This card comes with zero fraud liability and a credit limit increase after 6 months!

Keep Reading