Reviews

Revvi Card application: how does it work?

You don't need an excellent credit score to earn cash back on your purchases. Learn more about the Revvi Card application process and make your money worth more!

Advertisement

Revvi Card: Apply now to get 1% cashback

The Revvi Card application is quick and easy. However, before you apply, consider the following requirements.

- The application is secure and online, so make sure you have access to a computer with the internet;

- You must be 18 years old to apply, then review the policy for each state on their website;

- No credit checks are required; however, it targets those with bad or fair credit;

- They require a one-time program fee $95 that should be paid before opening your account. So make sure you have that amount;

- You must have a checking account to apply.

After that, go to their website and fill out the form. You’ll get a response in seconds!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

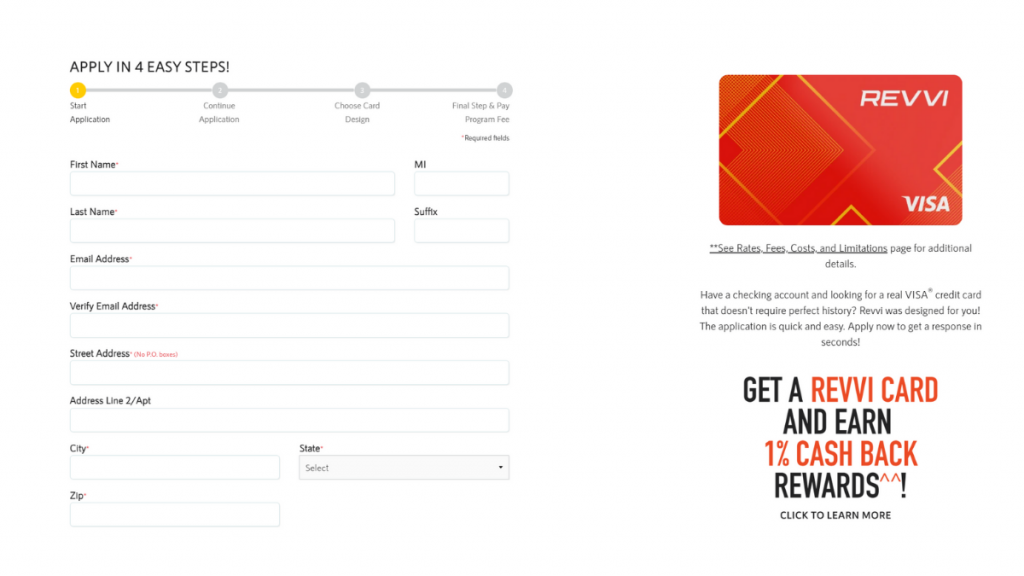

The application is online. Here’s the step-by-step to help you go as fast as 3 min.

So you will be prompted to fill out their application form. Then be ready to provide some personal and basic financial information.

Make sure to read the contracts and terms after you’ve finished. Then you may submit it.

Finally, remember to pay the $95 one-time program fee to start using it.

Apply using the app

It is not possible to use their app to request your Revvi Credit Card. Instead, use it to check balances and make transactions quickly.

Advertisement

Revvi Card vs. Total Visa® Card

If the Revvi Card doesn’t meet your needs, the Total Visa® is a similar alternative.

Both are above-average maintenance that lets you restore or establish credit with high chances of approval. Before you make your decision, compare them to see how they stack up.

Revvi Card

- Credit Score: Fair.

- Annual Fee: $75.00 1st year, $48.00 after.

- Regular APR: 35.99% on purchases.

- Fees: One-time program fee of $95. $8.25 monthly fee after 1st year. Late and return payment fees up to $41.

- Welcome bonus: N/A.

- Rewards: Earn 1% cash back rewards^^ on payments made to your Revvi Card.

- *See rates, fees, costs & limitations, and rewards for complete offer and Revvi Rewards details^^.

Advertisement

Total Visa® Card

- Credit Score: Fair/Bad Credit.

- Annual Fee: $75.00 1st year, $48.00 after.

- Regular APR: 35.99% on purchases and cash advances.

- Welcome bonus: N/A.

- Rewards: 1% cash back on card payments.

And if you are interested in knowing how to apply for the Total Visa® Card, check out our post below to find out!

How to apply to Total Visa

Learn how to apply for the Total Visa® credit card and get your credit history restored. It is a good solution if you want to rebuild your credit!

Trending Topics

Where Zero Means More: Navy Federal Platinum Card Review

Discover how to take advantage of an intro APR for transfers in this Navy Federal Platinum Credit Card review. Learn more!

Keep Reading

Cash Back for Heavy Spenders: PNC Cash Rewards® Visa® Credit Card review

Our PNC Cash Rewards® Visa® Credit Card review gives you the information you need to decide. Earn a $200 bonus and much more!

Keep Reading

How to request US Bank Altitude® Go Visa Signature® Card

See how to apply for the US Bank Altitude® Go Visa Signature® credit card today and enjoy cash back, lower rates, rewards, and more!

Keep ReadingYou may also like

Surge® Platinum Mastercard® credit card review: credit limit even for the lowest scores

Read the Surge® Platinum Mastercard® credit card review. This card comes with zero fraud liability and the ability to repair your credit score

Keep Reading

Metaverse investors are losing money to phishing scams

Find out how a new generation of cybercriminals is using the metaverse as a place to steal from unsuspecting investors. Read on for more!

Keep Reading

LightStream Personal Loan review: how does it work and is it good?

Read our LightStream Personal Loan review and find out if this lender is the best choice for you. Enjoy competitive rates and fast funding!

Keep Reading