Reviews

Wells Fargo Autograph℠ Card application: how does it work?

Find out what is necessary to apply for the Wells Fargo Autograph℠ Card, and start enjoying cash back on your purchases as soon as possible. Keep reading and learn more!

Advertisement

Wells Fargo Autograph℠ Card: Simple to apply for, and you can get a decision in minutes

Have you been dreaming of the amazing Wells Fargo Autograph℠ Card? Here’s your chance to discover how to apply for one.

We’ll help you through the application process step by step, providing all the details and information needed to maximize your chances of approval. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The process includes just a few simple steps that are straightforward to follow. It can all be done online and generally takes no more than 10 minutes.

First, prospective customers will be asked to provide some personal information such as their names, date of birth, citizenship, and Social security number.

Then some contact information: cell phone, number, email address, ad home address. Finally, employment status, annual income, and housing status.

Once completed, applicants will receive an instant decision on their card application status.

With its quick turnaround time and customizable features, Wells Fargo Autograph℠ Card is a great choice for those looking for reliable credit products.

Application Requirements

The minimum age requirement for applying for a Wells Fargo Autograph℠ Card is 18 years old. You must also be a U.S. citizen or permanent resident and have a valid Social Security number.

Additionally, you must not have opened any accounts with Wells Fargo in the past six months.

Advertisement

Apply using the app

With Wells Fargo’s app, you can keep an eye on your spending and control all the activity related to your card.

But if you’re interested in getting a credit or debit card from them, unfortunately, that won’t be possible through their mobile application – so use their website.

Wells Fargo Autograph℠ Card vs. HSBC Cash Rewards Mastercard® Card

If you want to take advantage of a good welcome bonus, the HSBC Cash Rewards Mastercard® Card also has a limited offer that will make your eyes pop.

With this card, you’ll earn an additional 12,5% cash back on all your purchases during the first 180 days of account after spending $1,000.

Competitively, the Wells Fargo Autograph℠ Card also comes with a juicy welcome bonus: 30K bonus points ($300) cash back after spending $1,500 in purchases during the first three months of account.

Check out other features of both cards:

Advertisement

Wells Fargo Autograph℠ Card

- Credit Score: 690-850 ( good to excellent);

- Annual Fee: $0 annual fee.

- Regular APR: 0% intro APR for the first 12 months, then 18.74%, 23.74%, or 28.74% variable;

- Welcome bonus: Earn 30K bonus points (equals $300 cash redemption value) after spending $1,500 in purchases during the first three months of account ( limited time offer);

- Rewards: Unlimited 3 points for purchases on restaurants, travel, gas, transit, popular streaming, and phone plans; 1 point on all other purchases.

HSBC Cash Rewards Mastercard® Card

- Credit Score: 760 – 900;

- Annual Fee: $0 annual fee;

- Regular APR: 20.99%;

- Welcome bonus: Earn additional 12,5% cash back on all your purchases during the first 180 days of account after spending $1,000 (conditions apply);

- Rewards: Earn 1,5% cash back on all eligible online purchases; 1% cash back for eligible gas, grocery, and drugstore purchases; and 0.5% cash back for all other purchases.

Find out how to apply for the HSBC Cash Rewards Mastercard® Card in our guide post below. Read on!

How do you get the HSBC Cash Rewards Mastercard®?

We love a good cashback. Even better if it comes with no annual fees. That's the case with the HSBC Cash Rewards Mastercard® card, so take a look on how to apply for it.

Trending Topics

ZippyLoan review: how does it work and is it good?

Looking for a loan? In our ZippyLoan review, you'll see one of the top online lenders' platforms. Borrow up to $15K for several purposes!

Keep Reading

Learn to apply easily for the Flagstar Bank Mortgage

Learn how to apply for a Flagstar Bank Mortgage. Enjoy several loan options and affordable pricing! Keep reading to learn more!

Keep Reading

15K bonus points: My GM Rewards® Mastercard® review

Earn points to reduce expenses with the My GM Rewards® Mastercard® - Full review here! Ensure 0% intro APR period - keep reading!

Keep ReadingYou may also like

Apply for the Hilton Honors American Express Card in a Flash

Here is the quickest way to apply for the Hilton Honors American Express Card - earn up to 7 points on purchases with $0 annual fee! Read on!

Keep Reading

Marcus by Goldman Sachs Personal Loans application: how does it work?

The Marcus by Goldman Sachs Personal Loans application process is simple and you can find your loan options in under five minutes!

Keep Reading

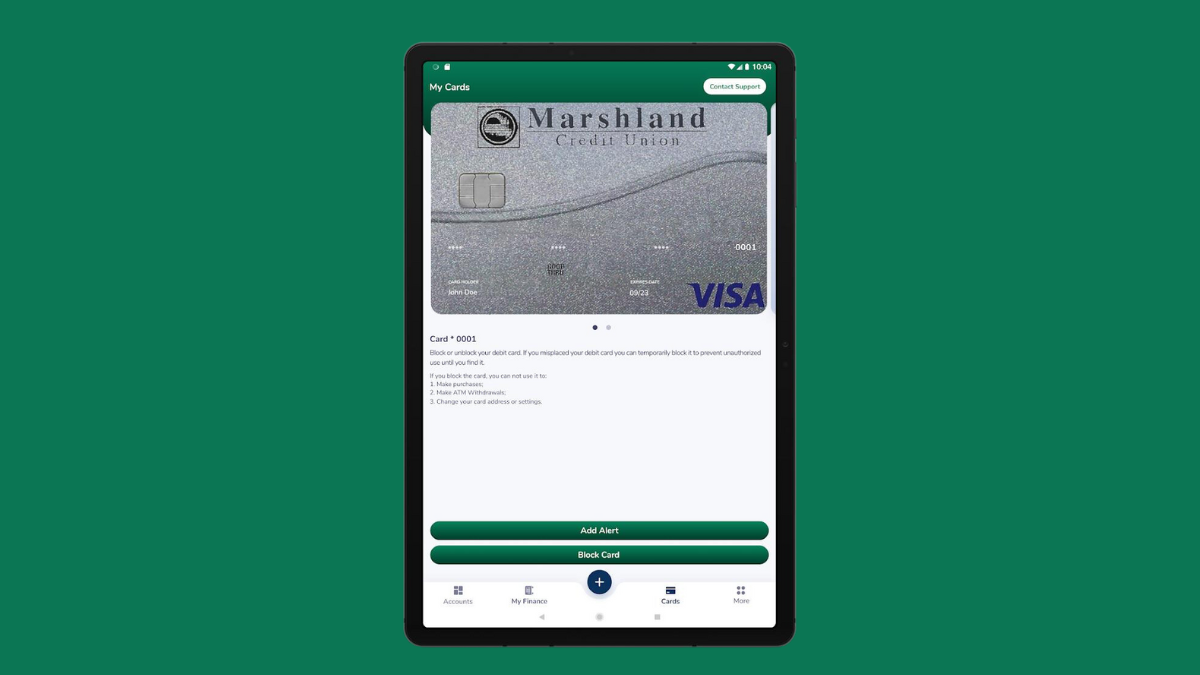

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Keep Reading