Are you ready to build credit easily? What about getting a card with 0% APR?

Tomo Credit Card, make the most of your purchases with no interest rate

Advertisement

Are you looking for a credit card with a great rewards program, no interest rates, and an easy application process? Look no further than Tomo Credit Card. This card offers the best value to those who want to simplify their financieal lives. With Tomo Credit Card, you can enjoy generous discounts and benefits on popular services like Doordash, ShopRunner, HelloFresh, and Lyft.

Are you looking for a credit card with a great rewards program, no interest rates, and an easy application process? Look no further than Tomo Credit Card. This card offers the best value to those who want to simplify their financieal lives. With Tomo Credit Card, you can enjoy generous discounts and benefits on popular services like Doordash, ShopRunner, HelloFresh, and Lyft.

You will remain in the same website

Before you miss out on all the rewards and benefits that come with Tomo Credit Card, take a moment to explore the benefits in more detail. You can save money while enjoying exclusive discounts and benefits on your purchases. Check out these benefits:

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Experience financial freedom like never before with the Tomo Credit Card. Say goodbye to interest rates and hello to a world of perks.

Enjoy amazing discounts on select brands and build your credit score effortlessly. With Tomo, you'll have a smarter, more rewarding way to manage your finances while enjoying the flexibility you deserve.

Join the Tomo family today and start reaping the benefits of a credit card designed with you in mind. Your financial journey just got a whole lot brighter with Tomo.

Strengths and Special Offerings

- No credit score needed: Get the Tomo Credit Card even if you don't have a credit score at all - find the financial freedom you need;

- Build credit easily: Get your transactions reported to all 3 major credit bureaus and build credit like a pro;

- World Elite Mastercard: Secure amazing benefits as a Mastercard cardholder - plus worldwide acceptance;

- Amazing discounts: Secure discounts at amazing brands, including Netflix, Hulu, Spotify and more.

- No interest rate: Enjoy the convenience of a 0% APR credit card.

Limitations to Consider

- No effective reward program: The Tomo Credit Card offers no reward program such as cash back, points, or miles;

- Fees: You'll have to pay a monthly fee with the Tomo Credit Card. But don't worry, its lower-than-average.

In brief, the Tomo Credit Card is designed to help you achieve your full financial potential! You're not just getting a credit card; you're gaining a trusted financial partner that empowers you to make the most of your money.

Elevate your financial journey with Tomo - where convenience, rewards, and financial freedom come together seamlessly.

The Tomo Credit Card is a credit card designed to be accessible to people with all types of credit, including those with no credit history or poor credit. The Tomo Credit Card offers discounts and benefits on popular services such as Doordash, ShopRunner, HelloFresh, and Lyft. The card has a 0% purchase APR and does not disclose its cash advance APR. Cardholders can apply online or using the Tomo Credit Card app.

The Tomo Credit Card does not offer a welcome bonus. However, the card does offer discounts and benefits on popular services such as Doordash, ShopRunner, HelloFresh, and Lyft. These discounts and benefits can vary and are subject to change. It's recommended to check the card's website or contact customer support to get the most up-to-date information on current discounts and benefits.

Yes, the Tomo Credit Card is designed to be accessible to people without credit history. The card is an excellent option for individuals who are new to credit and looking to establish a credit history. However, it's important to note that having no credit history may impact the approval decision, and the application will still be evaluated based on other factors, such as income and debt-to-income ratio.

No credit score needed: Apply forTomo Credit Card

Apply for the Tomo Credit Card today and take advantage of its 0% APR and various discounts and benefits on popular services.

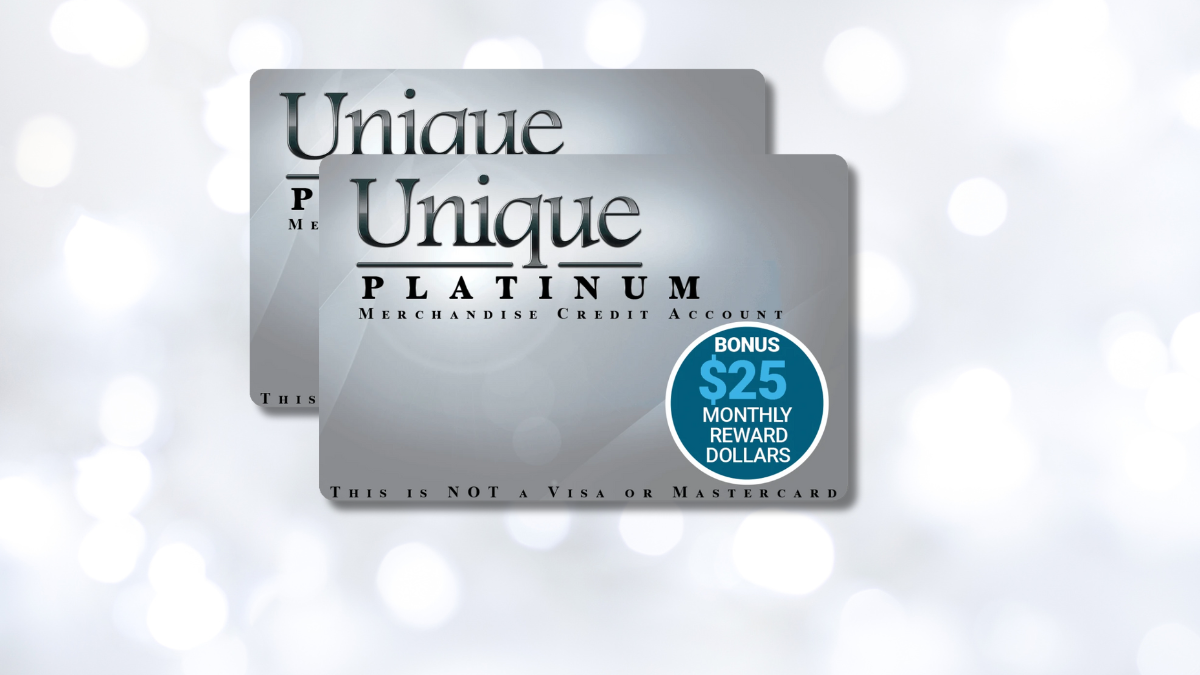

Looking for another credit card option? Check out our recommended alternative, the Unique Platinum Card.

This card is an amazing tool to help you build credit! With 0% APR, you can count on a convenient banking experience. Keep reading and learn more about it!

Apply for Unique Platinum Card: quick and simple

Elevate your spending power with the Unique Platinum Card - apply today and enjoy exclusive benefits that only a select few can access.

Trending Topics

Sam´s Club Credit Plus Member Mastercard credit card review: is it worth it?

Find out if the Sam’s Club Credit Plus Member Mastercard credit card, which offers cash back on gas and dining, is a good option for you.

Keep Reading

Checklist for moving out of state: your definitive guide

Are you packing up and relocating to another state? Check off all the to-dos with this moving out of state checklist.

Keep Reading

10 tips for first-time home buyers

Ready to become a homeowner? Here are some essential tips for first-time home buyers to get you started. Read on!

Keep ReadingYou may also like

How do travel credit cards work?

How do travel credit cards work? Find the answer here, and learn how to take advantage of them in your next adventure. Read on!

Keep Reading

BMO Ascend World Elite®* Mastercard®* Review

Maximize travel with BMO Ascend World Elite®* Mastercard®*: top rewards, extensive insurance, luxury perks. Elevate your journeys!"

Keep Reading

Luxury Gold credit card review: is it worth it?

The Luxury Gold credit card has premium benefits and is an excellent card to take on every trip. Learn more about this golden card here.

Keep Reading