You can pre-qualify for a LendingPoint Loan without hurting your credit score

LendingPoint Personal Loan: Quick funds for any needs!

Advertisement

LendingPoint Personal Loan offers loans in the range of $2,000 to $36,500. You can use them for any purpose with no restrictions on what you want to borrow. They come with competitive rates, and the funds will be deposited quickly upon approval. You won’t pay any fees for any early payoff, and you have the option to refinance.

LendingPoint Personal Loan offers loans in the range of $2,000 to $36,500. You can use them for any purpose with no restrictions on what you want to borrow. They come with competitive rates, and the funds will be deposited quickly upon approval. You won’t pay any fees for any early payoff, and you have the option to refinance.

You will remain in the same website

LendingPoint Personal Loan has great benefits to help you with those unexpected expenses. Check them out!

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Dive into the financial realm with LendingPoint Personal Loan - a beacon for those seeking a balance between ambition and fiscal responsibility.

Whether it's consolidating debts or financing a major purchase, LendingPoint might be the key to unlocking your monetary goals.

But as with any treasure, there are facets that shine bright and some that may appear dull. Let's unveil them.

Strengths and Special Offerings

- Flexible Credit Requirements: LendingPoint considers applicants with a broader range of credit scores, welcoming those who might be overlooked by traditional lenders.

- Swift Decision Process: In our fast-paced world, waiting is passé. Receive a loan decision within seconds and potentially get funded as early as the next business day.

- Personalized Payment Plans: Tailor your loan terms to suit your comfort zone. Choose from flexible loan durations and monthly payment options.

- No Prepayment Penalty: If you're keen on settling your debt ahead of schedule, LendingPoint won't hold you back with prepayment fees.

- Transparent Fees: With a clear fee structure, you won’t be left scratching your head over hidden charges.

Limitations to Consider

- Interest Rate Variability: Rates can be on the higher end for those with less-than-perfect credit, which might lead to heftier long-term costs.

- Origination Fee: A one-time fee is deducted from your loan amount, which might pinch if you're already on a tight budget.

- Limited Loan Amounts: The maximum loan cap may not cater to those seeking significantly larger funds.

- Not Nationwide: LendingPoint's services aren't available in all states. Check availability before making plans.

LendingPoint Personal Loan emerges as a valuable ally for many, especially those with average credit scores.

Its flexibility and transparency are commendable. However, every individual's financial landscape is unique, so weighing the potential costs against its advantages is essential.

For the right borrower, this might just be the financial boost they've been seeking.

No, unfortunately, LendingPoint Personal Loan doesn't cover all 50 states. However, it is available in 48 of them, except for W.Virginia and Nevada.

LendingPoint Personal Loan is perfect for mid-size expenses. You borrow amounts from $2,000 to $36,500. However, how much you'll get will depend on some information, such as your credit score. The maximum amount available is going to be the best for your circumstances.

You can borrow a LendingPoint Personal Loan for any purpose of your choice. You can have the peace of mind to use this loan for debt consolidation, an unexpected expense, to cover any vacation costs or even home repair.

Yes, it is safe. LendingPoint is committed to protecting your personal information. They use industry-leading procedures and safeguards, including encryption, so you can have peace of mind regarding privacy on their site or any other service they provide.

LendingPoint Personal Loan has a fast system approval. Typically, they take only one day to review documents. Then funds can be deposited into your account as soon as the next business day if the loan is approved.

How to apply for LendingPoint Personal Loan

Discover how easy it is to apply for LendingPoint Personal Loan and get the money you need in less than 24 hours. Read on!

Isn't LendingPoint the loan you're looking for? Then you'd better have a look at Best Egg Personal Loans. They have higher amounts, up to $50,000.

Egg Personal Loans are perfect for debt consolidation since they offer the option to pay directly from your credit card.

They're also good if you have more than a 640 score and want home improvement, wedding expenses, or other reasons - you can find an online lender who can help without hassles!

Read our post below to learn how to apply.

How to apply for Best Egg Personal Loans

We'll show you how easy it is to apply for Best Egg Personal Loans. Plus, learn about the benefits of borrowing with them. Check it out!

Trending Topics

Temporary Assistance for Needy Families (TANF): a guide for the program

This guide provides an overview of Temporary Assistance for Needy Families (TANF), including who is eligible and how to apply. Read on!

Keep Reading

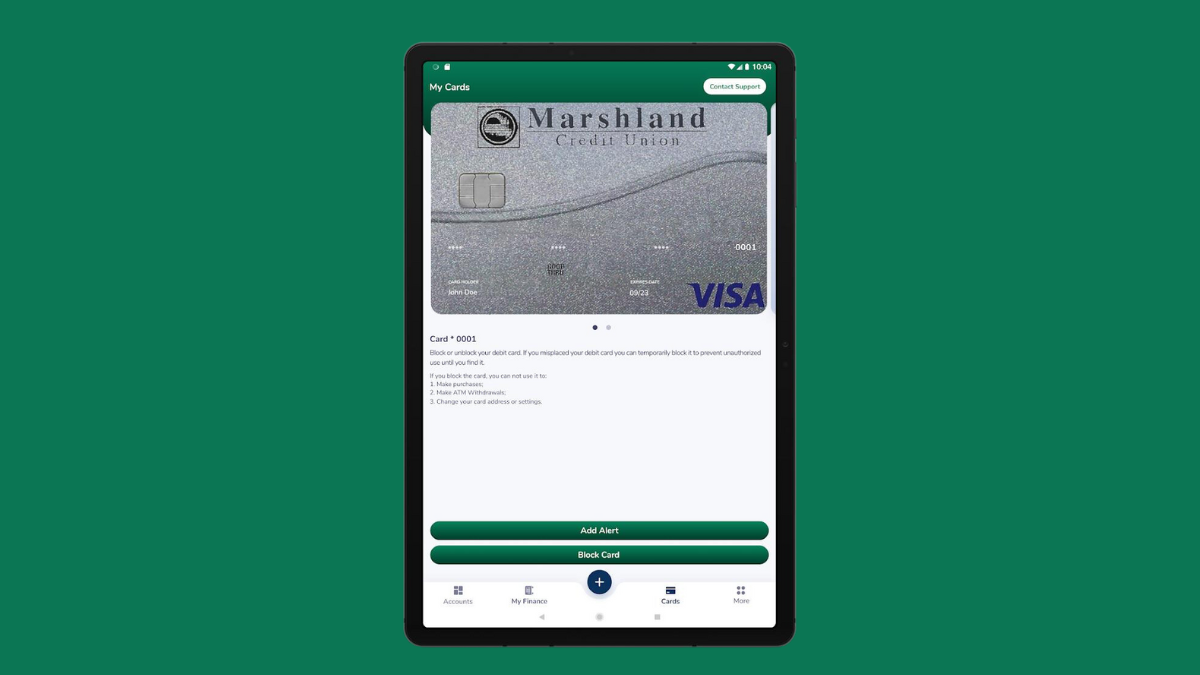

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Keep Reading

Application for the Assent Platinum Secured credit card: how does it work?

Learn how to apply for Assent Platinum Secured, a card with no credit history required and that helps you build your credit score!

Keep ReadingYou may also like

PenFed Mortgage review: how does it work and is it good?

Looking for a mortgage? Check out the PenFed Mortgage review! Enjoy competitive rates and lender credit! Keep reading to learn more!

Keep Reading

SoFi Mortgage review: how does it work and is it good?

A detailed SoFi mortgage review and how it works so you can decide whether you should use them to get a loan.

Keep Reading

Upgrade Cash Rewards Visa® review

The Upgrade Cash Rewards Visa® is perfect for you who need a higher credit limit. Enjoy a card with no annual fee and cash back!

Keep Reading