Reviews

Learn to apply easily for the Best Egg Personal Loans

A personal loan can help you cover various expenses, from debt consolidation to home improvement. Here's how to apply for Best Egg Personal Loans and quickly get the money you need. Keep reading!

Advertisement

Best Egg Personal Loans application: Easy online process to get the loan you need!

Are you considering to apply for Best Egg Personal Loans but aren’t sure where to start? We can help you!

This post will teach you how to apply easily and quickly to get the money you need. So what are you waiting for? Read on to learn more!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Online application

Best Egg personal loans are a great way to get the money you need for whatever you may need. The process is simple and easy to follow.

First, you’ll need to calculate your estimated monthly payment. You can do that on their website based on how much you’d like to borrow and the terms you’ll apply for.

Then, you’ll apply to see what rate you qualify for. Once you review and accept your loan offer, all that’s left is to verify your application information and receive your funds.

Requirements

Getting a loan with Best Egg Personal Loans requires some things from applicants:

- Prospective borrowers must watch their scores and apply if they have at least a 640 or higher;

- Also, make sure to have proof of income;

- It’s unavailable for applicants from Iowa, Vermont, West Virginia, the District of Columbia, and U.S. Territories.

Advertisement

Apply using the app

Best Egg offers an app to their credit card customers. However, it’s not available to track and manage your loan.

Best Egg Personal Loans vs. Red Arrow Loans: which one is the best?

Best Egg Personal Loans is a good option for people looking forward to getting cash for bigger expenses, such as a home project improvement or unexpected health costs.

Borrowers can repay the loans in up to 60 months, which is good for people looking for more flexibility.

On the other hand, Red Arrow Loans are payday loans. It means they are short-term loans with higher interest rates but fewer requirements.

Compare the Best Egg Personal Loans and the Red Arrow Loans below.

Advertisement

Best Egg Personal Loans

- APR: Variable APR from 7.99% to 35.99%;

- Loan Purpose: Debt consolidation and credit card refinancing, home improvements, taxes, moving expenses, medical bills, auto repair, travel and events, baby, and adoption;

- Loan Amounts: $2,000–$50,000;

- Credit Needed: At least 640;

- Origination Fee: Between 0.99% and 5.99% of the loan amount;

- Late Fee: $15;

- Early Payoff Penalty: Best Egg Personal Loan doesn’t charge any early payoff penalty.

Red Arrow Loans

- APR: The APR depends on the lender’s terms they may vary according to credit history, income, and other factors);

- Loan Purpose: Auto accident, emergency medical bills, unexpected expenses;

- Loan Amounts: $100 to $5,000 (depending on the state);

- Credit Needed: Bad to excellent;

- Origination Fee: It varies from lender to lender; it depends on the terms;

- Late Fee: Varies from lender to lender; it depends on the terms;

- Early Payoff Penalty: Varies from lender to lender; it depends on the terms.

Do you want to learn how to apply for Red Arrow Loans? Check out the post below!

How to apply for Red Arrow Loans

With Red Arrow Loans, you can apply quickly and easily and get the money deposited into your account right away. Read on to learn how!

Trending Topics

Hawaiian Airlines: Follow this guide to track the best prices!

Find out the best ways to buy cheap Hawaiian Airlines flights in this review. Keep reading for more information!

Keep Reading

What is APR in credit cards: understand how it works

Learn what is APR in credit cards and why is essential to avoid extra fees and save some money. Keep reading to know more!

Keep Reading

Learn to apply easily for the PNC Bank Mortgage

Are you looking to apply for a PNC Bank Mortgage? Check out our easy online application process – find out how to get started here.

Keep ReadingYou may also like

Apply for SoFi Student Loans: up to 100% financing

Students seeking financial assistance for education can apply online for SoFi Student Loans. Find affordable loan options for you!

Keep Reading

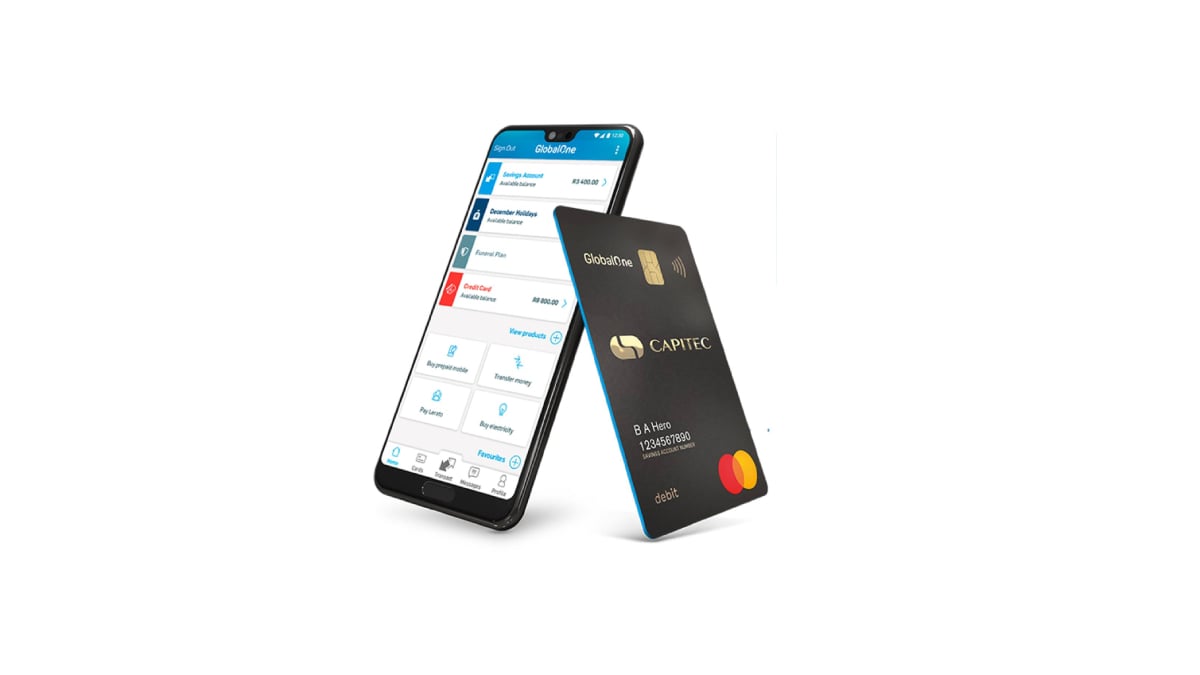

Learn how to download the Capitec Bank App

Find out how to quickly and easily make the Capitec Bank App download. Read on to learn how to enjoy banking online with this app!

Keep Reading

Porte Mobile Banking application: how does it work?

Don't miss out; explore the incredible benefits of Porte Mobile Banking. See how to apply, step by step, now in our post! No ATM fees.

Keep Reading