Unlock exclusive rewards, discounts, and more with this leading-edge credit card!

Chase Sapphire Reserve®: Your passport to an upgraded travel experience!

Advertisement

Do you have a restlessness constantly pulling you to explore and discover the world? Chase Sapphire Reserve® card could be ready for all your adventures! It comes loaded with rewards – 5x total points on flights, 10x total points on car rentals, and hotels worldwide after spending $300/year. Not only is dining rewarded but also, when redeeming those reward points, 50% more value than any other card.

Do you have a restlessness constantly pulling you to explore and discover the world? Chase Sapphire Reserve® card could be ready for all your adventures! It comes loaded with rewards – 5x total points on flights, 10x total points on car rentals, and hotels worldwide after spending $300/year. Not only is dining rewarded but also, when redeeming those reward points, 50% more value than any other card.

You will remain in the same website

Get rewarded for spending with the Chase Sapphire Reserve® card. Explore its exceptional benefits below!

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Renowned for its luxury benefits and unparalleled rewards, the Chase Sapphire Reserve® Credit Card invites you to step into a world where every purchase brings you closer to your next adventure.

Let’s explore the lavish landscape of benefits and the considerations that accompany this prestigious card.

Strengths and Special Offerings

- Lucrative Welcome Bonus: Kickstart your journey with a generous welcome bonus after meeting the spending requirement, setting the stage for an array of travel possibilities.

- Triple Points on Travel and Dining: Earn an impressive 3X points on travel and dining worldwide, turning every culinary experience and journey into a rewarding adventure.

- $300 Annual Travel Credit: Receive an automatic $300 travel credit every year as reimbursement for travel-related purchases, making your adventures more affordable.

- Complimentary Lounge Access: Access to 1,300+ airport lounges worldwide through Priority Pass™ Select, offering a serene start to every trip.

- 50% More Value through Chase Ultimate Rewards®: Your points are worth 50% more when redeemed for travel through Chase Travel℠, optimizing your reward value.

- Global Entry or TSA Pre✓® Fee Credit: Enjoy a credit for Global Entry or TSA Pre✓® every four years, smoothing your way through airport security.

- Luxury Hotel & Resort Collection: Gain access to exclusive benefits such as room upgrades and complimentary breakfast at over 1,000 luxury hotels and resorts around the world.

Limitations to Consider

- High Annual Fee: The card comes with a substantial annual fee, which requires careful consideration and usage to outweigh the cost.

- Credit Requirement: A high credit score is necessary for approval, making it less accessible to individuals with average credit.

- Spending Required for Bonus: The initial spending required to earn the welcome bonus is relatively high, which might not suit every applicant’s budget.

- No Introductory APR: Lack of a low introductory APR means carrying a balance from the beginning can be costly.

In essence, the Chase Sapphire Reserve® Credit Card is a masterpiece in the world of luxury travel, promising a plethora of premium benefits and exceptional rewards.

While the card’s allure is undeniable, prospective users should weigh the high annual fee and other considerations against their lifestyle and spending patterns.

For those who regularly indulge in travel and dining, the opulent experiences and rewards offered by this card can be truly priceless.

There are a lot of factors to consider when answering this question. For example, who the card is for, how often the person travels, and what their spending habits are like. But in general, people who travel frequently and charge a lot of expenses on their credit cards will likely benefit from having the Chase Sapphire Reserve®.

The credit score required for a Chase Sapphire Reserve® is excellent. You'll need a credit score of 720 or higher to be eligible for the card.

Earn 5x the points for taking flights, 10x more on car rentals & hotels, and 3x as much when you spend $300 yearly. Plus, earn 3 points at not part of our network, plus 1 point everywhere else! Still, there are many luxury travel perks, such as airport lounges access and car rental coverage.

Chase Sapphire Reserve® application

Chase Sapphire Reserve® offers multiple rewards. Get all the details you need to apply and learn to take your vacays up a notch.

If you consider collecting cash back instead of travel points, then the HSBC Cash Rewards Mastercard® is our recommendation. This card has no annual fee and saves you on foreign transaction fees!

Plus, its simple-to-use flat cashback rewards system ensures eligible purchases get 1.5% back in your pocket - without needing a calculator for complex reward points.

Are you ready to learn how to apply for the HSBC Cash Rewards Mastercard®? Check out our post below.

How do you get the HSBC Cash Rewards Mastercard®?

We love a good cashback. Even better if it comes with no annual fees. That's the case with the HSBC Cash Rewards Mastercard® card, so take a look on how to apply for it.

Trending Topics

Milestone® Mastercard® application: how does it work?

If you need to build credit and don't want to pay a security deposit, read our post to learn how to apply for the Milestone® Mastercard®!

Keep Reading

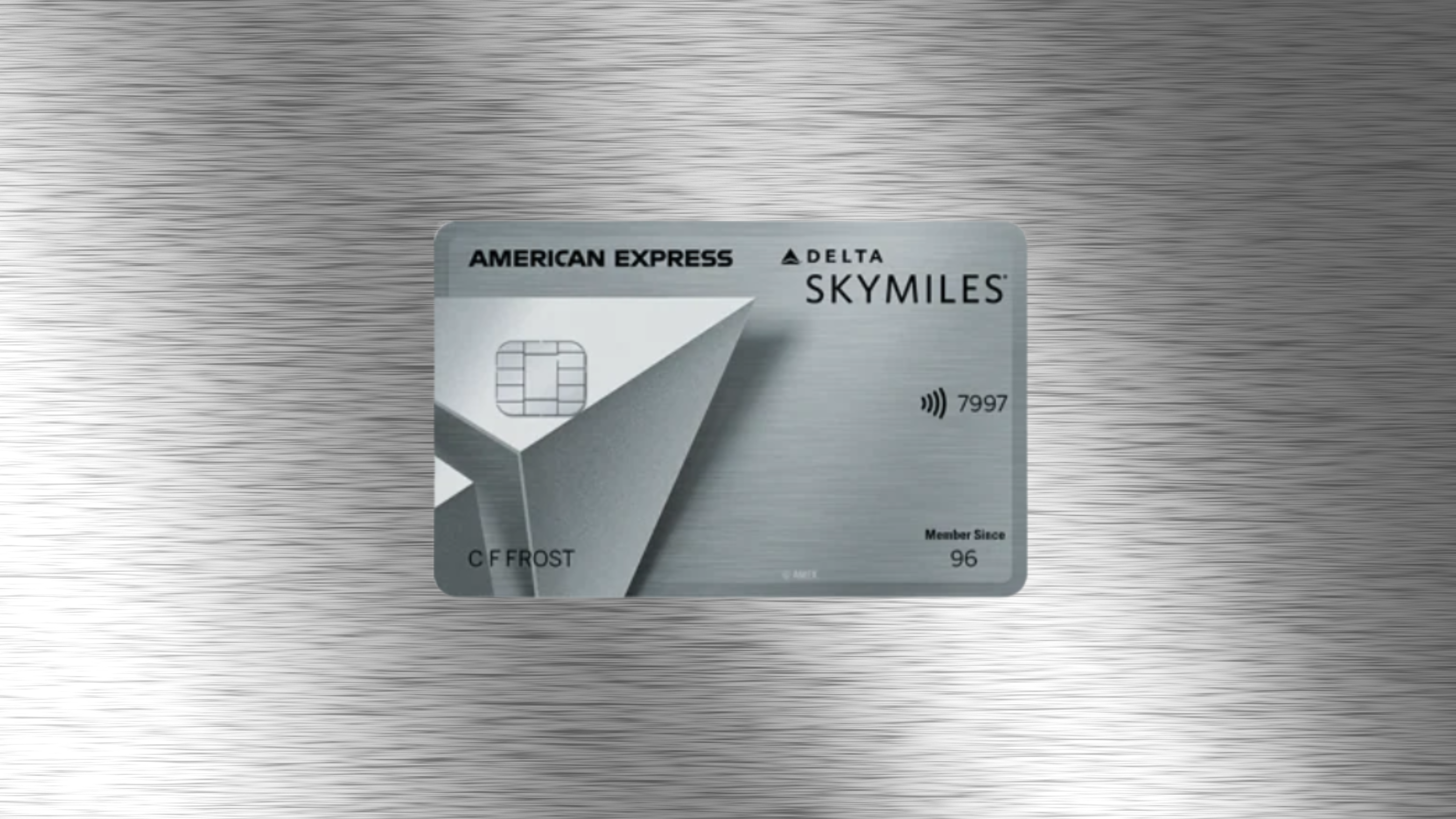

Delta SkyMiles® Platinum American Express Card application

Do you love to travel and earn card perks while doing so? Read our post about the Delta SkyMiles® Platinum American Express Card application!

Keep Reading

Learn to apply easily for the Citrus Loans

Are you wondering how to apply for a loan with Citrus Loans? Here are some tips that will help you. Read on!

Keep ReadingYou may also like

Citi Custom Cash℠ Card review: is it worth it?

The Citi Custom Cash℠ Card is a good opportunity to earn rewards and enjoy other perks. It offers a welcome bonus, no annual fee, and more!

Keep Reading

CarLoans.com review: how does it work and is it good?

Do you want to get a car loan, regardless of your bad credit score? Read this CarLoans.com review, and find out more! Fast approval!

Keep Reading

BankAmericard® Secured Credit Card review: build credit fast

Read our BankAmericard® Secured Credit Card review and discover a great tool to build credit - pay $0 annual fee and enjoy amazing features!

Keep Reading