Reviews

Milestone® Mastercard® application: how does it work?

Are you looking for a way to build credit? If so, you can try with the Milestone® Mastercard®. And there is no need for security deposit! Read on to learn how to apply!

Advertisement

Milestone® Mastercard®: Easy online application

Applying for a Milestone® Mastercard® is online and easy. You can visit their website and go through their qualification process. Plus, they accept even poor scores!

If you want to apply, make sure you meet the requirements before:

- You must meet their credit criteria, which include income and debt review

- You must not have a previous account with Milestone

- You must not have delinquencies of any kind with a Milestone card

Also, make sure you read all the agreements and terms. Pay special attention to the fees since they’re above average.

If you decide to go with this card, have a look at the online qualification guide. Keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

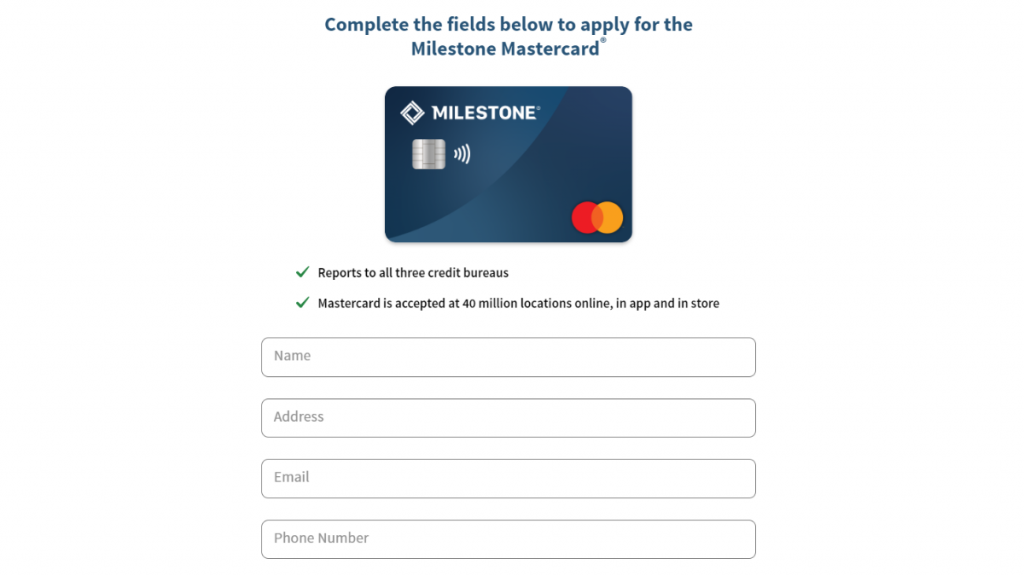

Apply online

First, you’ll need to provide some basic personal and financial information.

Once you’ve submitted your data, your profile will go through an analysis to decide which of the Milestone cards will be addressed to you.

In case of approval, their team will send you an email with the card you’ve been accepted to have, the annual fees for it, and more.

One more time, remember to read the fine print. This credit card has high maintenance fees, so you’d better be informed about what you get.

Apply using the app

The app for the Milestone® Mastercard® is available, but only contains options to manage it.

There you’ll find things such as balance control, history, and payment set. However, you can’t apply using the app. Instead, visit the website to apply.

Advertisement

Milestone® Mastercard® vs. First Progress Platinum Prestige Mastercard® Secured Card

If the Milestone® Mastercard® is not what you are looking for, make sure you check the benefits and cons of another option to rebuild credit: The First Progress Platinum Prestige Secured Card.

Milestone® Mastercard®

- Credit Score: bad to fair;

- Annual Fee: $175 the first year; $49 thereafter;

- Regular APR: 35.9% variable for purchases;

- Welcome bonus: N/A;

- Rewards: N/A.

Advertisement

First Progress Platinum Prestige Mastercard® Secured Card

- Credit Score: Poor/Limited/No Credit;

- Annual Fee: $49;

- Regular APR: 15.24% (V) and 24.24% (V);

- Welcome bonus: No welcome bonus;

- Rewards: No rewards.

If you like the second option to start building your credit, make sure you check the post below. Here we go!

How to apply for First Progress Platinum Prestige?

If you need a credit card with benefits and for those with bad credit, check our post to learn how to apply for First Progress Platinum Prestige Mastercard Secured!

Trending Topics

Apply for SimpleLoans123: Fast-track Approval

Unlock financial freedom! Apply for the SimpleLoans123 in just 3 steps with our easy-to-follow guide. Read on!

Keep Reading

Earn cash back: Apply for the PayPal Debit Card

Discover the easiest way to apply for the PayPal Debit Card online - no monthly fee and convenient banking experience! Keep reading!

Keep Reading

Veterans United Home Loans review: how does it work and is it good?

Check out this Veterans United Home Loans review to see how it works. This #1 VA Lender will help you buy your dream home! Read on!

Keep ReadingYou may also like

Solana is releasing a new crypto phone

Find out more about the upcoming Solana crypto phone, including its features and why you should be excited about it.

Keep Reading

How to buy cheap WestJet flights

Buy cheap WestJet flights to Canada, the U.S., Europe, and dozens of destinations paying less. Flights from $49.99! Read on!

Keep Reading

Southwest Rapid Rewards® Plus Credit Card review

Look into our Southwest Rapid Rewards® Plus Credit Card review to familiarize yourself with its traveling advantages. Keep reading!

Keep Reading