Earn up to 4 points on your business purchases

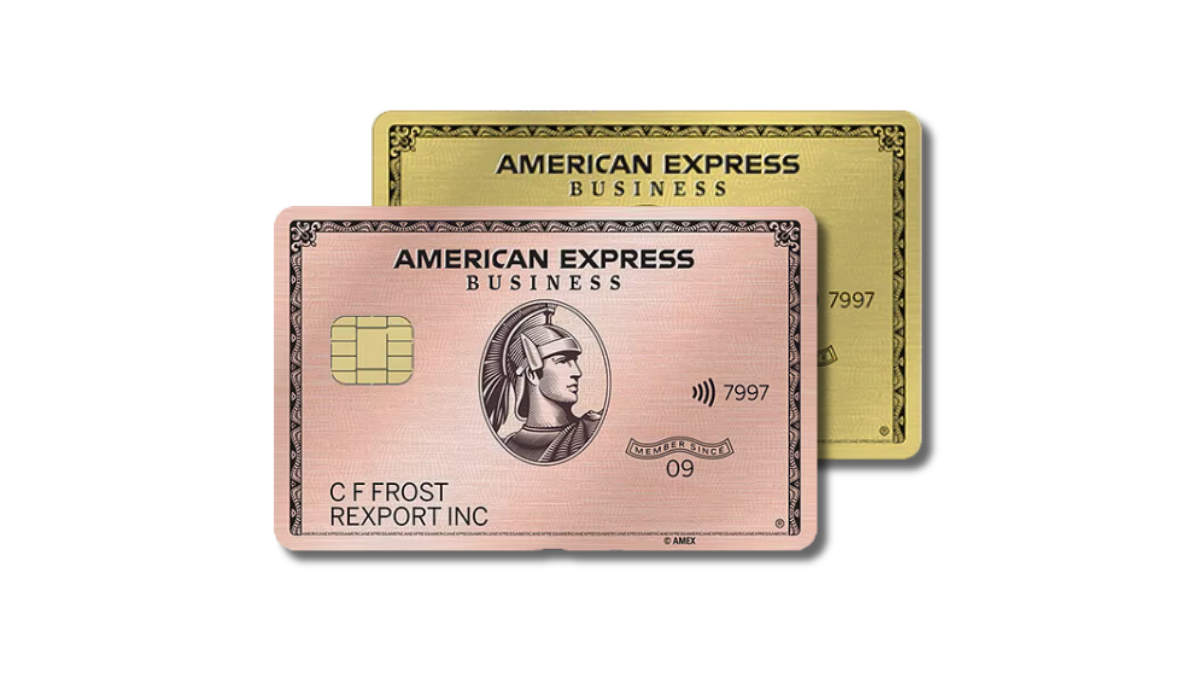

American Express® Business Gold Card, Manage Business Expenses with Ease

Advertisement

Business owners, take your rewards program to the next level with American Express® Business Gold Card! With no foreign transaction fees and card-management tools that make it easy to keep track of expenses, this card can help you stay on top of business costs while earning valuable rewards for everyday purchases!

Business owners, take your rewards program to the next level with American Express® Business Gold Card! With no foreign transaction fees and card-management tools that make it easy to keep track of expenses, this card can help you stay on top of business costs while earning valuable rewards for everyday purchases!

You will remain in the same website

The American Express Business Gold Card is a great way for business owners to earn rewards on everyday purchases. Discover 4 advantages of having this card in your business wallet:

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Meet the American Express® Business Gold Card, a powerhouse tailored for businesses that thrive on flexibility and yearn for growth.

As a perfect fusion of luxury and utility, this card is designed to elevate your business transactions to an experience rather than a mere necessity.

Strengths and Special Offerings

- Dynamic Bonus Categories: Tailor your rewards to fit your expenses. Earn 4x points on the two select categories where your business spends the most each billing cycle, making sure every dollar counts.

- Flexible Payment Option: Cash flow can be unpredictable in business. This card understands that, offering you the option to carry a balance with interest on certain charges, thus providing flexibility when you need it most.

- Generous Welcome Offer: New cardholders can benefit from a lucrative welcome bonus, which includes a generous amount of Membership Rewards® points upon meeting the initial spending requirements.

- Business Management Tools: More than just a payment tool, this card provides valuable business insights, seamless expense management features, and even the convenience of integrating your card transactions directly with QuickBooks.

- No Foreign Transaction Fees: Ideal for businesses with global operations or travel needs, this card waives foreign transaction fees, ensuring savings on international spends.

Limitations to Consider

- Notable Annual Fee: A prominent annual fee is attached to this card, which might be a consideration for smaller businesses or those watching their overheads closely.

- No Introductory APR: Businesses looking for an initial period of low interest might be disappointed, as this card doesn't offer an introductory APR for either purchases or balance transfers.

The American Express® Business Gold Card is not just a credit card; it's a business companion.

It offers a suite of features that resonate with dynamic businesses aiming for growth. While the annual fee might seem steep, the rewards and benefits can far outweigh the costs for the right enterprise.

If your business operations align with the card's strengths, it's an asset worth considering.

The American Express® Business Gold Card is a charge card designed for small to mid-sized businesses. It offers rewards for purchases made on the card, as well as a variety of other benefits. In addition to rewards points, the card offers benefits such as purchase protection, extended warranty coverage, and access to exclusive events and experiences.

Yes, American Express is widely accepted by millions of merchants in the U.S. and worldwide. For example, some popular stores and restaurants that accept American Express include Walmart, Target, McDonald's, Burger King, and Starbucks.

There is no foreign transaction fee for the American Express® Business Gold Card. This means that you can use the card to make purchases abroad without incurring any additional fees beyond the cost of the item or service you are purchasing. This can be a significant benefit for businesses that frequently travel or make purchases from international vendors!

Apply for American Express® Business Gold Card

Get an in-depth understanding of the American Express® Business Gold Card and its application process. Earn up to 4 points on purchases!

Get your business finances under control with the U.S. Bank Triple Cash Rewards Visa® Business Card!

This card offers an amazing 0% intro APR, no annual fees, and a generous welcome bonus to get you started - rewards just for running your business make it worth trying today. Read on to learn how to apply for this credit card.

Apply U.S. Bank Triple Cash Rewards

Discover what is necessary to apply for the U.S. Bank Triple Cash Rewards Visa® Business Card. Pay no annual fee! Keep reading and learn!

Trending Topics

Apply for Hawaiian Airlines® World Elite Mastercard® easily

Apply for the Hawaiian Airlines® World Elite Mastercard® following this step-by-step. Earn 60K bonus miles in no time! Read on!

Keep Reading

U.S. Bank Triple Cash Rewards Visa® Business Card application

Discover what is necessary to apply for the U.S. Bank Triple Cash Rewards Visa® Business Card. Pay no annual fee! Keep reading and learn!

Keep Reading

Delta SkyMiles® Gold American Express Card review

The Delta SkyMiles® Gold American Express Card review will show you how it works, the advantages and cons, and the credit score required!

Keep ReadingYou may also like

Obamacare: all you need to know about the program

Find out how Obamacare can help you get health care coverage for your family, plus what it covers and who is eligible. Read on!

Keep Reading

Citi® Secured Mastercard® review: Build your credit history from scratch

Read on to a Citi® Secured Mastercard® review and find out its pros and cons and how it can help you build your credit.

Keep Reading

Application for the Sam’s Club Credit Plus Member Mastercard card: how does it work?

Learn how to apply for a Sam’s Club Credit Plus Member Mastercard card and start earning cash back on your purchases today!

Keep Reading