Credit Cards

Gold benefits: American Express® Business Gold Card review

Looking for a card to help manage your business expenses? Here's the American Express® Business Gold Card! Earn points on every purchase and more!

Advertisement

Unlock 70,000 Membership Rewards® Points in 3 Months

As a business owner, managing your finances and expenses can be overwhelming. Find the features to help you in our American Express® Business Gold Card review.

Apply for American Express® Business Gold Card

Get an in-depth understanding of the American Express® Business Gold Card and its application process. Earn up to 4 points on purchases!

This card streamlines your business expenses and offers great rewards. Find out the main features, pros, and cons of the American Express® Business Gold Card. So read on!

- Credit Score: Good-Excellent;

- Annual Fee: $375;

- Regular APR: 19.49% – 27.49% Variable;

- Welcome bonus: Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- Rewards: 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap. Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.

- See Rates & Fees

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

American Express® Business Gold Card: how does it work?

The American Express Business Gold Card is a premium credit card designed for business owners in the United States.

So here’s a detailed review of its features, benefits, and drawbacks.

Welcome Bonus

Firstly, you’ll earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases within the first 3 months of card membership.

Advertisement

Points

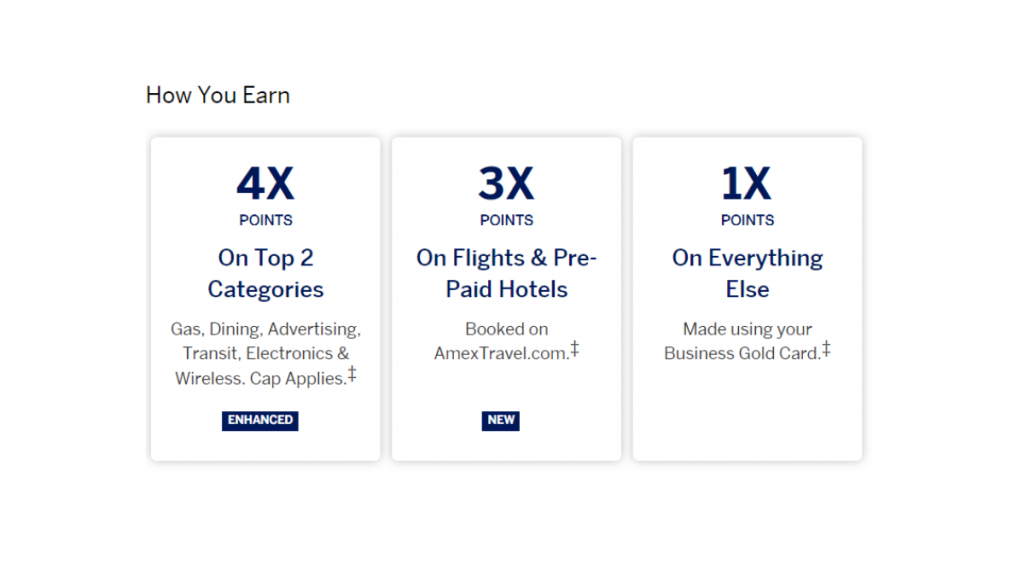

Also, earn 4X Membership Rewards® points on the two categories where your business spends the most each billing cycle from a list of six categories:

- U.S. purchases for advertising in select media;

- U.S. purchases at gas stations;

- U.S. purchases at restaurants;

- U.S. purchases for computer hardware, software, and cloud computing purchases made directly from select providers;

- Transit purchases; and

- Monthly charges for wireless telephone service made by a U.S. wireless telephone service provider.

Additionally, earn 1X Membership Rewards points for all other purchases.

Travel Benefits

Also, there are some travel benefits of this card.

- Baggage insurance;

- Car rental loss;

- Damage insurance;

- Access to the Global Assist Hotline.

Advertisement

Purchase Protection

You can still receive protection for eligible purchases with extended warranty coverage, purchase protection, and return protection.

Fees

Finally, check out two important fees in a business card:

- No Foreign Transaction Fees;

- Annual fee: $375.

- See Rates & Fees

American Express® Business Gold Card: should you get one?

Overall, the American Express Business Gold Card is a great choice for businesses that spend significant money in the eligible categories.

Then consider its pros and cons below to help you decide!

Pros

- Welcome Offer: Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.

- Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240.

- Get $12.95 back in statement credits each month when you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. $12.95 plus applicable taxes.

- Your Card – Your Choice. Choose from Gold or Rose Gold.

Cons

- High annual fee;

- Limited bonus categories.

Credit score required

If you want an American Express® Business Gold Card, ensure you have at least a good credit score.

So, the higher your credit score is, the higher your chances of approval.

American Express® Business Gold Card application: how to do it?

Ready to apply for the American Express® Business Gold Card and earn points on your business purchases?

We have the perfect guide to help you with the application. So check it out!

Apply for American Express® Business Gold Card

Get an in-depth understanding of the American Express® Business Gold Card and its application process. Earn up to 4 points on purchases!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Elon Musk is about to cut 10% of Tesla’s workforce

Musk has been talking about recession recently, and it looks like he’s prepared to do what it takes to protect his electric carmaker company.

Keep Reading

Secured vs unsecured credit card: which one is right for you?

Wondering if you should get a secured vs. unsecured credit card? Here's what you need to know about both options. Read on!

Keep Reading

Busy Days, Easy Meals: Time-Saving Airfryer Recipes in Minutes!

Cook delicious and crispy snacks with these 11 irresistible air fryer recipes anyone can make. Find out more!

Keep ReadingYou may also like

Payday loans: are they a good alternative?

Understand why Payday loans might not be the best choice if you need quick cash. Keep reading to learn more.

Keep Reading

Prime Visa Card application: how does it work?

If you're an Amazon Prime member, the Prime Visa Credit Card is a great way to earn rewards on your purchases. Learn how to apply here!

Keep Reading

Net First Platinum credit card review: is it legit and worth it?

To purchase at the Horizon Outlet, you need a merchandise credit card like the Net First Platinum. Learn more about this card here.

Keep Reading