Credit Cards

Marriott Bonvoy Bevy™ American Express® Card Review: Earn more

Explore the Marriott Bonvoy Bevy™ American Express® Card — a key to exclusive rewards and expanded privileges within the Marriott Bonvoy program.

Advertisement

A hotel card with solid benefits

Marriott Bonvoy Bevy™ American Express® Card review: Wondering about its features, benefits, and how it can make your trips more affordable with gold elite status?

Apply for Marriott Bonvoy Bevy™ American Express®

Embrace convenience: Apply for the Marriott Bonvoy Bevy™ American Express® Card – up to 6 points on purchases and more! Read on!

Keep reading to discover the perks, fees, rewards, pros, cons, and more!

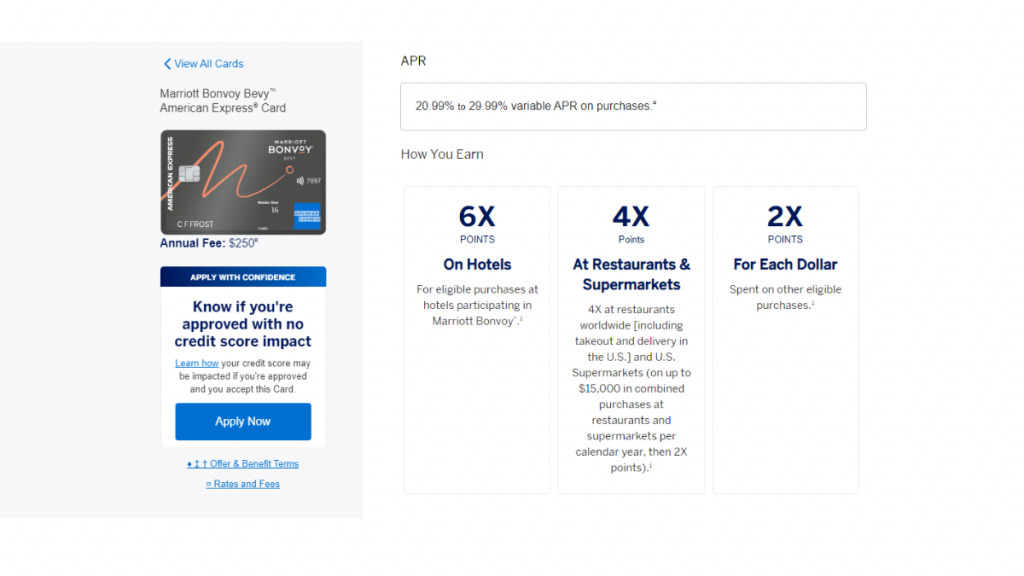

- Credit Score: Good to Excellent;

- AnnualFee: $250;

- Purchase APR: 20.99% to 29.99% variable;

- Cash Advance APR: 29.99%;

- Welcome Bonus: Earn 155,000 Marriott Bonvoy bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership.

- Rewards: 6 points on eligible purchases in Marriott Bonvoy hotels, 4 points at restaurants and supermarkets (on up to $15,000 in combined purchases at restaurants and U.S. supermarkets per calendar year, then 2X points), and 2 points on all other eligible purchases;

- See Rates & Fees

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Marriott Bonvoy Bevy™ American Express® Card: how does it work?

Marriott Bonvoy Bevy™ American Express® Card is a mid-tier co-branded card from Marriott Hotels, but is it worth the $250 annual fee?

The answer depends on your lifestyle. If you travel frequently and stay at Marriott Bonvoy hotels, then this card has valuable perks to make your travels affordable.

Firstly, you’ll get automatic complimentary gold status. So, it means access to late checkout, room upgrades, free breakfast, and wifi at participating hotels.

Secondly, it comes with 155K points as a welcome bonus if you spend $5,000 on your card within the first six months of membership.

Overall, the Marriott Bonvoy Bevy™ American Express® Card is decent, but other cards in the same category offer additional perks like TST Precheck and lounge access.

Rewards

The Marriott Bonvoy rewards program is free and offers potential benefits based on membership level.

So, members progress to higher levels through qualifying stays at eligible hotels, making it a valuable program for Marriott guests

- 6 points on eligible purchases at Marriott Bonvoy hotels;

- 4 points at restaurants worldwide and supermarkets in the U.S. (on up to $15,000 in combined purchases at restaurants and U.S. supermarkets per calendar year, then 2X points);

- 2 points on all other eligible purchases.

Redeem these points for complimentary nights or enjoy Amex perks, such as discounted VIP access to presales and events.

Advertisement

Rates and fees

Here are some of the rates and fees for the Marriott Bonvoy Bevy™ American Express® Card:

- Annual fee: $250;

- Foreign transaction fee: $0;

- Cash advance: $10 or 5% of the amount, whichever is greater;

- Late payment fee: Up to $40.

- See Rates & Fees

Marriott Bonvoy Bevy™ American Express® Card: should you get one?

Indeed, this hotel card is best for frequent travelers in the mid-tier category.

However, determining if the Marriott Bonvoy Bevy™ American Express® Card is the right fit depends on an honest review of your travel needs and habits.

Advertisement

Pros

- Earn 155,000 Marriott Bonvoy bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership.

- Earn 6X Marriott Bonvoy® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy.

- Earn 4X points at restaurants worldwide and U.S. supermarkets (on up to $15,000 in combined purchases at restaurants and U.S. supermarkets per calendar year, then 2X points).

- Earn 2X points on all other eligible purchases.

- Marriott Bonvoy 1K Bonus Points Per Stay: Earn 1,000 Marriott Bonvoy® bonus points per paid eligible stay booked directly with Marriott for properties participating in Marriott Bonvoy.

- With complimentary Marriott Bonvoy Gold Elites status, earn up to 2.5X points from Marriott Bonvoy® on eligible hotel purchases with the 25% Bonus Points on stays benefit, available for Qualifying Rates.

- Marriott Bonvoy Bevy Free Night Award: Earn 1 Free Night Award after spending $15,000 on eligible purchases on your Marriott Bonvoy Bevy™ Card in a calendar year. Award can be used for one night (redemption level at or under 50,000 Marriott Bonvoy® points) at a hotel participating in Marriott Bonvoy®.

- 15 Elite Night Credits: Each calendar year with your Marriott Bonvoy Bevy™ American Express Card® you can receive 15 Elite Night Credits toward the next level of Marriott Bonvoy® Elite status.

- Plan It® is a payment option that lets you split up purchases of $100 or more into equal monthly installments with a fixed fee. Plus, you’ll still earn rewards the way you usually do.

Cons

- High annual fee;

- No TSA PreCheck;

- No lounge access.

Credit score required

Since the Marriott Bonvoy Bevy™ American Express® Card brings amazing benefits, it will require a good to excellent credit score.

Marriott Bonvoy Bevy™ American Express® Card application: how to do it?

Elevate your hotel stay at Marriott Bonvoy with the exclusive Marriott Bonvoy Bevy™ American Express® Card.

Want to apply? Then read on for simple instructions in our post below!

Apply for Marriott Bonvoy Bevy™ American Express®

Embrace convenience: Apply for the Marriott Bonvoy Bevy™ American Express® Card – up to 6 points on purchases and more! Read on!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

CitiBusiness® / AAdvantage® Platinum Select® Mastercard® application: how does it work?

If you are thinking about applying for the CitiBusiness® / AAdvantage® Platinum Select® Mastercard®, read this post to learn how!

Keep Reading

Revvi Card application: how does it work?

Earn cash back on all your purchases without worrying about a secured deposit. See how to apply for the Revvi Card and enjoy its benefits!

Keep Reading

Capital One Savor Rewards Credit Card review: is it worth it?

Looking for a generous cash back card that offers rewards for entertainment? Check out this Capital One Savor Rewards Credit Card review!

Keep ReadingYou may also like

Discover effective apps to recover deleted photos: 9 top choices!

Discover the top 9 apps to recover deleted photos for Android and iOS. Get your precious photos back using reliable and user-friendly tools.

Keep ReadingThe Mad Capitalist recommendation – Ally Bank Mortgage

Discover how the Ally Bank Mortgage works, and find out more about the advantages, drawbacks, and terms to get it!

Keep Reading

No need to leave home: 10 best Pregnancy Test Apps to download

Expecting a baby? Don't miss out on our top 10 picks for the best pregnancy test apps to make your journey easier.

Keep Reading